Zcash Price Prediction: Institutional Money and Privacy Hype Ignite 370% Surge—Is the Bull Run Just Starting as Privacy Narrative Grips Crypto Market?

Privacy-focused token Zcash (ZEC) spearheads a major altcoin rally, surging over 370% in the last month. The rally is driven by new institutional access via Grayscale’s ZEC Trust and high-profile endorsements highlighting its shielded transaction technology. Zcash Price Prediction optimism is fueled by ZEC breaking multi-year resistance levels and a potent derivatives short squeeze.

Trending Zcash

The cryptocurrency market is experiencing significant capital rotation, with attention shifting decisively to the privacy sector, driven by Zcash’s (ZEC) spectacular performance. Zcash has emerged as the standout large-cap performer, demonstrating a powerful reversal that has erased three years of downtrend within a single week.

At the time of writing, Zcash is trading around $237.79, having recorded over 35% gains in the last 24 hours alone, with its 24-hour trading volume surpassing $1.4 billion. This meteoric rise, which saw the price break above the $260 level and reach a three-year high of $274 before retracing, has put the privacy coin in a class of its own.

Why Is Zcash Price Surging? Privacy Coin Mania Grips the Market

The Zcash rally is fueled by an intersection of robust, technical and fundamental drivers, ultimately driven by an increasing appreciation for financial privacy in the days of digital communication. It is no longer a fringe topic but an imperative feature set that will redefine the future of digital asset development.

Institutional Interest and Access

One of the primary drivers is the breakthrough in institutional accessibility. Grayscale, a major digital asset manager, recently launched a dedicated Grayscale Zcash Trust, making it significantly easier for institutional investors to gain exposure to ZEC and fueling confidence in its long-term potential. This move has increased the possibility of a future ZEC ETF filing, making Zcash a more appealing diversification play beyond the traditional BTC and ETH portfolio allocations.

High-Profile Endorsements and the Privacy Narrative

The rally was fueled by high-profile support from prominent figures in the crypto and venture capital community. Venture capitalist and AngelList co-founder Naval Ravikant provided a powerful endorsement that resonated across the community, framing Zcash as a hedge that is required:

“BTC is insurance against fiat. ZCash is insurance against BTC.”

BTC is insurance against fiat.

ZCash is insurance against BTC.

— Naval (@naval)

This quote reignited the privacy debate, highlighting that Zcash, through its zero-knowledge proofs, offers stronger privacy protections than BTC, which has a public and traceable ledger. The endorsement of this “old coin, new endorsement” narrative has coincided closely with the sharp price rise.

Furthermore, the CEO of Helius Labs, Mert Mumtaz, underscored the necessity of privacy:

“a world where crypto succeeds but privacy doesn’t is a dystopian nightmare,” and highlighted Zcash’s “stronger privacy and scale design.”

Mumtaz, a vocal backer who called for the token to hit $1,000, stated that he “love[s] shilling privacy stuff because it actually ends up making a difference in the privacy properties of these systems.”

gorgeous chart

The amount of ZEC being shielded on Zcash is going up and to the right over time

I love shilling privacy stuff because it actually ends up making a difference in the privacy properties of these systems (view the rightmost vertical bump)

$1,000

— mert | helius.dev (@0xMert_)

Regulatory and Technological Implications for Zcash Price Prediction

The timing of this rally aligns perfectly with increasing global concerns over financial surveillance. The growing discussions about financial censorship and government oversight are pushing investors toward privacy answers.

Former White House advisor and Zcash advisory board member Thor Torrens noted the long-term trend:

“Surveillance and censorship is increasing not decreasing. privacy will continue to become more valuable not less. More and more people will become aware of how visible they truly are online.”

This sentiment is especially compelling when applied to legislated proposals, such as the EU’s draft legislation “On Chat Control,” which proposes monitoring users’ private messages. Such a context makes privacy tokens such as ZEC a compelling hedge and investment vehicle.

Ecosystem Developments Fueling Demand

The technical story behind Zcash is also strong. The network’s mobile wallet, Zashi, now supports cross-chain swaps into shielded ZEC, enhancing user utility and privacy. Furthermore, Zcash’s tokenomics are similar to BTC’s, featuring a scarce, mineable token with a 21 million maximum supply, with a halving scheduled for November 2025 expected to further reduce supply and boost scarcity-driven demand.

Technical Analysis Reveals Zcash Price Prediction and Potential

The recent surge has flipped the technical chart for ZEC decisively bullish, though the speed and magnitude of the move warrant caution.

Current Momentum and Overbought Signals

The Relative Strength Index (RSI) on the weekly chart reads 91, a historically high number that signals the rally is severely overheated and bears the risk of a potential short-term reversal or cooling-off period. Conversely, the Moving Average Convergence Divergence (MACD) holds a steady upward trend above the zero line, confirming the consistent, rising bullish momentum.

Technical Forecast and Zcash Price Prediction

This provides a clear Zcash Price Prediction framework:

- Immediate Resistance: The local peaks around the psychological $300.00 level pose the most immediate resistance. A clean break above $300.00, potentially targeting the previous correction level at $303, would signal a continuation of the rally.

- Ultimate Resistance/Bull Target: A decisive push past $303 could extend the rally toward ultimate multi-year target at $374. Analysts are already eyeing long-term targets of $471–$522.

- Key Support Levels (purchase Opportunity): Due to the bearish divergence on the daily RSI, a pullback is healthy and anticipated. The most critical short-term support zone is the psychological $200 level, reinforced by the 0.5 Fibonacci level at $195. If momentum fades and profit-takers dominate, ZEC is likely to retrace to the major support at $177, with the Parabolic SAR at $124 serving as the critical “bearish flip” level that bulls must defend.

Overall, the chart suggests that while volatility is extremely high, the structural breakout and institutional support mean that dips are likely to be treated as purchaseing opportunities, strengthening the long-term Zcash Price Prediction outlook.

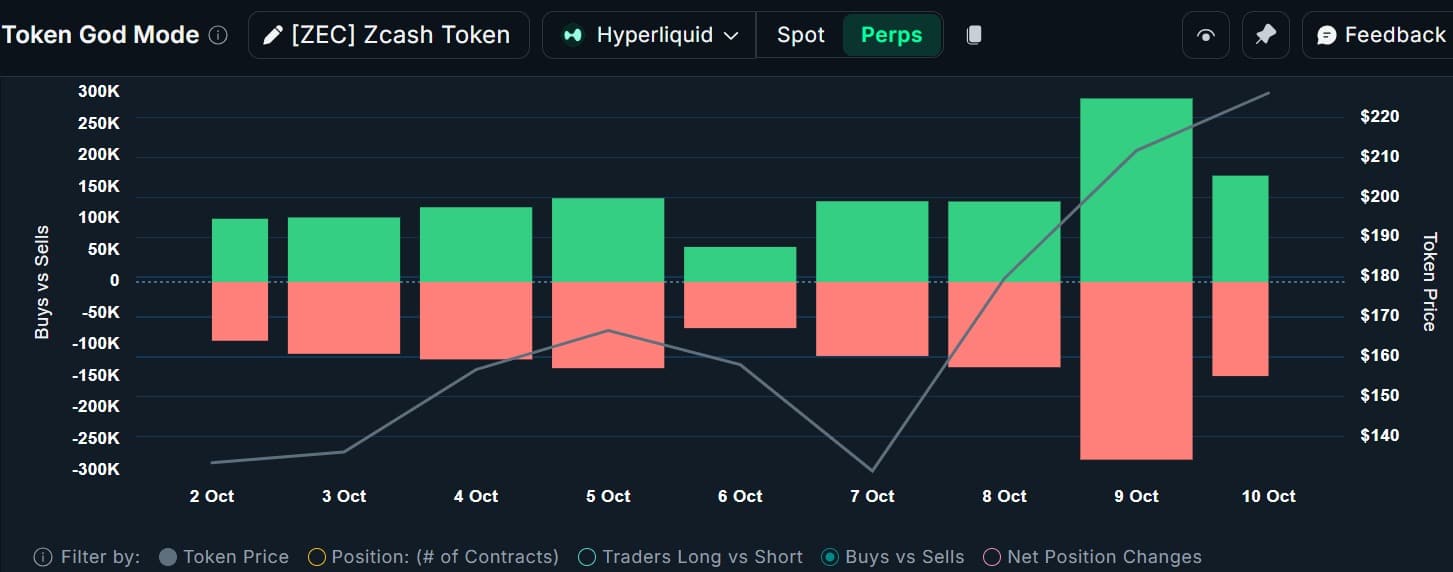

Institutional & Derivatives Activity

The Zcash rally is supported heavily by derivatives investors, adding to the volatility. Among the key drivers was the listing of ZEC/USDC perpetual contracts with 5x leverage on decentralized platform Hyperliquid, which fueled a huge surge in volume in ZEC futures. Long positions are prevalent in futures markets, and the rally is characterized by purchaviewrs with control of the futures market, according to data from Nansen.

The notional value of outstanding Zcash futures contracts also increased to $237 million, reflecting renewed retail and leveraged institutional purchaseing of the token. As one would expect in such a steep market rally, also in evidence are profit-takers, and Zcash saw positive Spot Netflow for three consecutive days, reflecting rising inflows as speculators take profit.

Broader Crypto Market Performance: ZEC Leads the Altcoin Rotation

The ZEC effect has spilled over, boosting other privacy coins. Other assets like Railgun (RAIL) have viewn gains of over 117%, and even so-called ‘dinosaur coins’ like Dash (DASH) have rallied, as traders revisit them in the context of the growing privacy narrative.

The fact that privacy tokens are showing multi-day strength means this is not just a one-day pump but a structural shift: the flows of capital are following stories—AI, meme, infrastructure, and now privacy—as new institutional capital continues to flood into altcoin diversification.

Zcash Price Prediction FAQ

Why did Zcash jump 35% in 24 hours?

Zcash price skyrocketed due to a perfect storm of all of the following conditions: new via the Grayscale ZEC Trust, celebrity endorsements (Naval Ravikant), solid revived demand for privacy coins amid global surveillance concerns, and a technical break which triggered a strong derivative short squeeze.

What is the Zcash Price Projection in the long term? Will ZEC reach $1000?

Reaching $1000 is very speculative but a figure occasionally cited by optimistic analysts like Helius Labs CEO Mert Mumtaz, who anticipates reaching $1,000 in asset price. Based on current technical analysis, ZEC finds nearest resistance of $274–$303, with ultimate medium-term resistance at the $374 level. Reaching $1000 would require sustained institutional flows, the success of halving in 2025, and full market adoption of the privacy narrative.

Is Zcash a excellent purchase today?

Zcash investment will be based on individual risk appetite as volatility is extremely high. Current technical analysis suggests that ZEC is extremely overbought (RSI of 91), which means there is a very high chance of a short-term pullback. The currency, however, has just registered a large structural breakout. Long-term players will hold on for a retracement to the upper support levels, i.e., $200 or $177, in the hope of purchaseing at lower prices. The positive long-term outlook is driven by its unique value proposition of privacy and rising institutional exposure.