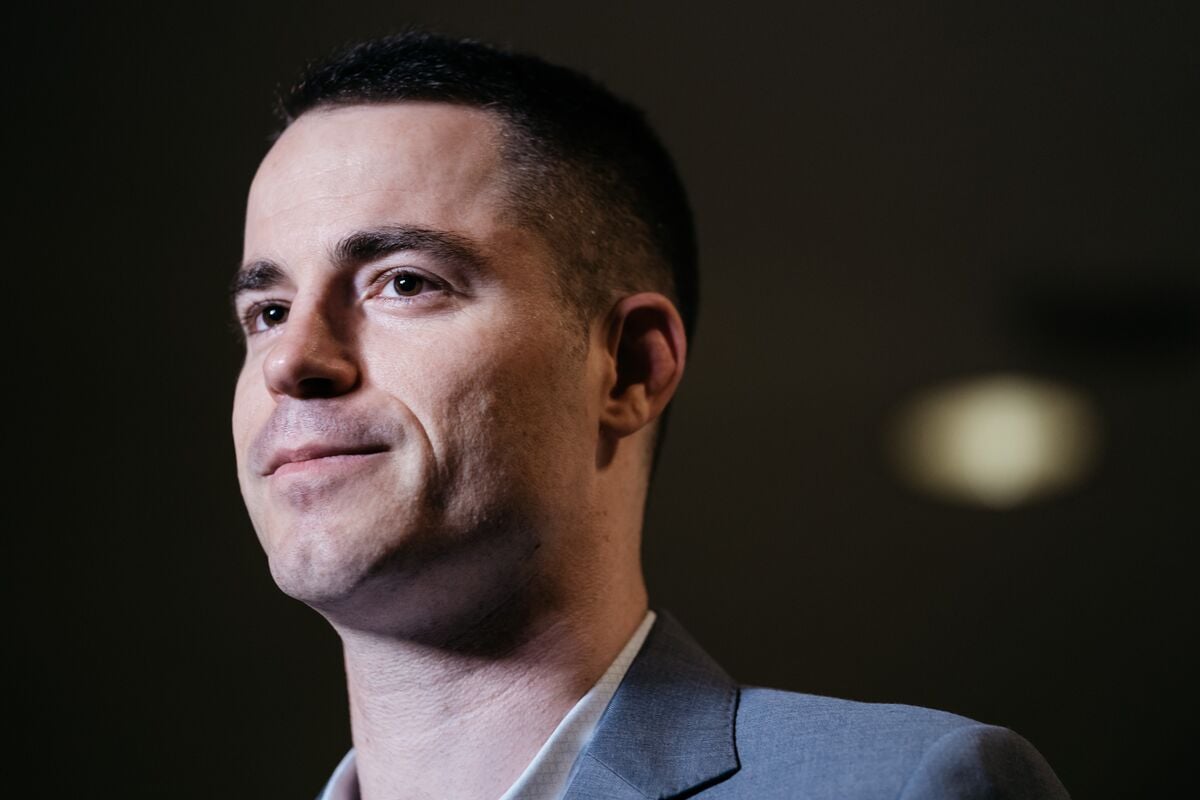

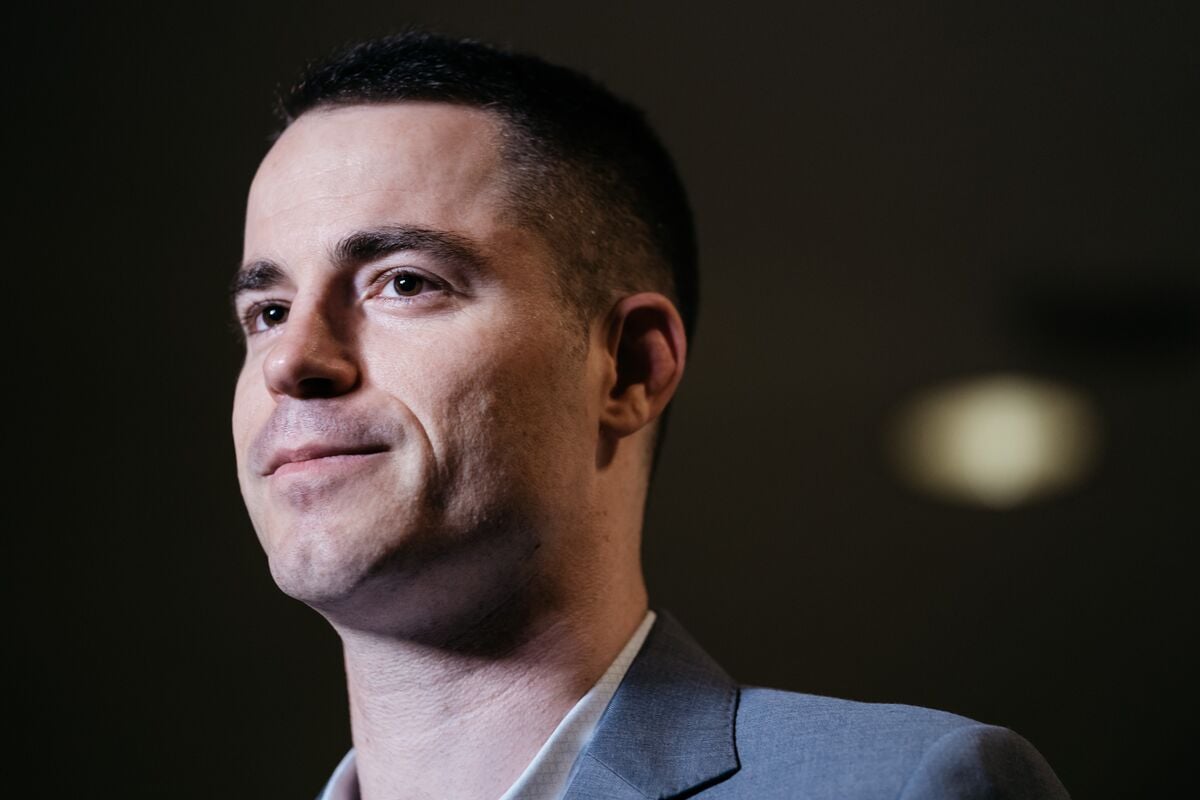

Roger Ver Settles U.S. Tax Evasion Case with $50 Million Payment

Roger Ver, famously nicknamed “” for his ahead advocacy of BTC, has reached a reanswer with U.S. federal authorities in a tax evasion and mail fraud case by agreeing to pay nahead US $50 million.

Background and Indictment

In April 2024, a federal grand jury indicted Ver on multiple counts, including tax evasion, mail fraud, and filing false tax returns.

The indictment alleged that Ver failed to properly report his holdings and capital gains following his renunciation of US citizenship in 2014 and his acquisition of citizenship in St. Kitts and Nevis. Prosecutors claimed Ver’s omissions and underreporting caused at least $48 million in losses to the .

Deferred Prosecution Agreement and Admission of Misconduct

Rather than face trial, Ver entered into a deferred prosecution agreement with the Department of Justice, admitting to willful misconduct. As part of the deal, Ver has paid the nahead $50 million, encompassing back taxes, penalties, and interest. The motion to dismiss the indictment is contingent on his compliance with the terms of the agreement.

In his admission, Ver conceded that when he filed his expatriation-related return in 2016, he did not fully disclose all BTC holdings or pay necessary capital gains taxes. He also accepted that this understatement was willful and thus subject to the maximum penalty available under the statute (26 U.S.C. § 6663).

Implications and Reactions

The justice officials framed this settlement as a reminder that digital assets do not exempt individuals from tax obligations. “Whether you deal in dollars or digital assets, you must file accurate tax returns and pay what you owe,” stated Associate Deputy Attorney General Ketan D. Bhirud.

From a high-level perspective, the agreement spares Ver from a potential prison sentence in platform for financial compliance and public admission of wrongdoing. It also reflects the US government’s increasing resolve to enforce the tax code against high-net-worth crypto actors.

For the community, this case underscores the regulatory risks of aggressive avoidance, especially for personalities who formerly portrayed themselves outside traditional financial frameworks. It also may catalyze more assertive enforcement in the crypto space.

BTC Jesus Pays the Price: Ver’s $50 Million Settlement Marks a Crypto Turning Point

Roger Ver’s $50 million settlement represents more than just the end of a high-profile tax case; it marks a turning point for the cryptocurrency industry’s relationship with regulators. Once celebrated as a pioneer of BTC’s libertarian ideals, Ver’s legal troubles highlight how far the crypto space has evolved from its unregulated beginnings.

The US government’s insistence on full tax compliance, even for offshore citizens and digital assets, sends a clear message: crypto wealth is not exempt from traditional financial laws. For investors and influencers alike, Ver’s case underscores the growing alignment between digital finance and established regulatory frameworks.