BTC Tests Critical Support as Momentum Weakens Near $110,000

BTC (BTC) is hovering around $110,600 later than a sharp pullback from its recent peak near $126,000, raising questions about whether the world’s largest cryptocurrency is entering a consolidation phase or facing a deeper correction. The price has declined roughly 2% over the past 24 hours, hitting an intraday low of $110,292 before rebounding slightly.

fragileness in short-term momentum indicators and a cluster of resistance levels have limited upside potential in recent sessions. Technical charts show that BTC is now testing a crucial support zone between $107,000 and $110,000, with analysts citing this range as a potential pivot point for the next major move. If BTC breaks below this area, market watchers view a possible slide toward $100,000, while a sustained recovery above $123,000 could restore bullish momentum.

Moving averages show a mixed picture. While BTC remains above its 200-day moving average—signaling that the broader trend is still positive—shorter-term averages such as the 20-day and 50-day have begined to turn lower. This crossover pattern suggests waning short-term strength, aligning with momentum oscillators like the Relative Strength Index (RSI), which has drifted into neutral territory.

Analysts note that despite the recent pullback, long-term holders remain largely unmoved, suggesting confidence in BTC’s structural outlook. However, the market’s inability to reclaim the $123,000–$124,000 resistance range could prolong the current period of sideways trading.

For now, BTC appears trapped between key support and resistance levels, awaiting a catalyst that could determine its next direction. Whether that comes from macroeconomic developments, ETF inflows, or regulatory updates, traders are watching closely as volatility compresses and the next breakout setup takes shape.

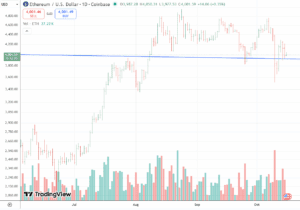

ETH (ETH) is hovering around the $4,000 mark later than losing momentum from its recent rally, as traders assess whether the second-largest cryptocurrency is preparing for a deeper correction or another leg higher. Over the past 24 hours, ETH has slipped roughly 1.5%, with intraday lows near $3,980 and highs around $4,080, signaling indecision across key trading ranges.

The current consolidation comes later than a strong multi-week rebound that pushed prices above major moving averages. While the broader trend remains intact, short-term indicators are beginning to show signs of fatigue. Technical charts reveal that ETH faces strong resistance between $4,200 and $4,400, a zone that has repeatedly capped upside attempts in recent sessions. On the downside, immediate support lies between $3,800 and $4,000, making this area a critical battleground for the next directional move.

Moving averages continue to offer mixed readings. The longer-term 100-day and 200-day moving averages remain well below current price levels, confirming that the underlying uptrend is still valid. However, shorter-term averages, including the 10-day and 20-day lines, have begined to flatten—indicating a loss of near-term purchaseing strength. Oscillators such as the MACD are also tilting toward a bearish crossover, while the Relative Strength Index (RSI) hovers around neutral levels.

Analysts note that a decisive break below the $3,900 support zone could trigger a correction toward $3,500. Conversely, if ETH reclaims the $4,400 level with strong volume, it could open the door to a retest of $4,800 and potentially higher.

With momentum balanced between both sides, ETH appears to be in a holding pattern as traders wait for a catalyst—whether from broader market sentiment, macroeconomic shifts, or updates to the ETH protocol—to define its next major move.