What Are Privacy Tokens and Three Privacy Tokens to Watch Out for in 2025

As blockchain adoption grows, privacy is becoming a critical part of crypto’s evolution. While transparency is one of blockchain’s strengths, it also means anyone can trace transactions. Privacy tokens aim to fix this by ensuring users can transact securely and discreetly—an idea that builds on BTC’s original goal of financial freedom through decentralization.

Key Takeaways

-

ZEC is testing critical resistance within a bullish channel; a breakout could trigger a strong upward move toward previous highs.

-

DASH shows fragileening momentum later than a breakout but could rebound if it holds support near $41 and retail sentiment turns bullish.

-

Monero remains under pressure, trading near $307 with key resistance at $325; a breakout could shift its trend upward.

-

Privacy tokens continue to uphold BTC’s decentralization goal, offering users greater control over financial privacy.

-

Market momentum across privacy coins is mixed, suggesting traders should watch for volume shifts and breakout confirmations in the coming days.

What Are Privacy Tokens?

are cryptocurrencies designed to conceal transaction details such as sender and receiver addresses, wallet balances, or transferred amounts. They use advanced cryptography—like zero-knowledge proofs, ring signatures, and stealth addresses—to achieve this.

Unlike or ETH, where all transactions are visible on-chain, privacy tokens emphasize financial confidentiality without compromising network integrity. They cater to individuals who value privacy, businesses managing sensitive data, and users in regions with restrictive financial systems.

How They Work

Each privacy token employs a distinct method for achieving anonymity:

-

Zero-Knowledge Proofs (ZKPs): Allow one party to prove a transaction’s validity without revealing its contents (used by Zcash).

-

Ring Signatures: Mix multiple transactions to obscure the true sender (used by Monero).

-

Stealth Addresses: Generate one-time wallet addresses to protect recipients (used by Verge).

While regulators have expressed concerns over potential misuse, the innovation driving these privacy mechanisms is strengthening the broader goal of secure, censorship-resistant finance that BTC introduced.

Three Privacy Tokens to Watch in 2025

Monero (XMR)

remains the benchmark for privacy-focused crypto. Its use of ring signatures, stealth addresses, and RingCT technology ensures full anonymity. Despite facing delistings in some jurisdictions, its strong developer community continues to refine its protocol for improved efficiency and scalability.

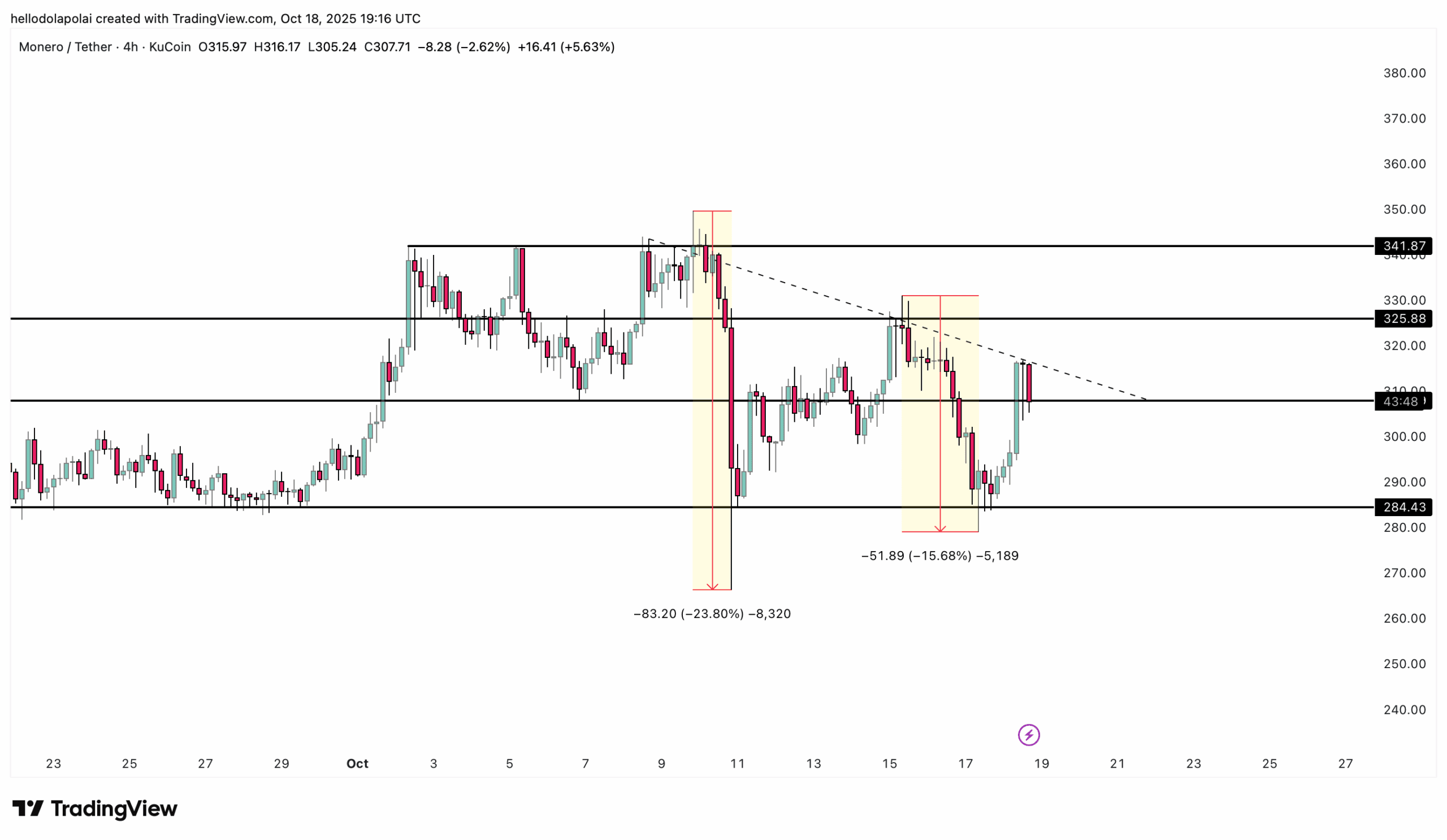

Monero currently holds a bearish outlook on the chart. The asset has failed to post a new high and has significantly declined in recent sessions.

At present, XMR trades near $307.89, which could serve as a potential support level that may spark a rebound. A successful move higher would face resistance around $325—a key level behind the 15% drop viewn between October 15 and 17.

A breakout above $325 could lead the asset to retest $341, the level that triggered a 23% decline between October 9 and 10. For now, momentum remains fragile as trading volume has dropped 14% to $167 million in the past 24 hours.

Zcash (ZEC)

Zcash utilizes zk-SNARKs to allow both transparent and shielded transactions. Its flexibility and ongoing upgrades make it one of the most technically advanced privacy projects, blending compliance options with true user privacy.

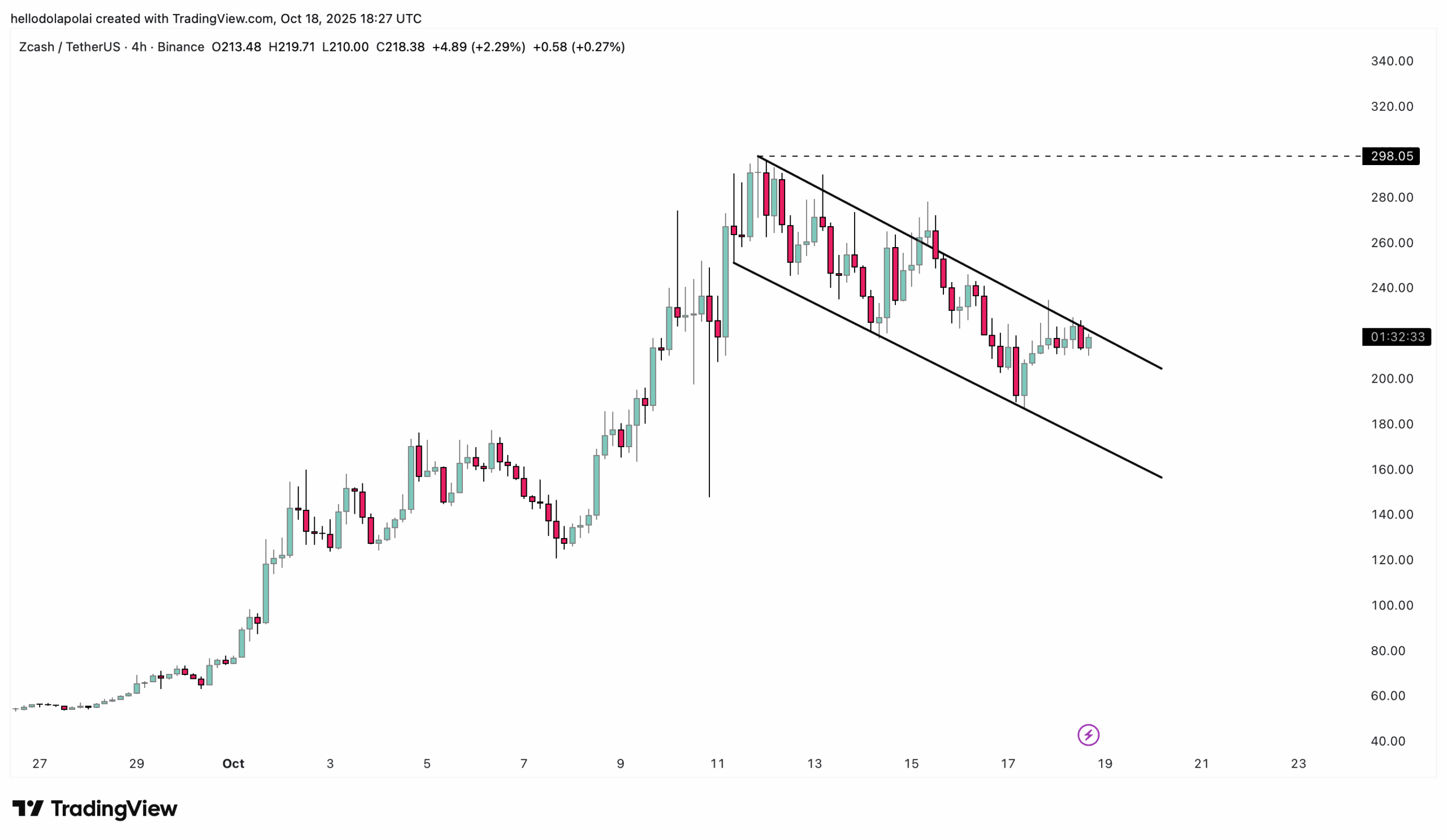

ZEC shows strong potential for a rally as it trades within a descending bullish channel, a pattern known to catalyze upward price movement.

At the time of writing, the asset is testing the resistance level of this bullish structure, with no decisive breakout yet. A successful breakout from this point could push ZEC toward its most recent high from October 11, when it traded around $298.

However, if the breakout attempt fails, the asset could retrace toward the descending support level of the channel. Sustained momentum above resistance could trigger a price discovery phase, potentially setting a new all-time high.

Dash (DASH)

Originally forked from BTC, Dash introduced a feature called PrivateSend, which uses a coin-mixing process to obscure transaction sources. Although Dash now positions itself more as a payments-focused cryptocurrency, its privacy function still appeals to users viewking optional anonymity alongside speed and low fees.

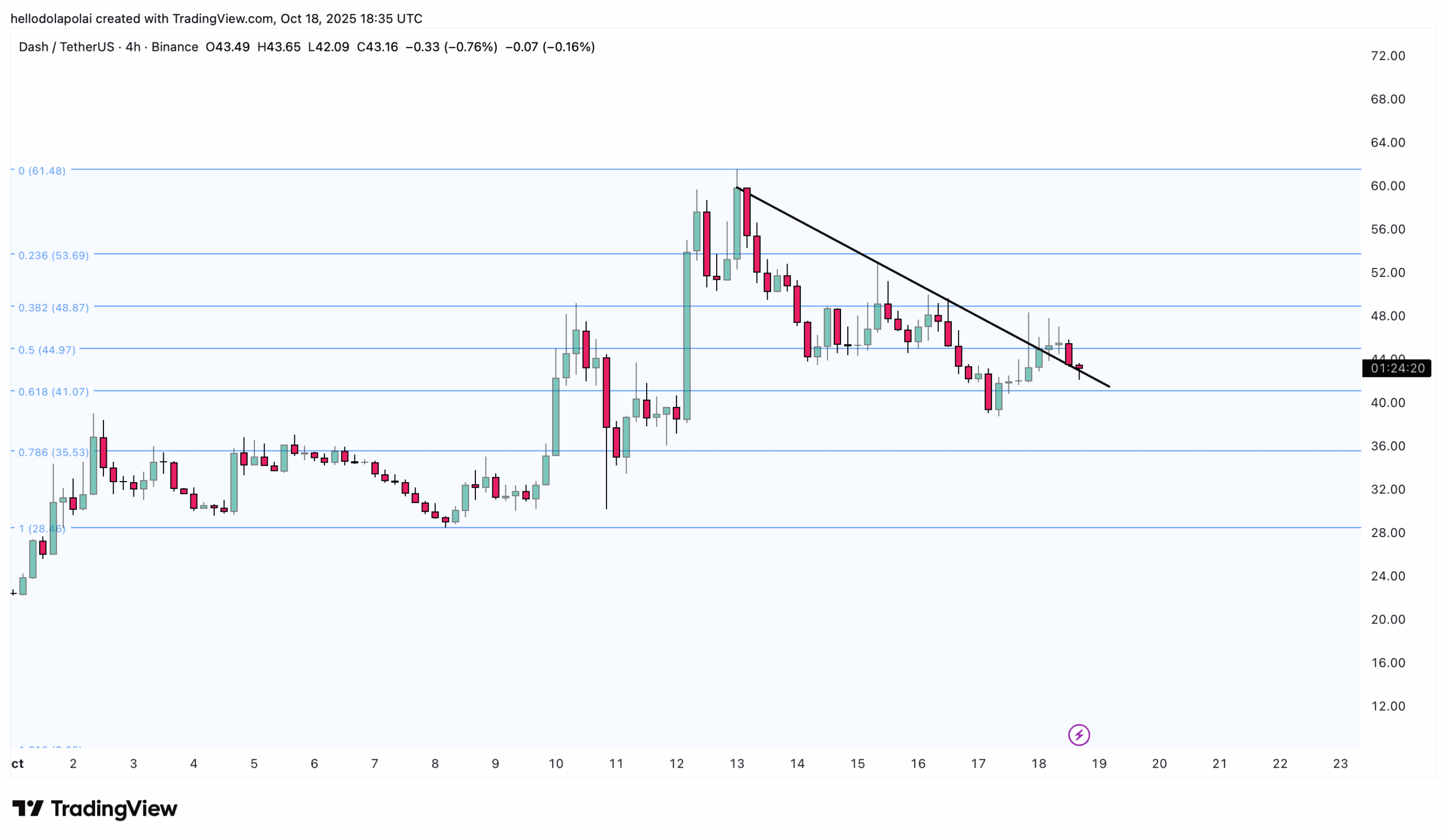

DASH shares a similar outlook with ZEC, although its momentum has begined to fragileen. The asset recently broke out from a descending resistance line, reaching the Fibonacci zone near $41, before declining and forming consecutive bearish candlesticks.

If DASH falls back below the descending resistance line and retests the $41 support level, it could attempt a gradual recovery. A shift in retail sentiment over the weekend could fuel a move toward $61, with the asset already posting a 12% weekly gain.

Conclusion

While privacy tokens like Zcash (ZEC), Dash (DASH), and Monero (XMR) are showing mixed technical signals, their broader relevance extends beyond short-term price action implying that fundamental sentiments will play a key role in the assets overall movement.

As the market enters deep in fourth quarter of 2025, investor focus will likely shift between technical setups and the growing regulatory conversation around privacy-focused assets. Whether through bullish breakouts or temporary corrections, these tokens remain central to the debate on how blockchain can balance transparency with the right to financial privacy.

Frequently Asked Questions (FAQs)

1. What are privacy tokens?

Privacy tokens are cryptocurrencies that conceal transaction details—like sender, receiver, and amount—using cryptographic methods such as ring signatures or zero-knowledge proofs.

2. Why are privacy tokens significant?

They build on BTC’s decentralized vision by allowing users to maintain financial freedom and anonymity while transacting securely on public blockchains.

3. Which privacy tokens are currently leading the market?

Monero (XMR), Zcash (ZEC), and Dash (DASH) are the most established privacy-focused cryptocurrencies, each using unique mechanisms to enhance on-chain confidentiality.

4. What is driving ZEC’s potential rally?

ZEC is trading within a descending bullish channel, and a breakout above resistance could lead to a move toward its recent high around $298.

5. Why does Monero (XMR) have a bearish outlook?

XMR has struggled to break new highs and remains below key resistance at $325, with declining trading volume suggesting fragileening market momentum.