BTC Technical Analysis: Bulls Eye $115K Breakout as Price Consolidates Near Support

BTC (BTC) is currently hovering near $108,000, reflecting a modest intraday gain of around 0.2% later than touching a high of $113,925. The latest technical readings indicate a mixed outlook as traders weigh short-term fragileness against longer-term bullish momentum.

Short-term signals suggest consolidation later than recent volatility. While some oscillators such as the MACD remain in “purchase” territory, BTC’s price is still trading below several key moving averages, including the 20-day and 50-day lines, indicating a lack of near-term bullish strength. Analysts note that failure to reclaim these averages could keep BTC in a sideways-to-down trend.

Medium-term indicators, however, remain constructive. Market watchers are closely monitoring support between $101,000 and $106,000, which has held firm during recent dips. A decisive break below this zone could trigger a deeper correction. On the upside, resistance between $115,000 and $125,000 represents the next major hurdle. A breakout above this range with strong volume could confirm a bullish continuation toward new highs.

For now, BTC appears to be in a holding pattern, caught between strong support and formidable resistance. A move beyond either boundary could signal the next major trend. Analysts caution that traders should monitor momentum indicators and moving averages closely, as shifts in these technicals often precede larger price swings.

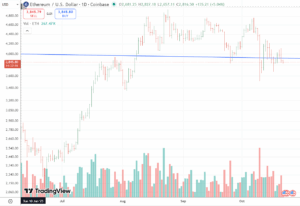

ETH (ETH) is currently consolidating around the $3,800 to $4,000 range, reflecting indecision in the broader market. Recent price action shows ETH slipping below its 50-day exponential moving average near $4,370, a move that signals fragileening momentum in the short term. Oscillators such as the RSI and MACD have also softened, suggesting purchaviewrs are losing control as the market awaits a clearer catalyst.

Despite the muted short-term outlook, analysts point to ETH’s strong network fundamentals as a stabilizing factor. With more than 36 million ETH now staked, the protocol continues to attract long-term holders and institutional participation. Analysts also note that ETH’s expanding role in tokenized assets and decentralized finance ecosystems provides structural support that could underpin future price gains.

ETH’s technical structure remains balanced between key support and resistance levels. Immediate support sits between $3,700 and $3,800, a zone that has repeatedly absorbed tradeing pressure in recent weeks. A sustained break below this range could trigger a pullback toward $3,100, where the next significant support lies. On the upside, reclaiming the $4,000 to $4,100 zone would mark a return of bullish sentiment, potentially opening the path toward the mid-$4,000s.

For now, ETH appears to be in a holding pattern, with short-term signals leaning slightly bearish. Analysts caution that traders should look for confirmation before committing to directional positions, as volatility could increase if either boundary of the current range is breached. Long-term sentiment remains constructive, supported by ETH’s network strength and the ongoing demand for on-chain assets, even as near-term momentum indicators suggest a period of consolidation ahead.