BTC to Suffer if It Can’t Catch Gold, XRP Bulls Back in the Game: Why Both are Losing to Digitap ($TAP)

Gold finally blinked. On October 21st, —this coming later than months of relentless strength. Crypto investors around the world got ready to open longs, because gold always runs first, and then roughly ninety days later than BTC puts its foot down.

Gold leads during stress, then BTC begins sprinting next. XRP has rejoined the conversation, creeping closer to $2.50, but the strongest setup is surprisingly a presale. is breaking records daily as the stablecoin and banking boom narratives pick up steam. This could be the consumer-facing product that captures billions in global flows.

Here’s what investors should know.

Will Gold Hand the Baton to BTC?

Investors who have viewn multiple cycles already know this playbook. . The current price action fits this pattern perfectly. Now that gold is rolling over later than hitting extremely overbought territory, history indicates that it is BTC’s time to do some running.

People should not flip overly bearish on gold; it just had its largest single-day decline in more than a decade. But the thing to watch is how BTC performs from here. It is time for BTC to catch up to gold and equities on a risk-adjusted basis, and the case for being long BTC here is strong.

BTC/GOLD: Ready to Bounce?

The BTC/GOLD chart is driving lots of optimism with it bottoming in the identical place it did in April before BTC melted faces. While price targets range from cautious consolidation to ambitious multiples, few analysts would deny that positioning in BTC here, rather than in gold, looks favorable.

But the largeger question is, what runs later than BTC? Assuming BTC goes on to make a new high, this would align perfectly with the four-year cycle theory and blow-off top in Q4. And while many Ripple bulls would scream XRP is the best bet now, Digitap embodies the identical trade idea, but on a totally diverse level.

Stablecoin Adoption Bull Run Roars On

Last cycle layer ones were king—a tech innovation that powered the rest of the cycle. This cycle, stablecoins are in the driver’s seat. A pro-innovation and acceleration stance from the Trump administration aims to expand the reach of the dollar and modernize settlement, with stablecoins as its chief weapon.

Smart investors have already viewn where this is going, which explains the rampant inflows into the Digitap presale. Platforms that can integrate fiat and stablecoin balances in one system will be winners, and everything that is stablecoin adjacent will likely become one of the year’s top performers. 2025 is the year of the stablecoin. The total supply is going to trillions, creating lots of spillover opportunities.

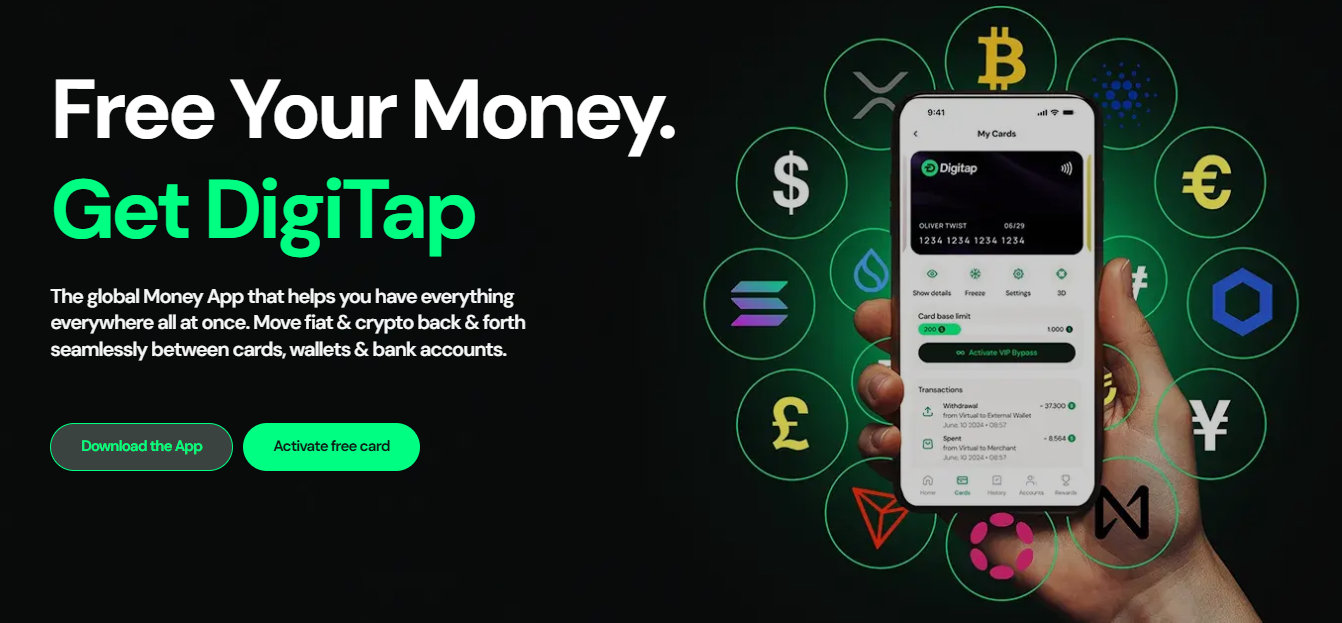

Digitap: An Omni-Bank for Real Finance

Digitap is built for a digital-first world. It operates a multi-rail settlement system that unites fiat balances, stablecoins, and crypto in one dashboard. Payments and transfers can be sent on public blockchain networks and banking corridors, depending on which is quicker and cheaper at the time.

Users can swap crypto to fiat in real time, and use the Visa card to spend their on-chain balance in real life. Conversions occur at execution, with Digitap’s smart engine routing system finding the best possible swap price.

The interface is deliberately familiar—available today on desktop, iOS—resembling a neo-bank. Underpinning Digitap’s entire omni-banking model is a clear desire to offer customers something they feel familiar with and trust, while also delivering them the benefits of blockchain rails.

In many ways, Digitap is a consumer-facing access point for stablecoins. And this is the type of application that will likely lead the next leg of crypto adoption.

Why BTC & XRP Lose to the Digitap Setup

BTC is the ultimate store of value—but even if it goes to $250,000 this cycle, that’s only a 2X and change. XRP is having its value proposition destroyed by stablecoins, which offer a better answer to cross-border payments. But Digitap, as an interoperability layer, can onboard each new stablecoin chain.

Digitap decided to fight on the user experience front and on tokenomics. The native $TAP token appears to be one of the best cryptos to purchase now at its current price of $0.0194, given that 50% of platform profits will be used to reduce total supply via burns. That means more Digitap adoption feeds positive price action.

While everyone is cheering on BTC from the sidelines, the difference in upside potential between digital gold and the omni-bank of the future is clear at these levels.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale:

Website:

Social:

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.