Visa’s Quiet Partnership With This New Altcoin is a Game-Changer for the Payments Industry

The payments sector is changing quick, and not because of central bank innovation. A new infrastructure is stepping in to handle everyday transactions, cross-border transfers, and small business finance. One of the most interesting phenomena right now is Visa’s quiet collaboration with a project that’s already shipping a working product: .

This partnership has the potential to shake up not just the blockchain industry, but the global payments system itself. The combination of Visa’s reach and Digitap’s DeFi rails could make crypto usable for millions of people around the world. With a live app, complete user ownership, and growing presale, $TAP is positioning itself as one of the best altcoins to invest in right now.

A Live Omni Bank — Not Just Marketing Spin

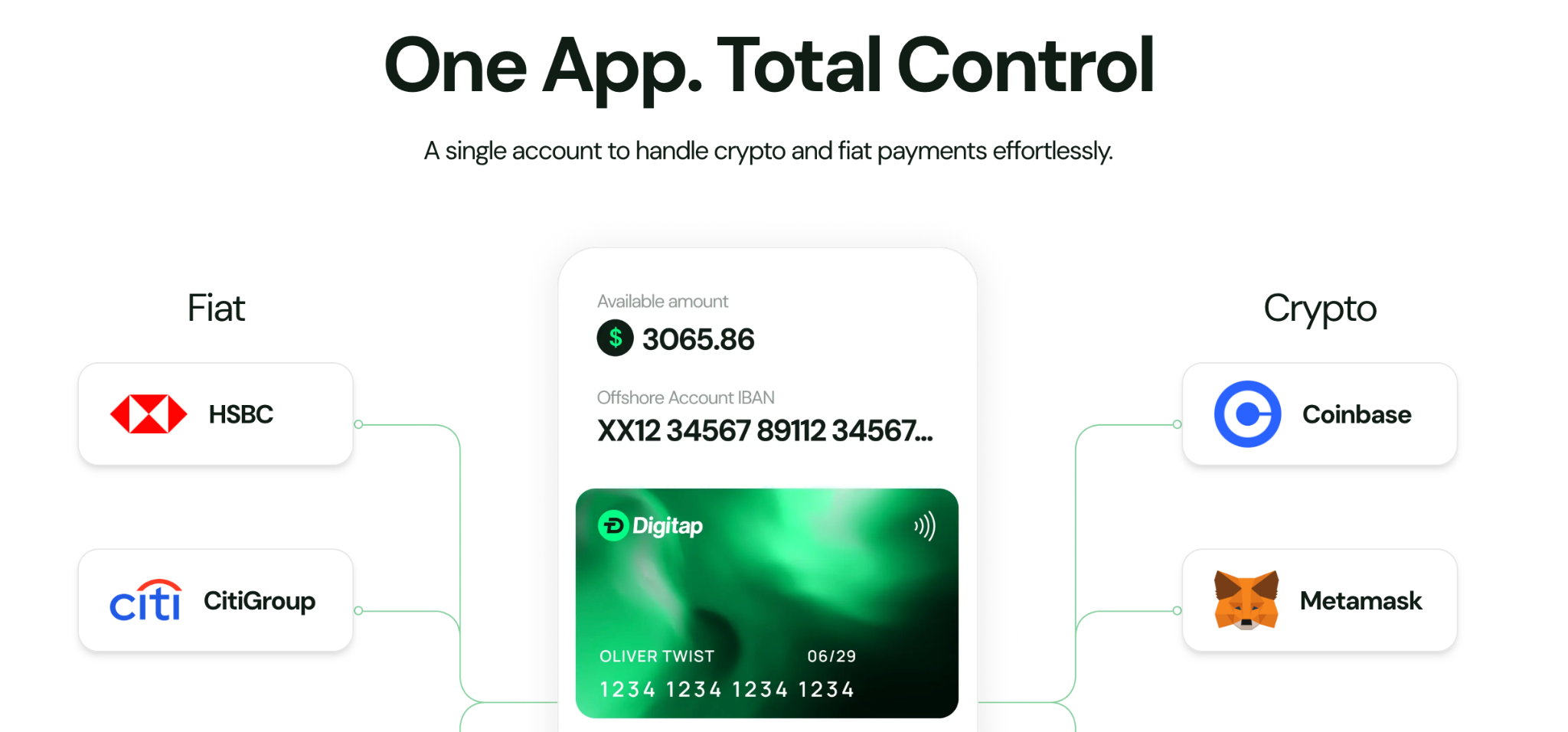

Digitap is a live omni bank that provides a full suite of financial services for remote workers, small business owners, and unbanked citizens. This includes one-tap PoS payments, global IBANs, payroll, invoicing, fiat to crypto transfers, staking APY, a zero-KYC crypto platform, and more. It’s a unified global superapp for all financial requirements, with full user control.

Unlike the majority of presales that lean on vague promises or ahead-stage partnerships, Digitap has moved past the concept stage as a fully functional omni bank. It already has an active, functioning app available on both the Apple App Store and Google Play Store, meaning users can register, onboard, and actually use their accounts today.

What makes this diverse is Visa. Through a card integration partnership, Digitap enables users to spend their digital assets anywhere Visa is accepted. Instead of locking funds in speculative wallets, users can move money seamlessly between crypto and fiat. This is exactly the kind of utility layer blockchain has been promising for years, but has rarely delivered.

This isn’t a small thing. Visa processes annually and operates in over 200 countries. If Digitap captures even a sliver of this activity, the token mechanics behind $TAP could experience a structural demand shock. This is why the project has caught the attention of institutional traders and retail speculators alike.

Zero-KYC Compliance for Global Access

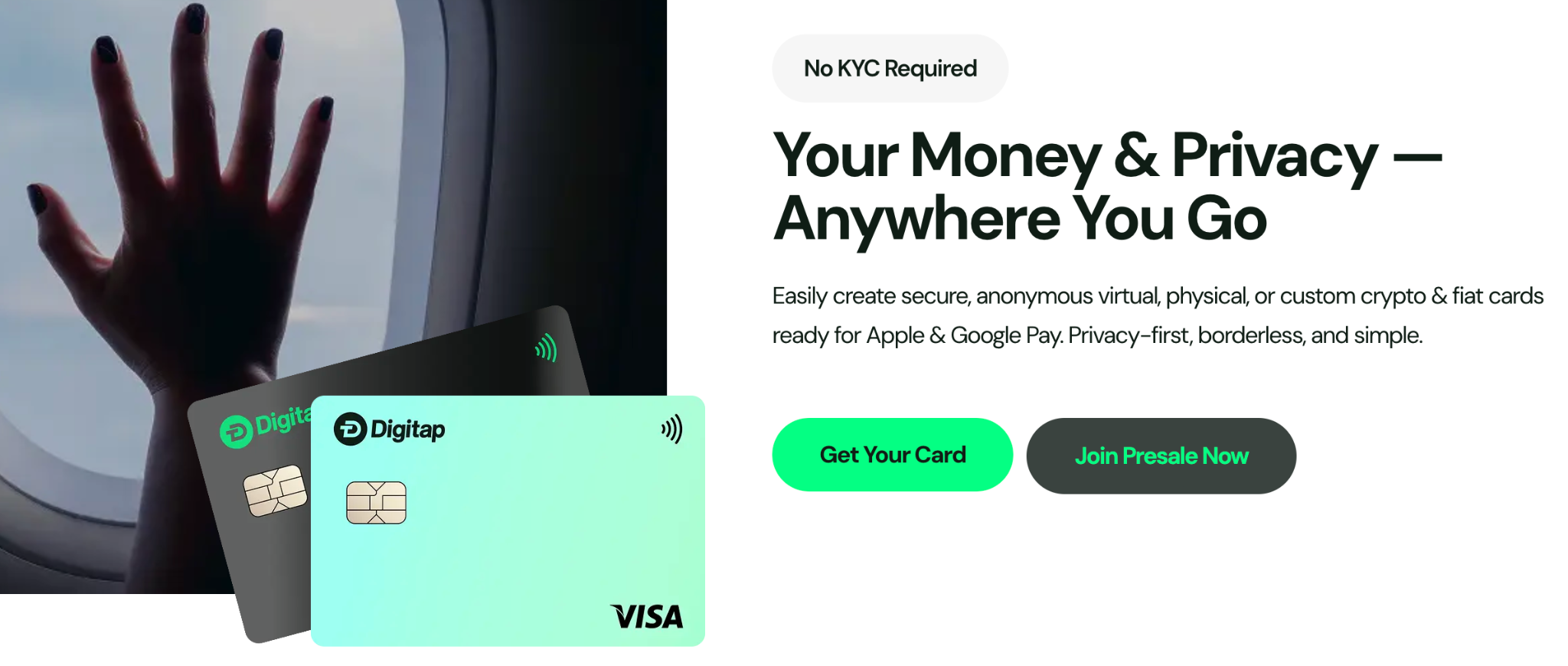

Digitap’s architecture goes beyond payment convenience. It’s built to support stablecoins directly within its ecosystem, giving users the ability to park funds in stable value instruments during volatile market cycles. This feature alone makes it attractive to people in regions where banking is limited or inflation is rampant. Another major component is its zero-KYC approach.

Unlike traditional fintech platforms that require lengthy verification, Digitap’s compliance model aligns with evolving global regulation while keeping user onboarding quick and accessible. This combination of privacy and usability fits perfectly with Visa’s interest in expanding card access to underbanked populations globally.

In this way, Digitap tap works with existing fintech infrastructures while enhancing them with flexible crypto finance. More than 1.4 billion unbanked people could benefit from this model, particularly in regions where traditional banks are sluggish or exclusionary. With Visa’s network reach and Digitap’s infrastructure, these populations could leapfrog directly into modern financial systems.

Explosive Tokenomics Back the Visa Integration

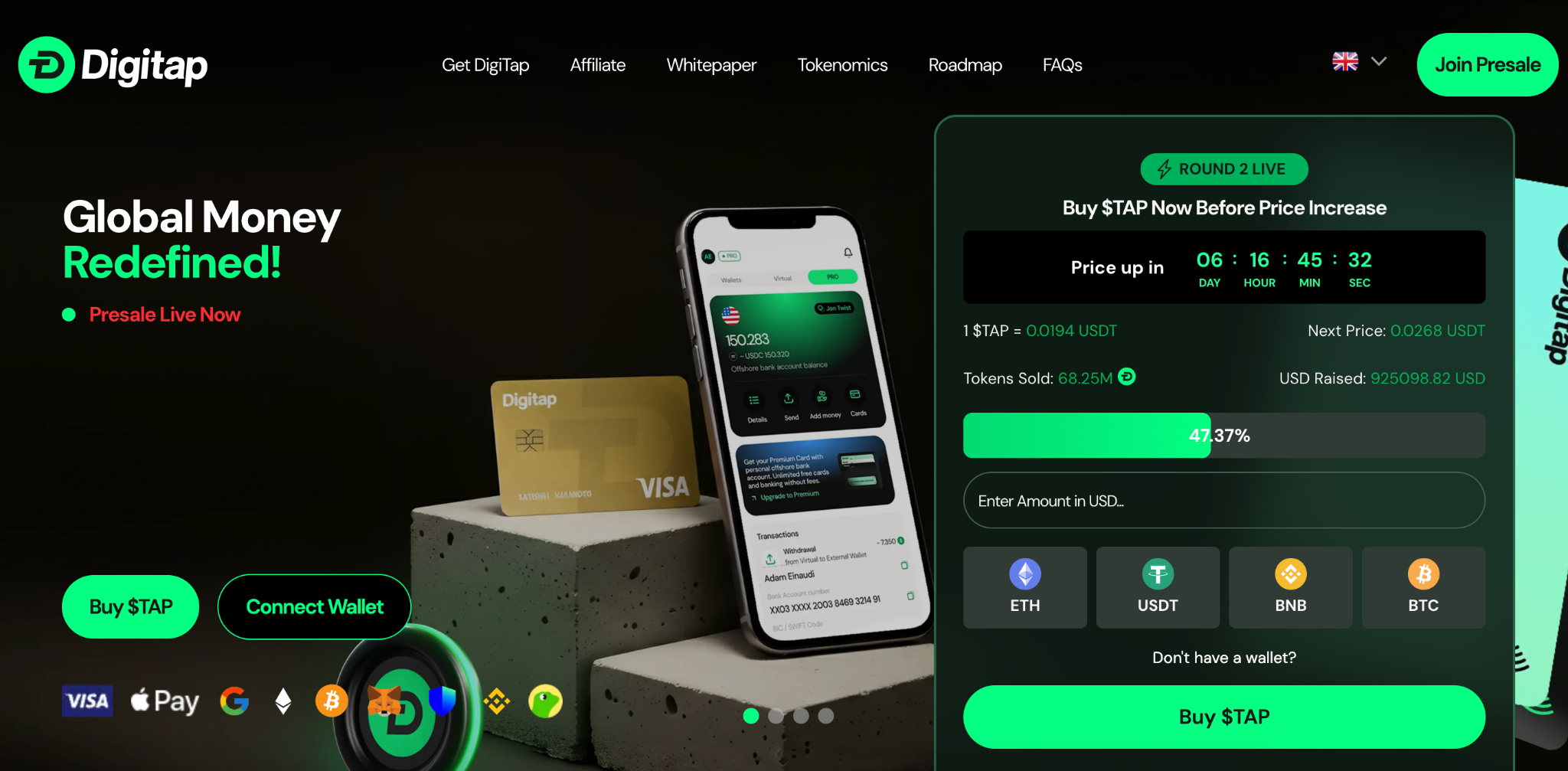

Digitap isn’t just another app — it has precise token mechanics that tie platform growth directly to $TAP value. The presale has already raised more than $900,000 and sold more than 66 million tokens. The current price of $TAP is $0.0194, and the next stage will view the price jump to $0.0268, an increase of nahead 40%.

Fifty percent of platform profits are allocated to burning $TAP and rewarding stakers. This means that as transaction volume grows — especially with Visa integration — demand for the token is set to rise while supply decreases over time. This deflationary structure is partly why analysts are labeling $TAP as one of the best altcoins to invest in, before public listing.

Unlike speculative meme tokens, Digitap combines a functional payments product, regulatory positioning, and profit-backed mechanics. That’s why many in the space are calling it one of the most promising ahead-stage fintech disruptors on the market.

Why Visa + Digitap Could Redefine Payments

Visa has always been at the forefront of payment technology. Its infrastructure assisted globalize commerce by allowing near-instant settlement across borders. But it also came with centralized gatekeeping, high fees, and limited access. Digitap’s open and borderless architecture changes that dynamic.

By integrating Visa rails into a decentralized payment platform, Digitap effectively blends two worlds: traditional financial stability and decentralized financial freedom. Users get the trust and familiarity of Visa while benefiting from lower costs, open access, and crypto flexibility.

As the presale continues to gain traction, the market is begining to recognize that this isn’t just another speculative play. It’s a rare example of a presale project that’s already delivering at scale. And if it penetrates the payments market, $TAP could view massive price multipliers.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale:

Website:

Social:

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.