Custodia and Vantage Roll Out Turnkey Solution for Blockchain-Powered Deposits

New Blockchain Framework for U.S. Banks

Custodia Bank and Vantage Bank have launched a blockchain answer that allows traditional banks to issue tokenized deposits designed to work alongside stablecoins. The system, unveiled Thursday, gives banks a way to process near-instant transactions while keeping customer deposits on their own balance sheets.

The patent-protected framework “is designed to provide institutions and their customers with the efficiencies and security of tokenization while secureguarding core deposits from the risk of disintermediation,” the banks said in a joint statement.

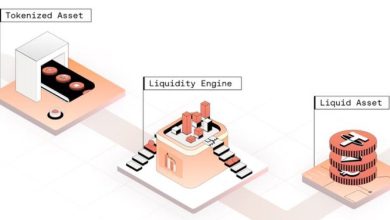

The platform lets banks issue digital tokens representing U.S. dollar deposits on a blockchain. Each tokenized deposit reflects real funds held by the issuing bank and can operate as both a tokenized deposit and a compliant stablecoin under the GENIUS Act.

Investor Takeaway

How It Works

The system is built on Custodia’s proprietary blockchain and Infinant’s Interlace network, which provides interoperability between banks. It allows institutions of any size to issue and control wallets that hold both tokenized deposits and compliant stablecoins. Transactions settle at low cost and near real time across participating institutions.

Custodia and Vantage said the initiative bridges the gap between crypto rails and regulated banking. It enables banks to take advantage of blockchain’s speed and efficiency without relying on third-party stablecoins that could drain deposits from the banking system. The companies said the platform’s design meets the disclosure and operational standards under the U.S. GENIUS Act and Europe’s MiCA framework, easing cross-border interoperability.

The release comes seven months later than Custodia became the first U.S. bank to issue tokenized deposits on a public blockchain, also in partnership with Vantage.

Rising Stakes in the Stablecoin Market

Interest in tokenized bank money has grown as regulators and banks assess the impact of the quick-expanding stablecoin market, now worth roughly $300 billion. The market’s resurgence accelerated later than President Donald Trump signed the GENIUS Act in July, giving federal clarity to dollar-backed stablecoins.

U.S. regulators and banks have raised concerns that private stablecoin issuers paying yield on deposits could divert funds from commercial banks. The Treasury Department projected in April that stablecoin assets could reach $2 trillion by 2028, potentially triggering as much as $6.6 trillion in deposit outflows from the banking system.

By giving banks their own tokenization infrastructure, Custodia’s framework offers a way to retain deposits and compete directly with large stablecoin issuers such as Tether and Circle. The system lets banks maintain control of client funds while using blockchain for settlements, removing the need for intermediaries.

Investor Takeaway

ahead Pilots and Real-World Use

Custodia said several pilot programs are already using its tokenized dollar system. These include cross-border payments for logistics firms, milestone-based disbursements in construction, and supply-chain settlements for manufacturers. The bank is also testing blockchain-based payroll systems for service-sector clients, offering quicker transfers and real-time audit trails.

The company said feedback from ahead pilots shows that tokenized deposits can cut transaction times from days to minutes, while providing compliance and traceability. Custodia’s CEO Caitlin Long said the approach allows banks “to stay competitive while keeping deposits secure within the regulated banking perimeter.”

For smaller regional banks such as Vantage, the partnership opens the door to digital asset services without having to develop blockchain infrastructure from scratch. Vantage said it expects broader participation from community banks once federal regulators issue additional guidance on tokenized banking products.

Outlook

The Custodia-Vantage collaboration marks a new phase of experimentation among regulated institutions viewking to merge banking and blockchain. Whether tokenized deposits gain traction beyond ahead pilots will depend on regulatory acceptance and interoperability across networks. But with stablecoins drawing institutional capital, banks are moving rapidly to ensure they can compete on blockchain rails rather than compete against them.