Best Crypto to Buy in 2025: DeepSeek AI Picks DeepSnitch Over XRP and HYPE

Aave Labs has just announced its acquisition of Stable Finance, a San Francisco-based DeFi app focused on yield-generating stablecoins.

The deal brings founder Mario Baxter Cabrera and his team under Aave’s umbrella, reinforcing the protocol’s push into retail-friendly crypto products.

While the news is undeniably bullish for AAVE, Deepviewk AI’s latest model points elsewhere. According to the chatbot’s updated projections, DeepSnitch AI is the best crypto to purchase in 2025.

Even with Hyperliquid and Ripple flashing strong setups, stands alone in offering true asymmetrical upside. Here’s what makes it the next 100x crypto.

Aave Labs acquires Stable Finance to expand retail DeFi offerings

Aave Labs San Francisco–based Stable Finance, a mobile app that enables users to earn yield on stablecoins through overcollateralized DeFi markets. The move marks Aave’s latest push into consumer-facing crypto services.

The deal, announced on October 23, includes the onboarding of founder Mario Baxter Cabrera and his engineering team. While financial terms weren’t disclosed, the acquisition complements Aave’s recent institutional expansions, including its Maple Finance integration and the Horizon RWA marketplace.

With in TVL, Aave is now strengthening its retail presence at a time when demand for on-chain yield continues to grow, even amid regulatory grey zones surrounding stablecoin rewards.

The acquisition also comes as rivals like Coinbase and Crypto.com roll out DeFi yield integrations of their own.

While U.S. lawmakers passed the GENIUS Act banning yield-bearing stablecoins, on-chain lending protocols remain legally unaddressed, fueling tension with traditional banks and opening the door for further growth in decentralized finance.

Top 3 best crypto to purchase for 2026 according to Deepviewk: DeepSnitch AI vs. XRP and HYPE

DeepSnitch AI

The era of 100x crypto tokens isn’t over: investors are just looking in the wrong places. In 2021, hype was enough to deliver 100x returns. But in 2025, cash flows into projects with real utility and a defined customer base. That’s why top-tier investors have already poured over $459K into DeepSnitch AI’s presale.

The protocol delivers something retail traders have always lacked: access to the identical high-level information and tools that whales use.

While large players trade with insights and discipline, smaller traders often panic or chase pumps. DeepSnitch AI assists retail users trade calmer and smarter, offering the possibility of constant returns to everybody.

And all of this happens inside Telegram, the platform with and the beating heart of the crypto community. On top of that, DeepSnitch AI was fully audited by Coinsult and SolidProof. Every contract is verified, offering a level of transparency and securety most ahead-stage tokens don’t even attempt.

That’s why Deepviewk points out that a $1,000 investment today could turn into $100,000 once hits the open market.

XRP

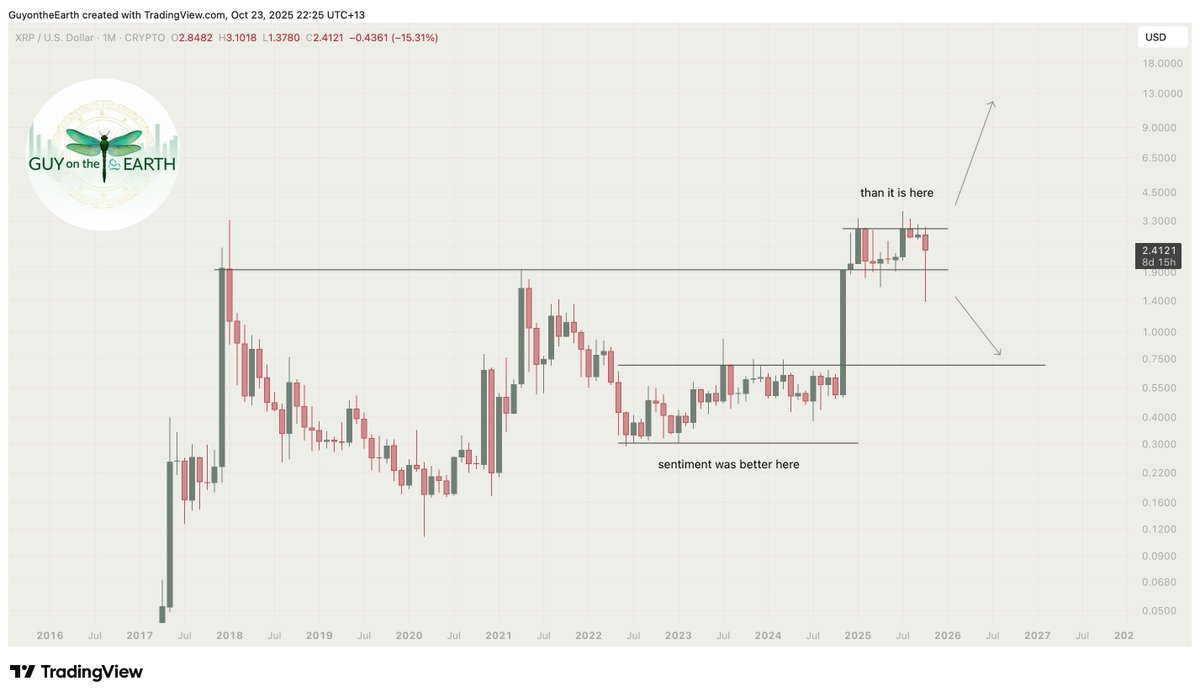

XRP was holding strong above $2.40 on October 23, keeping its bullish setup alive despite lower volume and cautious market sentiment.

Price has been bouncing between $2.33 and $2.44, forming a descending channel that often breaks upward. A close above $2.41 and put $2.72 and $2.85 in sight.

view $2.33 as the key pivot. If it breaks, $2.28 may follow, but strong support around $2.30 still limits downside. MACD and RSI show low volatility, which often comes before a sharp move. A green monthly close above $2.42 would confirm strength.

On the largeger picture, Ripple’s legal clarity and ETF buzz are boosting confidence. If XRP clears $2.41 cleanly, a push toward $4 by year-end looks more likely.

Hyperliquid

Hyperliquid is gaining strength again, closing above $40 on October 23. Investor interest is rising, with hitting $2.17 billion and futures growing to $1.37 billion, signs of renewed confidence in the ecosystem.

Earlier in the month, HYPE $44 but pulled back into a choppy range between $27.50 and $44. Now it’s stabilizing, with the 200-day EMA at $36 offering solid support. Traders are eyeing $42.50 as the next key level, where the 50- and 100-day EMAs meet.

Momentum is picking up. MACD flipped bullish, and RSI is climbing toward 50. If HYPE reclaims $45, a strong breakout could follow. But $40 needs to hold. A drop below might trigger a quick liquidity sweep before bulls regain control.

Closing thoughts

Aave’s acquisition of Stable Finance signals strong growth in DeFi, but legacy tokens like AAVE may not deliver the explosive returns investors are hunting in 2025.

That’s why DeepSnitch AI’s presale became so popular in the last month. At just $0.01992, with over $450K already raised, it’s one of the few ahead-stage projects still capable of a 100x move.

According to Deepviewk’s own AI model, DeepSnitch may be the best crypto to purchase heading into 2026.

Check out for more information.

FAQs

Is DeepSnitch AI one of the top cryptocurrencies to purchase today?

Yes, because DeepSnitch AI combines real utility and ahead-stage pricing. With over $459K already raised and audited smart contracts, it’s one of the top cryptocurrencies to purchase today for serious 2026 upside.

How secure is investing in DeepSnitch AI during presale?

DeepSnitch AI has been fully audited by Coinsult and SolidProof, with all contracts verified. Unlike most presales, it puts transparency first, giving ahead purchaviewrs more security than typical speculative launches.

Where can I purchase DeepSnitch AI?

You can join the presale directly via the official DeepSnitch AI website, using ETH, USDT, or BNB. Wallets like MetaMask, Trust Wallet, and WalletConnect are supported. ahead access is still open.

What are the trending coins this week?

This week, Hyperliquid (HYPE) and XRP are trending. HYPE surged later than a Robinhood listing and a $1B funding push, while XRP gained momentum from institutional accumulation.

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.