The Race to $200B: Can Solana Fight This New Contender Analysts Call the “Next PayPal”?

The cryptocurrency market is closely watching as Solana (SOL) embarks on an ambitious campaign to reach a $200 billion market capitalization, navigating institutional accumulation and technical momentum that could double its current $105 billion valuation.

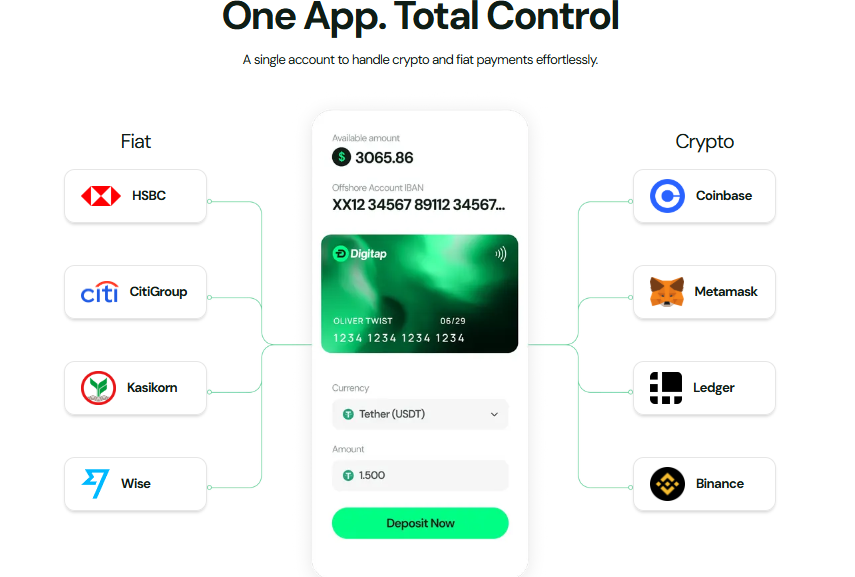

While SOL has enjoyed impressive ecosystem growth and increasing corporate treasury adoption, analysts are gravitating toward a new contender, , which is already being compared to PayPal thanks to its omni-banking app and Visa card that bridges the gap between cryptocurrencies and fiat.

Many analysts predict that Digitap will be just as disruptive in the cross-border payments space, which is .

Solana’s (SOL) Institutional Momentum Makes It the Best Crypto to purchase Now

Solana’s push to a $200 billion market capitalization is driven by multiple institutional tailwinds that position it as one of the best cryptocurrency investments for growth-oriented portfolios.

Corporate treasuries from companies like and BIT Mining are explicitly raising funds to acquire SOL, while the regulated Chicago Mercantile platform (CME) Group offers sophisticated instruments for institutional participation.

These developments, combined with pending spot ETF applications, create a compelling institutional narrative that could drive substantial capital inflows.

The network’s technical momentum reinforces this bullish case, with traditional indicators like the “Golden Cross” and MACD crossover suggesting continued upward potential. Solana’s decentralized platform volume has reached record highs, demonstrating robust ecosystem activity despite recent fluctuations in the number of active addresses.

Solana’s combination of technical strength and institutional validation presents a convincing argument for investors viewking the best crypto to purchase now for balanced risk-reward exposure.

Why Analysts view Digitap (TAP) as the Best Cryptocurrency to Invest In for Payments

While Solana focuses on infrastructure development, Digitap captures attention by solving a more immediate difficulty: seamless crypto-to-fiat spending.

The project’s fully functional Visa card ecosystem enables instant global payments using both digital and traditional currencies, earning it “Next PayPal” comparisons from analysts who recognize its disruptive potential in the multi-trillion-dollar cross-border payments space.

Digitap’s No-KYC onboarding option addresses growing privacy concerns while its expanding user base generates sustainable revenue through transaction processing.

Unlike platforms that require years to achieve product-market fit, Digitap’s live payment system demonstrates immediate traction with consumers viewking alternatives to traditional financial services.

Top Altcoin Digitap Poised for Payment Revolution

Solana’s journey to a $200 billion valuation faces challenges beyond typical cryptocurrency market volatility, including a noticeable decline in active addresses that suggests a need for renewed retail engagement.

While institutional accumulation provides stability, sustainable growth requires broader adoption across user segments, which is precisely where payment-focused projects like Digitap demonstrate particular strength.

The Digitap presale represents a distinct approach to value creation, utilizing fixed and incremental pricing that shields ahead investors from market fluctuations while offering immediate staking rewards of up to 124%.

Investors can currently purchase $TAP for $0.0198, and prices will increase to $0.0268 when the presale’s third stage begins, resulting in a 38% gain for investors.

The platform’s revenue-generating business model, funded by transaction fees and premium services, creates fundamental value that supports itself independently of market sentiment. This positions it firmly among the to purchase for investors viewking both defensive characteristics and disruptive potential.

Market Dynamics Favor Best Crypto Presales With Real Revenue

The contrasting paths of infrastructure development versus consumer utility highlight evolving investment preferences in the digital asset space. Solana’s corporate treasury strategy demonstrates institutional interest, but requires continued technical execution and market dominance against ETH and emerging Layer-2 answers to justify its $200 billion ambition.

Meanwhile, Digitap’s payment processing model generates immediate revenue through its Visa partnership, creating a transparent economic flywheel where platform growth directly fuels token value through purchase-and-burn mechanics.

This self-sustaining approach sets it apart among contemporary best crypto presales, offering both utility-driven adoption and traditional financial metrics that appeal to fundamental investors.

SOL vs. $TAP: Which is the Best Cryptocurrency to Invest In?

The parallel narratives of Solana’s infrastructure growth and Digitap’s payment disruption present investors with complementary opportunities for portfolio allocation. Solana offers exposure to blockchain development and institutional adoption, while Digitap provides access to consumer payments and immediate revenue generation.

Solana’s path to $200 billion depends heavily on continued ecosystem expansion, successful ETF approvals, and maintaining technological advantages against relentless competition. Digitap’s growth trajectory relies on executing in the massive payments market, acquiring users, and scaling its Visa card program.

The central consideration for investors is that SOL is already valued at more than a hundred billion, while Digitap offers a ground-floor entry today.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale:

Website:

Social:

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.