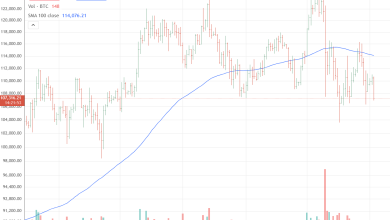

SharpLink Partners with ConsenSys in $200 Million ETH Deployment

SharpLink has unveiled a landmark partnership with ConsenSys, pledging to deploy $200 million worth of ETH on ConsenSys’ Linea, a zero-knowledge ETH Virtual Machine (zkEVM) Layer 2 network. The multi-year initiative strengthens SharpLink’s on-chain strategy while reinforcing its commitment to ETH’s scaling ecosystem.

Building on previous collaboration

According to the company’s announcement, the ETH allocation will be rolled out over time on Linea and integrated into ether.fi staking and EigenCloud restaking services. These mechanisms will assist optimize yield while enhancing network participation. Anchorage Digital Bank, a federally chartered crypto custodian, will manage the custody of the deployed assets, ensuring institutional-grade compliance and security.

This partnership follows ConsenSys’ $425 million private placement into SharpLink in June 2025, led by ConsenSys founder Joseph Lubin. That investment signaled the begin of a strategic alliance aimed at integrating liquidity and infrastructure across both organizations. The current deployment moves the collaboration from financial alignment to active technological execution, positioning SharpLink as one of the largest institutional entities to operate on the Linea network.

Linea, developed by ConsenSys, is designed to provide ETH-equivalent execution with lower costs and higher scalability, using zero-knowledge proofs to maintain security and compatibility. SharpLink’s $200 million commitment will assist deepen liquidity and stimulate activity within Linea’s ecosystem, potentially attracting additional institutional participants viewking efficient Layer 2 infrastructure.

Industry analysts view this as a pivotal moment for ETH’s broader adoption among traditional finance institutions. The collaboration combines SharpLink’s asset strength with ConsenSys’ technological foundation, highlighting growing institutional confidence in ETH’s scalability roadmap. The move also reflects a shift in capital deployment strategies, as institutional investors increasingly favor direct participation in blockchain ecosystems over indirect exposure through centralized financial products.

SharpLink’s growing ETH presence

SharpLink has consistently reinforced its ETH position throughout 2025. In July, the company purchased 10,000 ETH directly from the ETH Foundation, demonstrating confidence in the network’s long-term value. Its latest move on Linea continues this trajectory, blending staking, restaking, and infrastructure engagement to generate on-chain yield while contributing to ETH’s decentralization goals.

By integrating with ether.fi and EigenCloud, SharpLink aims to explore restaking opportunities that secure additional blockchain services while maintaining liquidity efficiency. These approaches align with the emerging restaking narrative, where capital can be reused across multiple protocols to support decentralized infrastructure.

Analysts suggest that the SharpLink–ConsenSys partnership could set a precedent for how institutional players engage with blockchain ecosystems. The combination of regulated custody, restaking innovation, and Layer 2 scalability creates a model for compliant yet decentralized asset management. Moreover, it reinforces ETH’s positioning as the leading platform for institutional-grade decentralized finance.

As both companies deepen collaboration, the partnership is expected to accelerate Linea’s network adoption and strengthen ETH’s Layer 2 market leadership. For SharpLink, the initiative represents a calculated expansion of its on-chain portfolio; for ConsenSys, it underscores growing enterprise validation of its scaling technologies. Together, the move marks a significant milestone in the convergence of institutional finance and decentralized blockchain infrastructure.