Foresight Weekly Recap

Macro & Calendar Watch: Liquidity Tightens as Bank Stress Returns

Global liquidity conditions are tightening again. ahead stress among U.S. regional banks is sparking speculation that the Federal Reserve may pause quantitative tightening and pivot to easing sooner than expected. Still, inflation risk remains a policy overhang. European leaders issued a joint call for an immediate ceasefire and peace talks, but Polymarket prices only a ~30% probability of a truce by March 2026. Equities and gold remain firm, while continues to lag.

Key dates ahead include:

- Oct 22: CCP 20th Central Committee, 4th Plenum

- Oct 30: FOMC Rate Decision; Bank of Japan policy update

- Oct 31–Nov 1: APEC Leaders’ Summit in Gyeongju

Investor Takeaway

Market Moves: BTC Slips, Altcoins Drain Liquidity

extended its recent drawdown, while altcoins sold off amid evaporating liquidity. Centralized platform (CEX) order-book depth has fallen to roughly 40% of pre-drop levels. BNB-related tokens led relative outperformance.

Illustrative movers:

- Winners: “Binance Life” (+90%), TIBBIR (+70%)

- Laggards: ATONE (–40%), FORM (–30%), SNX (–30%)

Narrative drivers:

- “Binance Life” spiked later than CZ amplified the meme on X and derivatives listings followed on Binance.

- TAO (AI L1): Halving set for Dec 11; subnet narrative gaining attention.

- Limitless (LMTS): Base’s flagship prediction market token teased a 10B supply cap and airdrop route.

Investor Takeaway

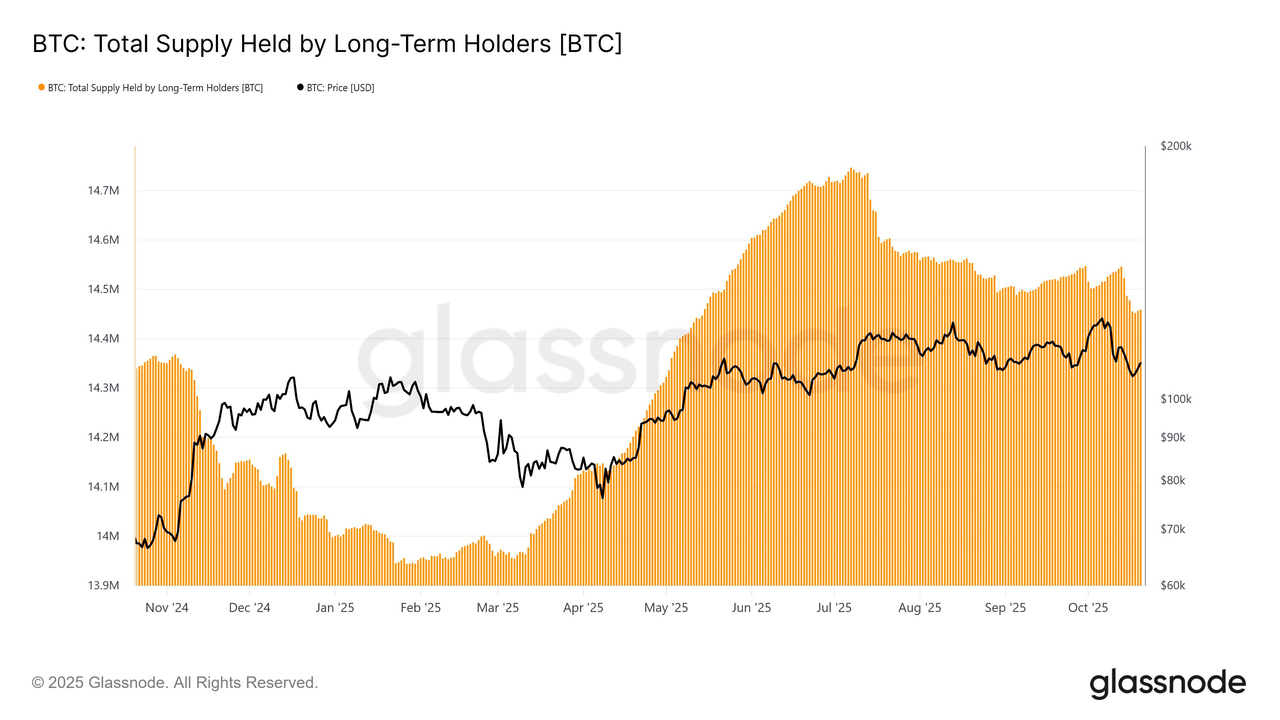

On-Chain & Derivatives: Long-Term Holders begin Distributing

Long-term holder (LTH) supply declined by roughly 28,000 BTC since October 15, marking the strongest distribution phase since summer. This suggests active tradeing, not just natural cohort aging.

- Leverage reset: BTC open interest down 30%; funding rates near neutral, reducing liquidation risk.

- Flows: Institutional flows turned net negative; ETH dip-purchaseing partially offset BTC outflows.

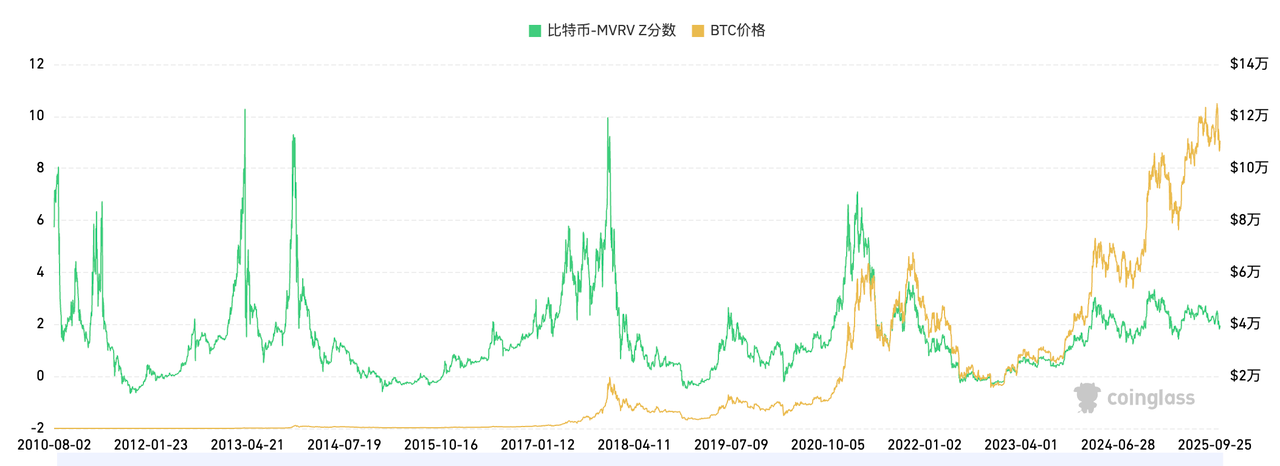

- Valuation: MVRV Z-Score near 1.9—back toward mid-cycle norms later than dipping below 1 earlier.

Investor Takeaway

Spot Markets: Macro Friction Pressures Crypto

BTC fragileness coincides with renewed U.S.–China trade frictions and rumored tradeing by offshore betting syndicates. Outside of majors and platform tokens, alt markets remain predominantly PvP: event-driven, fleeting, and conviction-light.

Investor Takeaway

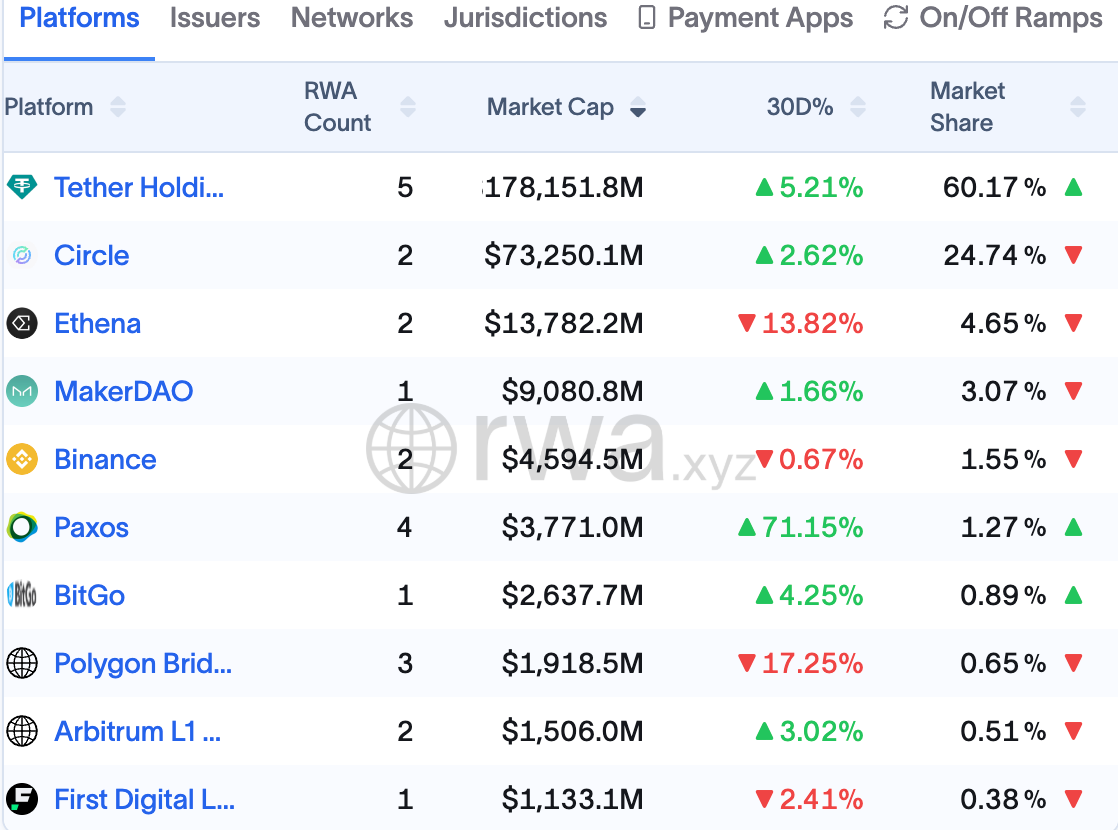

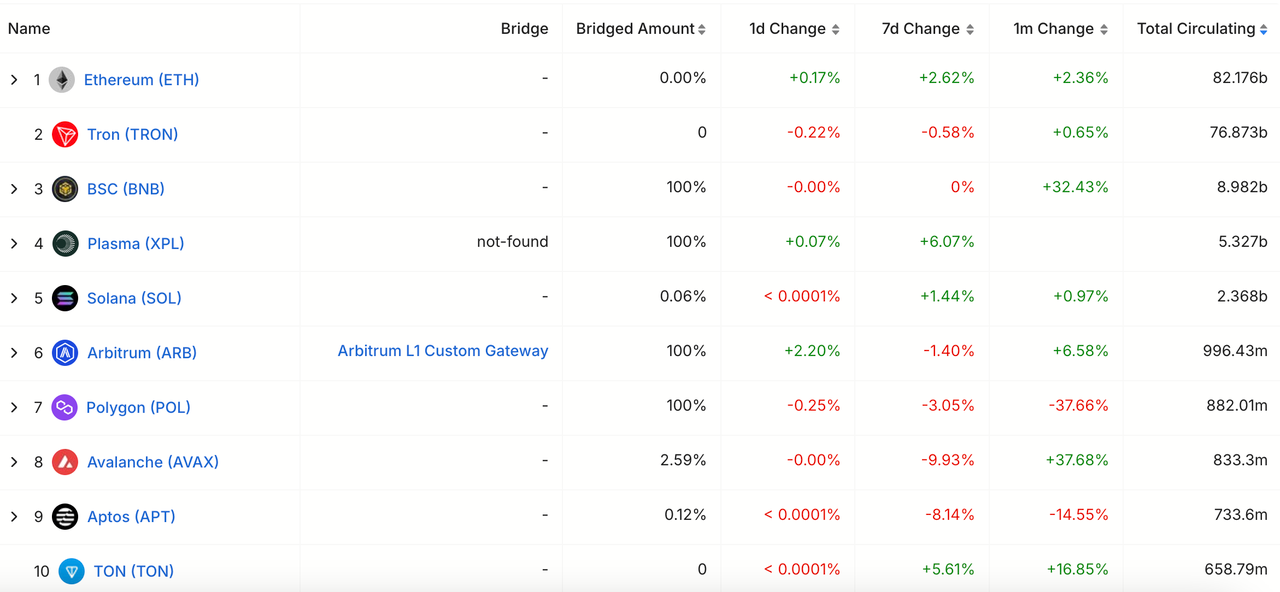

Stablecoins: Capital Expands to $307.7B, New Entrants Rise

The global stablecoin market grew 0.9% week-on-week to $307.7B. Market share remains dominated by USDT (~60%) and USDC (~25%).

- Tempo (by Stripe + Paradigm): Raised $500M Series A to build a payments-first EVM-compatible L1 optimized for low-fee, stablecoin-based commerce.

- BNB Chain × BPN: Announced plans for a multi-stablecoin, on-chain settlement layer leveraging real-time programmable liquidity.

- Chain distribution: USDT up on BNB (+32%) and AVAX (+38%); USDC growth led by Sui (+90%) and Arbitrum (+38%).

Meanwhile, Japan’s largest banks—MUFG, SMFG, and Mizuho—are jointly developing a MiCA-style EUR/JPY stablecoin program for cross-border finance.

Investor Takeaway

Payments & Infrastructure: M&A Wave Accelerates

- acquired Dynamic Labs to expand enterprise wallet and embedded-crypto tooling for payout infrastructure.

- purchased Beam (~$40M, all-stock) to integrate stablecoin rails directly into its bank-grade treasury stack.

The strategic theme: major enterprise platforms are internalizing crypto capabilities to meet demand for on-chain settlement, yield, and B2B payments.

Investor Takeaway

Policy & Enforcement: Global Regulators Move in Sync

: The Bank of England will release its stablecoin consultation on Nov 10, targeting a full framework by end-2026. Reserves will include short-duration government paper and high-grade bonds, with interest permitted on backing assets to attract issuers. Meanwhile, the FCA filed suit against HTX entities for unlawful UK promotions.

: DOJ seized 127,271 BTC (~$15B) linked to a Cambodia-based scam network, signaling ongoing enforcement focus. Blockchain.com is exploring a U.S. SPAC listing (valuation $5.2B–$14B), while Evernorth—a Ripple-backed venture—plans a Nasdaq SPAC merger to build a public XRP liquidity pool by Q1 2026.

: Ant Group and JD.com reportedly paused stablecoin initiatives following mainland regulatory consultations.

Investor Takeaway

Funding Round-Up: Capital Targets Payments, Data, and DePIN

- Tempo — $500M Series A (Thrive, Greenoaks, Sequoia, Ribbit, SV Angel).

- BTCOS — $10M (Greenfield, FalconX, DNA Fund) to develop BTC yield bridges.

- Keycard — $38M (a16z, Acrew, Boldbegin) for open-source hardware wallet tech.

- echo — $375M (Coinbase) for private chat and instant remittances.

- Kotani Pay — expansion of Africa-focused stablecoin on/off-ramp via Tether.

- Orochi Network — $8M for verifiable RWA data infrastructure.

- APRO Oracle — multi-chain oracle spanning BTC, EVM, and TON ecosystems.

- Limitless — $10M viewd; Base’s top prediction market project.

Investor Takeaway

Ecosystem & Product Updates

- Orderly (OmniVault): Now live on Sei; generating ~40% APY on USDC with minimal drawdown.

- Ethena: USDe/sUSDe PTs listed on Aave Plasma with $200M caps each; new leverage avenues emerging.

- Avail × Tron: Avail Nexus SDK enables gasless UX and cross-chain liquidity on Tron.

- CUDIS (DePIN): Wearable health data rings go live on Solana; users tokenize health metrics for on-chain rewards.

Investor Takeaway

Final Thoughts

October closes with tightening liquidity, cautious long-term holders, and expanding stablecoin infrastructure. Macro uncertainty weighs on crypto, yet institutional and enterprise developments—from payments rails to DePIN data—show a resilient builder base beneath the volatility.