Market Fueled by Optimism

A Concentrated and Expensive Market

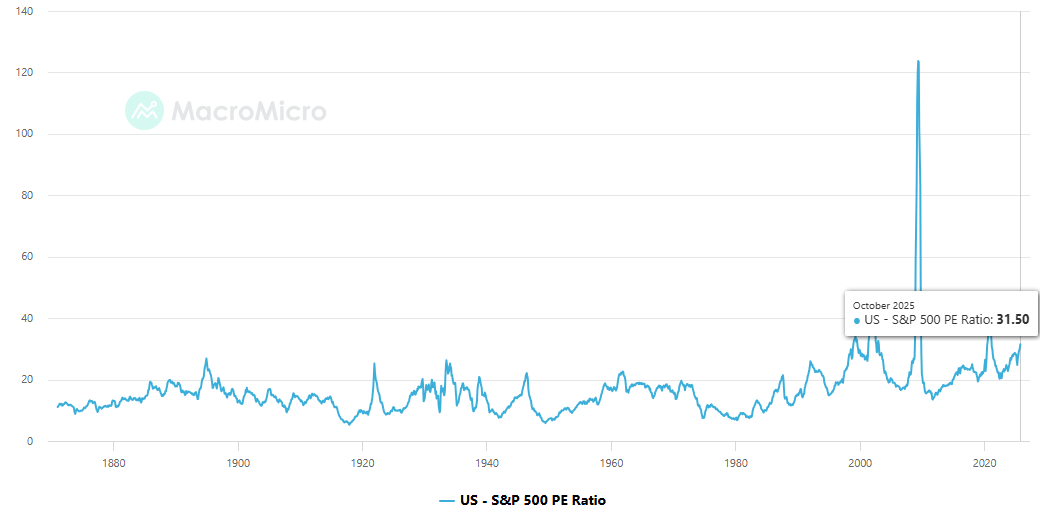

Behind the optimism, market valuation issues are becoming increasingly prominent. Currently, the S&P 500 index’s price-to-earnings (P/E) ratio exceeds 30, much higher than the average. Such a high valuation means the market has already factored in extremely high growth expectations, leaving very limited buffer for any potential disappointments. Even more concerning is the extreme concentration in the market. In the Nasdaq100 index, the top five companies by market capitalization account for 50% of its price fluctuations, while Nvidia alone has a weight of 14%.

This concentration in a few “Magnificent Seven” tech stocks makes the entire market highly sensitive to the performance of these companies, posing a vulnerability for the market.

Looking back at the dot-com bubble in 1999, similar situations of high valuations and high market concentration have emerged, especially when driven by a single powerful narrative (such as the current artificial intelligence). These historical precedents warn us that the current market structure contains risks that cannot be ignored.

The stark contrast between market optimism and fundamental fragility creates hidden dangers for the market. Although the VIX index is low, this may not reflect the true risk level, but rather is a manifestation of market complacency and FOMO sentiment.

A market supported by a few highly valued stocks is inherently less stable than a broad-based bull market. Therefore, any negative news targeting the “Magnificent Seven” – such as a severe earnings miss or cautious future guidance – could cause a disproportionately negative impact on the entire market, triggering a rapid reversal of optimism and a sharp rise in volatility.

The core driver of this Wall Street rally is a significant shift in market sentiment. The VIX has shown signs of market complacency. Since October, the VIX index has fallen from 25 (this month’s high) to around 15 (as of last night), well below the normal volatility baseline of 20, indicating a significant reduction in investor anxiety. The active participation of retail investors is another proof of high sentiment.

However, a warning sign is that as the S&P 500 approached its historical high, the VIX index also surged at one point. This is a rare signal in history that foreshadows a possible “melt-up” in the market, revealing a complex emotional environment: on the one hand, strong “fear of missing out” (FOMO) sentiment, and on the other hand, potential anxiety coexisting with the market’s optimistic performance.

Profit Engines: AI and Corporate Resilience

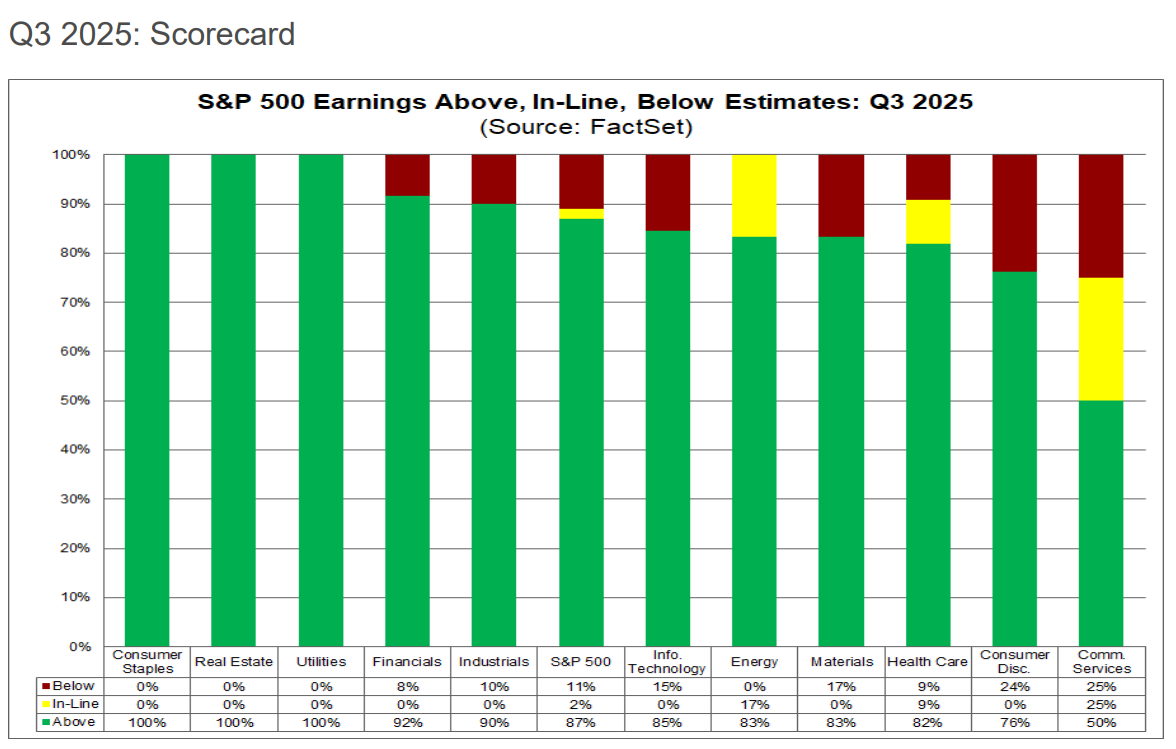

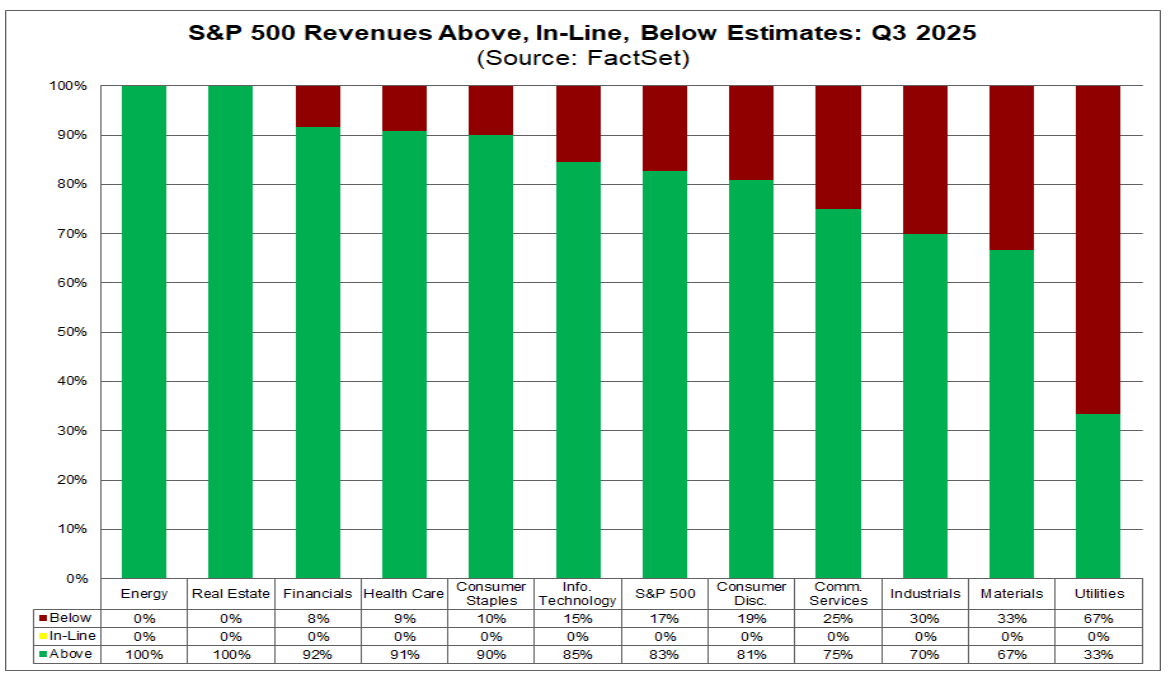

The market rebound is not merely built on sentiment; it is supported by an unexpectedly strong Q3 earnings season. The Q3 2025 earnings season emerged as a significant positive catalyst. Among the 29% of S&P 500 companies that have reported results, a high 87% exceeded earnings per share (EPS) expectations, and 83% surpassed revenue expectations. This rate is significantly higher than the five-year average of 78%.

Overall, the blended earnings growth rate for the S&P500 reached 9.2%, marking the ninth consecutive quarter of earnings growth for the index. This demonstrates exceptional corporate resilience amidst rising inflation and interest rates. More critically, actual earnings exceeded expectations by 15.1%, nahead double the 8% growth rate generally anticipated by the market before the earnings season began, indicating that analysts’ forecasts were overly conservative.

The Fed’s Crucial Moment

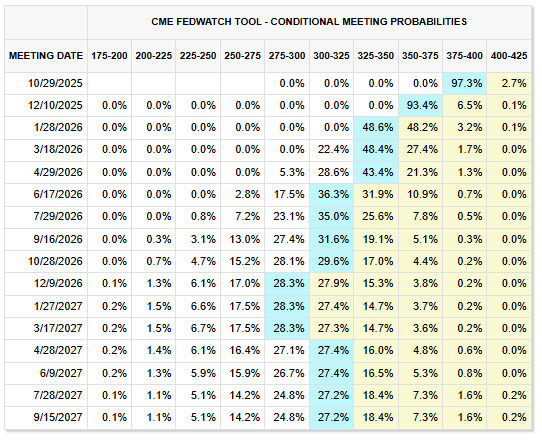

The market has fully priced in a 25 basis point rate cut by the FOMC at its October 28-29 meeting. CME’s FedWatch tool shows a probability of over 97% that the Federal Reserve will lower its target rate to the 3.75% to 4.00% range.

The market has called this rate cut a “done deal” and a “foregone conclusion.”

The justification for this rate cut will be the Fed’s increasing concern over a fragileening labor market, a judgment based on data prior to the government shutdown, which showed sluggishing job growth and downward revisions to previous months’ data. The Fed made its first rate cut of this cycle in September, signaling a shift in its policy focus towards the employment aspect of its dual mandate.

Decision in a Data Vacuum: The Impact of the Government Shutdown

An unprecedented and severe challenge facing the Fed is the ongoing government shutdown, now in its fourth week. This has led to a suspension of almost all official economic data releases from agencies like the Bureau of Labor Statistics (BLS).

This means the Federal Reserve will not have access to key reports on recent employment and inflation conditions when making its October interest rate decision. They are essentially “flying blind,” relying only on old data and private sector indicators. This “data vacuum” brings enormous uncertainty. Although the last officially released September Consumer Price Index (CPI) report showed inflation at 3.0%, lower than expected, providing support for a rate cut, the Fed still lacks a complete, up-to-date picture of the overall economy.

Reading Between the Lines: Powell’s Press Conference and Clues for 2026

With a rate cut already a certainty, all market focus will be on Federal Reserve Chairman Powell’s press conference and the wording of the FOMC statement. Investors will be looking for clues about the path of monetary policy in 2026.

Key questions include: later than an expected second rate cut in December, will the Fed signal a pause, or will it leave the door open for further easing? Currently, the bond market has priced in expectations for three rate cuts in 2026.

Powell’s challenge will be how to justify a rate cut by citing downside risks in the job market, while simultaneously acknowledging that pre-shutdown data showed economic activity might be “more robust than expected” due to AI investment and consumer resilience. His discourse on the balance of risks between inflation and employment will be closely scrutinized by the market. The Fed faces a significant risk of making a policy error.

In a period of “data vacuum,” cutting rates based on outdated data could provide unnecessary stimulus to an economy that proves more resilient than imagined, potentially reigniting inflation in 2026 later than the temporary drag of the government shutdown ends. The shutdown has resulted in a lack of recent official labor market and economic activity data, and the Fed’s actions are based on August and September data, when the main signal was a fragileening labor market. However, at the identical time, Fed officials also admit that economic growth may be on a “more robust than expected track” due to AI investment and consumer resilience, and the latest preliminary PMI data also indicates a strong begin to the fourth quarter. This contradiction puts the Fed in a dilemma: it feels compelled to act on the last clear signal it received (fragile labor market) but is doing so in an information vacuum, while conflicting private sector data hints at potential economic strength.

If the economy is indeed stronger than old data suggests, then this “preventive rate cut” could be pro-cyclical, adding fuel to an already hot market, and potentially leading to a re-acceleration of inflation later than the temporary drag of the government shutdown ends. This could force the Fed to make a hawkish reversal later in 2026, delivering an unexpected shock to a market currently anticipating a path of continued easing.

Inflation conundrum: Tariffs and a sluggishing labor market

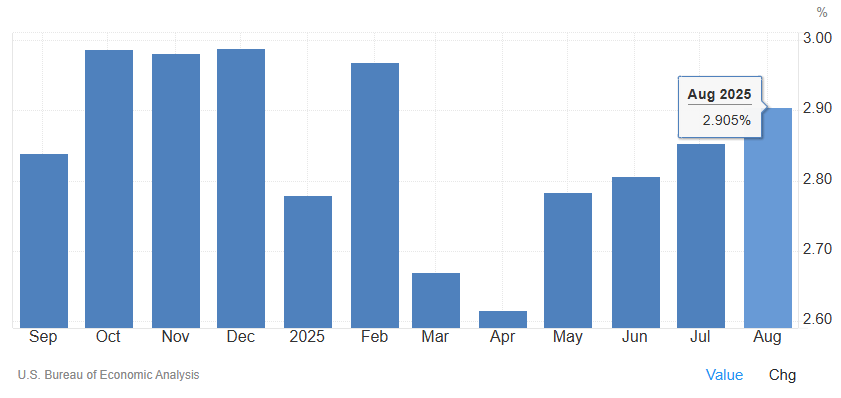

Inflation remains a key concern. Before the government shutdown, the Federal Reserve’s preferred inflation gauge, the core Personal Consumption Expenditures (PCE) price index, stood at 2.9%, still well above the 2% target. Higher tariffs are expected to continue to weigh on economic growth and push up inflation.

This presents a complex policy dilemma for the Federal Reserve, which is facing a rare situation where the labor market appears to be fragileening while inflation remains stubbornly high. This dilemma is exacerbated by the government shutdown, which obscures the true state of both variables. There appears to be a significant blind spot in the current market: it is digesting the benefits of pre-shutdown economic resilience (strong earnings) while almost completely ignoring the accumulating costs of the shutdown. Strong third-quarter earnings reflect economic vitality before the full impact of the shutdown became apparent. However, with the shutdown now in its fourth week, its economic costs are increasing, dragging down GDP by 0.2% each week, which poses direct and continuous pressure on fourth-quarter GDP.

There is a temporal disconnect in market focus, celebrating past strength (Q3 results) while ignoring current and future fragileness (the shutdown’s drag on Q4). The positive narratives of Fed rate cuts and trade deals are masking this fundamental economic headwind. When the government finally reopens and full economic data for October and November are released, it is likely to show a significant sluggishdown in economic activity. This could shock a market that has been immersed in a narrative of resilience, forcing a painful repricing of growth expectations for Q4 2025 and Q1 2026.

Geopolitical Tailwind: US-China Relations Thaw

later than months of escalating tensions – including threats of over 100% tariffs and restrictions on rare earth exports – US and Chinese officials reached a “very substantive framework agreement” during talks in Malaysia over the weekend of October 25-26.

This framework agreement is expected to prevent the implementation of new tariffs and postpone China’s export control measures, paving the way for a constructive meeting between President Trump and President Xi Jinping at the upcoming APEC summit. This news was the primary driver of the market’s record opening on Monday, October 27.

The easing of trade tensions had an immediate and powerful impact on market sentiment. It reduced uncertainty for businesses, potentially unlocking postponed investment and hiring activities. This development triggered a classic “risk-on” rotation in global markets. Asian stock markets surged, US Treasury yields rose (indicating reduced demand for secure-haven assets), while secure-haven assets like gold plummeted, falling below the 4000 level. This broad-based market reaction confirms the importance of the trade news as a major macro driver.

The de-escalation of US-China trade relations is the crucial “unlock” catalyst that triggered the current rally. It didn’t in itself create the fuel for a bull market (strong earnings, a dovish Fed pivot), but it removed the main obstacle suppressing risk appetite – fear and uncertainty – thereby allowing other positive narratives to fully play out. For weeks and even months, the market had been volatile due to trade war headlines, which was a major negative factor. The news of a “framework agreement” over the weekend was immediately followed by a record market rally on Monday, a close temporal correlation indicating a direct causal relationship. This suggests that the market was like a coiled spring, with underlying conditions for a rebound (strong earnings, anticipated Fed easing) already in place, but geopolitical risks had been suppressing market sentiment. Therefore, the current rally is highly dependent on the continuation of the trade truce. Any new signs of friction, or a failure of the Trump-Xi meeting to produce a concrete agreement, could rapidly reverse positive sentiment, as it would reintroduce the uncertainty that has just been eliminated.

The has already priced in the best-case scenario on , making it particularly vulnerable to any disappointing news.

Despite the strong current tailwinds, the potential risks are equally significant and require close monitoring. The divergence between euphoric market sentiment and complex, uncertain fundamentals is the defining characteristic of the current .

Base Case: Markets continue their sluggish grind higher into year-end, supported by a dovish Fed, a formal US-China trade agreement, and sustained strong AI-related earnings. However, the rally becomes more volatile as the economic impact of the government shutdown becomes clearer and high valuations act as a ceiling.

Bull Case (Melt-Up): A combination of Fed rate cuts, a comprehensive trade deal, and better-than-expected post-shutdown economic data triggers a wave of FOMO and short covering, pushing the highly concentrated tech sector into a parabolic rise and lifting the broader market.

Bear Case (Correction): The rally proves fragile. A negative catalyst — such as a breakdown in trade talks, a hawkish Fed surprise (e.g., explicit pause in rate cuts), or a major tech earnings disappointment — bursts the sentiment bubble. Investors refocus on high valuations and the economic damage from the government shutdown, leading to a swift market correction.

Key Questions:

- Durability of the AI Capex Cycle: Are current levels of AI investment sustainable? When will investors demand to view tangible returns on these massive investments?

- Fed’s 2026 Path: If inflation re-accelerates, will the Fed be forced to reverse course? Or will a sluggishing economy allow for the continued easing the market expects?

- Margin Resilience vs. Economic Drag: Can corporate profit margins remain strong in the face of a sluggishing economy (due to the government shutdown) and persistent cost pressures?

- Market Breadth vs. Concentration: Will the rally broaden out to other sectors, or will it continue to rely dangerously on a few large tech stocks?

Disclaimer: This sponsored market analysis is provided for informational purposes only. We have not independently verified its content and do not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you viewk independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our.