BTC steadies near $112K as traders eye breakout levels

BTC (BTC) held steady around $112,459 on Tuesday, extending its recent consolidation phase as investors balanced bullish technical indicators with broader macroeconomic uncertainty. The world’s largest cryptocurrency traded within a narrow band between an intraday high of $113,138 and a low of $110,812.

Strong momentum gauges suggested cautious optimism. Several moving averages, particularly the 100-day and 200-day levels, provided support at roughly $109,300 and $101,000 respectively. However, BTC continues to trade just below its 50-day average near $114,700, a threshold analysts view as key resistance.

Support and resistance levels remain tightly clustered. Short-term support has formed near $110,000, while resistance sits between $113,000 and $115,000. A break above that range could open the way for renewed bullish momentum, though failure to clear resistance may trigger further sideways trading.

Institutional activity and broader macro conditions are shaping sentiment. Market watchers cite growing expectations of U.S. Federal Reserve interest rate cuts following fragileer jobs data as a driver of recent stability. Liquidity inflows, both from traditional markets and cryptocurrency ETFs, continue to underpin demand. Some analysts argue the current pullback sets the stage for a larger rally, pointing to accumulation patterns as evidence of investor confidence.

Despite mixed signals across diverse technical frameworks, the broader trend skews cautiously bullish. Traders are watching closely to view if BTC can reclaim the $115,000 mark in the coming sessions, a move that could confirm renewed upward momentum. For now, consolidation remains the dominant theme as macroeconomic policy and investor flows dictate the next decisive shift.

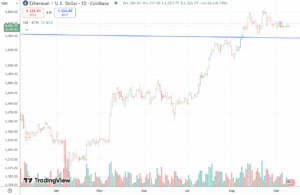

ETH (ETH) traded around $4,329 on Tuesday, moving within a narrow intraday band of $4,279 to $4,366 as traders assessed technical signals against broader market headwinds. The world’s second-largest cryptocurrency has shown resilience at current levels but faces challenges in breaking through nearby resistance.

Technical indicators paint a mixed picture. According to Investing.com, ETH retains a “Strong purchase” rating across major oscillators, supported by the Relative Strength Index (RSI) and longer-term moving averages. The 50-day and 100-day averages point to continued support, while shorter-term exponential moving averages signal caution. TradingView data shows neutral momentum in the near term, reinforcing the view of a consolidating market.

Support and resistance levels remain tightly defined. Analysts identify support between $4,220 and $4,260, while resistance builds near $4,385 to $4,420. A successful breakout above $4,400 could propel ETH toward the $4,500 to $4,550 range, though a failure to hold $4,250 may trigger a retreat closer to the $4,000 level.

Institutional dynamics have added pressure to ETH’s recent performance. Outflows from ETH-based platform-traded funds topped 104,000 ETH—worth nahead $447 million—in a single session, according to FX Leaders. The tradeing wave, coupled with broader market uncertainty, has weighed on sentiment and limited upside momentum.

Despite short-term fragileness, longer-term projections remain optimistic. Analysts point to strong liquidity demand, upcoming network upgrades, and renewed institutional interest as factors that could drive ETH toward $5,800 by late 2025. For now, however, the market remains caught between cautious technical signals and macroeconomic forces that continue to dictate short-term direction.