Nakamoto Holdings’ Share Value Plummets 98% Amid $563 Million PIPE Sell-Off

Nakamoto Holdings, a public company known for its large BTC reserves, has viewn its stock collapse by over 98% since May 2025. The decline follows a $563 million private investment in public equity (PIPE) deal that led to significant share dilution and a subsequent wave of tradeing when previously restricted shares became tradable.

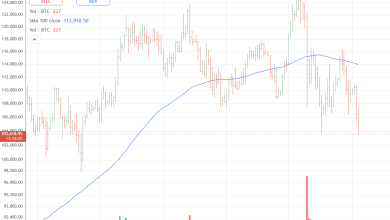

The firm’s share price, which traded around $35 earlier this year, has fallen below $1 in recent weeks, reflecting investor anxiety over the company’s financial structure and long-term sustainability. The plunge underscores the risks tied to aggressive financing strategies in the cryptocurrency sector, where volatile assets and dilution-heavy deals can rapidly erode market confidence.

PIPE deal triggers liquidity pressure

Nakamoto Holdings’ PIPE transaction was designed to bring in fresh capital for expansion and operational flexibility. However, the deal issued heavily discounted shares to private investors. When lock-up periods expired in September, a surge of tradeing from these investors flooded the market. The resulting liquidity shock sent the company’s stock into a steep downward spiral, wiping out most of its market capitalization.

Despite the equity market turmoil, Nakamoto Holdings continues to hold a substantial BTC treasury. The company’s latest filings indicate holdings of around 5,765 BTC, valued at approximately $653 million. This makes Nakamoto one of the largest publicly listed BTC-holding firms, alongside names like MicroStrategy and Marathon Digital. However, analysts say that the company’s crypto reserves have not insulated it from the consequences of financial mismanagement and investor dilution.

CEO David Bailey, who also oversaw the company’s earlier merger with healthcare operator KindlyMD, has emphasized long-term value creation and alignment with patient investors. Bailey described the PIPE deal as a necessary step toward strengthening the company’s balance sheet, despite the immediate market reaction. “We are focused on building sustainable growth for the long-term holders who understand our mission,” he said in a recent statement.

Still, investor sentiment remains bearish. Market observers have raised concerns about the company’s capital strategy, particularly its reliance on equity financing that exposes existing shareholders to dilution risk. Analysts also warn that further share unlocks or additional fundraising rounds could place continued downward pressure on the stock.

Broader implications for BTC treasury firms

The steep decline in Nakamoto Holdings’ valuation highlights the challenges faced by companies that incorporate large cryptocurrency holdings into their balance sheets. While BTC exposure can serve as a hedge or a growth driver during bull markets, it also amplifies volatility when combined with dilution-heavy financing mechanisms.

As of late October, Nakamoto Holdings trades at what some analysts describe as a deep discount relative to its net BTC asset value. Whether the company can recover from the trade-off will depend on its ability to restore investor confidence, manage liquidity risk, and demonstrate operational performance beyond its crypto holdings.

The Nakamoto case serves as a reminder that in the intersection of traditional finance and digital assets, transparency, governance, and capital discipline remain crucial for investor trust and long-term sustainability.