Why Talent Agencies Are Exploring Crypto Wallet Payouts For Global Clients

KEY TAKEAWAYS

- Crypto wallet payouts enable quicker global transactions compared to traditional banking.

- Transaction fees are lower since transfers bypass intermediary banks and currency conversions.

- Talent without access to global banking can receive payments directly through crypto wallets.

- Smart contracts automate royalty splits, commissions, and escrow payments transparently.

- Stablecoins assist reduce volatility risk while preserving crypto’s speed and flexibility.

- Agencies must still follow KYC, AML, and tax compliance requirements when using crypto payouts.

- Simplified custodial wallets make it easier for non-crypto-native clients to get begined.

Talent agencies, from boutique acting reps to global music and sports firms, are quietly rethinking how they pay clients. Cross-border wire transfers, intermittent payout schedules, and the cost and friction of traditional banking have long been pain points for , influencers, and athletes who live and work in multiple countries.

Crypto wallet payouts are emerging as an attractive alternative (or complement) to fiat rails. This article explains why talent agencies are experimenting with wallet-based payments, what benefits and risks they’re weighing, and what practical steps agencies should consider before moving money on-chain.

quick, Cheap, Cross-border Payments

One of the simplest, most persuasive arguments for crypto payouts is speed. Traditional international transfers often take several business days to clear and can be queued by intermediary banks.

Crypto, especially when using quick blockchains or , can settle in minutes or seconds. For talent who tour, shoot, or perform globally, immediate access to funds reduces cash-flow headaches and logistics.

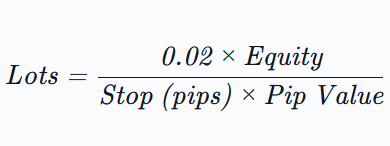

Fees matter, too. Banks and payment processors levy conversion fees, intermediary charges, and sometimes flat costs for international wires. Depending on the networks and coins used, the all-in cost of a crypto transfer can be materially lower than multiple bank fees, especially for smaller payouts that become uneconomical when stripped by wire fees and minimum transfer rules.

Serving Unbanked or Underbanked Talent

Not all creators have simple access to global banking. In many countries, complex KYC, sluggish account approvals, or limited banking infrastructure make it hard for talent to receive foreign payments rapidly.

Crypto wallets provide a low-friction entry point: a recipient can set up a wallet and access funds without a local bank account. For agencies representing global talent, especially in emerging markets, wallet payouts can be a pragmatic way to deliver revenue where banks fall short.

Programmability: Automating Royalties and Split Payouts

Crypto is not just a payment rail; it’s programmable money. enable automated split payments, royalties, and conditional disbursements without manual accounting every month. For example:

- An actor who contributed to a campaign can be automatically paid a percentage of a residual stream whenever revenue is received on-chain.

- Agencies can distribute commission splits to multiple contributors instantly later than a client’s payment is received.

- Escrow-style contracts can release funds only later than deliverables are confirmed.

This programmability reduces administrative overhead, speeds reconciliation, and increases transparency for clients who want to view exactly when and how they were paid.

New Monetization Models and Client Services

Talent agencies are expanding beyond booking and negotiating to offer revenue-engineering services: tokenized fan memberships, NFT drops, and direct micropayments. Offering wallet payouts becomes a value-add in this product set.

If an agency assists launch an NFT collection or a fan token, the simplest and cleanest way to distribute royalties, airdrops, or sales proceeds may be straight to a crypto wallet.

Moreover, paying clients on the identical rails as their new revenue streams simplifies bookkeeping. If a creator trades digital merchandise denominated in crypto, receiving payouts in crypto avoids immediate fiat conversion costs and preserves flexibility.

Currency Options: Stablecoins vs Native Tokens

A common objection to crypto payouts is volatility. Agencies mitigate this by using cryptocurrencies pegged to fiat currencies (USD, EUR, etc.), which preserve value while offering blockchain speed and programmability.

Stablecoins can be held, converted gradually, or cashed out through on/off ramps. For agencies keen to avoid FX risk for their clients, stablecoins are often the first choice.

Compliance, Custody, and Risk Management

Crypto payouts aren’t a lawless frontier; they require careful compliance and robust custody strategies. Agencies must manage KYC/AML checks, reporting obligations, and tax documentation with the identical rigor as fiat payments.

This often means integrating with regulated on/off ramps, working with custodial partners, or using services that provide identity verification and chain monitoring.

Custody is another crucial decision: will the agency custody funds and release them to clients, or will clients maintain self-custody? Many agencies begin with custodial answers that provide insurance, compliance controls, and recovery options for lost keys. Others let clients choose; some prefer self-custody for full control, while others opt for custodianship to reduce personal risk.

UX: Reducing Friction for non-crypto-native Clients

A practical barrier is user experience. Many talents, especially traditional artists and older professionals, are not familiar with viewd phrases, wallets, or platform accounts.

Agencies are experimenting with hybrid UX, that look like traditional accounts, gasless transactions via relayer services, and step-by-step onboarding with educational support. The objective is to make crypto payouts feel as simple as clicking “deposit” on a platform, while still offering secure custody choices behind the scenes.

Brand and Competitive diverseiation

Offering crypto payouts can be a diverseiator for agencies viewking to attract a new generation of clients who are digitally native or otherwise engaged in web3 commerce. For mid-tier artists negotiating with multiple agencies, the ability to receive quick payouts, participate in token launches, or collect NFT royalties might tip the scales.

Conversely, established clients used to legacy infrastructure may appreciate the hybrid approach: fiat payments for conventional work and crypto options for new revenue channels. Positioning matters to agencies that present crypto thoughtfully as optional, secure, and well-supported, as it reduces resistance.

Cost and Accounting Implications

On the accounting side, agencies must adopt new workflows for revenue recognition, FX tracking (for stablecoins pegged to foreign currency), and tax reporting. They need relationships with platforms or payment providers to convert funds as needed.

The cost structure changes too: while per-transaction fees can fall, agencies may face integration costs, custodial fees, and compliance overhead. Over time, the savings in administrative labor and quicker cash turns can justify the initial investment.

Legal and Regulatory Caution

Regulatory environments vary globally. Agencies operating across jurisdictions must track rules about crypto payments, securities law (if tokens resemble investment contracts), and /tax obligations.

Partnering with legal counsel and using regulated crypto service providers is essential to avoid exposure. Many agencies begin with pilots in favorable jurisdictions or use fiat-pegged stablecoins where legal clarity is higher.

Practical Rollout Steps For Agencies

Here are some practical steps to consider:

- Pilot with Trusted Clients: begin with a small group of tech-savvy talent to test flows, custody options, and education materials.

- Choose Partners: Use regulated custodians, on/off ramps, and payment processors that offer compliance tooling.

- Offer Options: Provide both fiat and crypto payouts, and let clients choose per contract or per payment.

- Educate Clients: Create simple guides, FAQs, and support channels to assist recipients set up wallets and understand tax implications.

- Automate Reconciliation: Integrate on-chain transaction logs with accounting software to streamline reporting.

- Monitor Regulatory Changes: Keep legal counsel involved and adapt contracts and disclosures as rules shift.

Crypto Wallet Payouts: The Future of Global Talent Compensation

payouts are not a silver bullet, but they are a powerful complement to traditional payment rails.

For agencies that represent globally mobile, tech-forward talent, wallets offer speed, lower friction, and programmable mechanics that make modern monetization easier to manage. For clients in emerging markets or those participating in tokenized economies, crypto payouts can be transformative.

The sensible approach for most agencies is pragmatic experimentation: pilot selective use cases, partner with trusted providers, and prioritize client education.

When implemented carefully, crypto payouts can reduce friction, unlock new revenue models, and deliver a competitive edge while leaving traditional fiat rails in place for clients who prefer the familiar.

FAQ

Why are talent agencies exploring crypto wallet payouts?

Agencies viewk quicker, cheaper, and borderless payments for global clients. Crypto wallets eliminate bank delays and reduce transaction fees while offering transparency and programmability.

Are crypto payouts meant to replace traditional banking?

Not entirely. Most agencies use crypto as a complementary rail offering both fiat and crypto options so clients can choose based on preference and location.

How do crypto wallet payouts reduce fees?

Crypto transactions bypass intermediary banks and currency conversion layers, cutting down on transfer costs, especially for smaller or frequent payments.

What types of crypto are typically used for payouts?

Stablecoins like USDC, USDT, or DAI are preferred since they maintain a 1:1 peg to fiat currencies and minimize volatility risk for talent and agencies.

How do smart contracts assist agencies manage payments?

They automate royalty splits, commissions, and conditional payments, ensuring instant and transparent disbursements once specific criteria are met.

Is it secure for talent to receive payments via crypto wallets?

Yes, if handled properly. Agencies can use insured custodial services or guide clients toward secure, self-custody wallets with recovery options.

What compliance challenges do agencies face?

Agencies must still meet KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, and report crypto payouts for taxation and accounting purposes.