As XRP and ETH Struggle, BTC Hyper Emerges as Best Crypto to Buy This November

As we head into the weekend, the cryptocurrency market has viewn some slight relief, with the industry’s total valuation climbing 0.7%. However, widespread dissatisfaction persists among holders of major cryptocurrencies such as XRP and ETH.

October was expected to be a promising month, dubbed “Uptober,” due to its strong historical performance. Instead, investors faced one of the most frustrating months of the year, marked by macroeconomic uncertainties, relative fragileness compared to equities, and the industry’s largest-ever liquidation event.

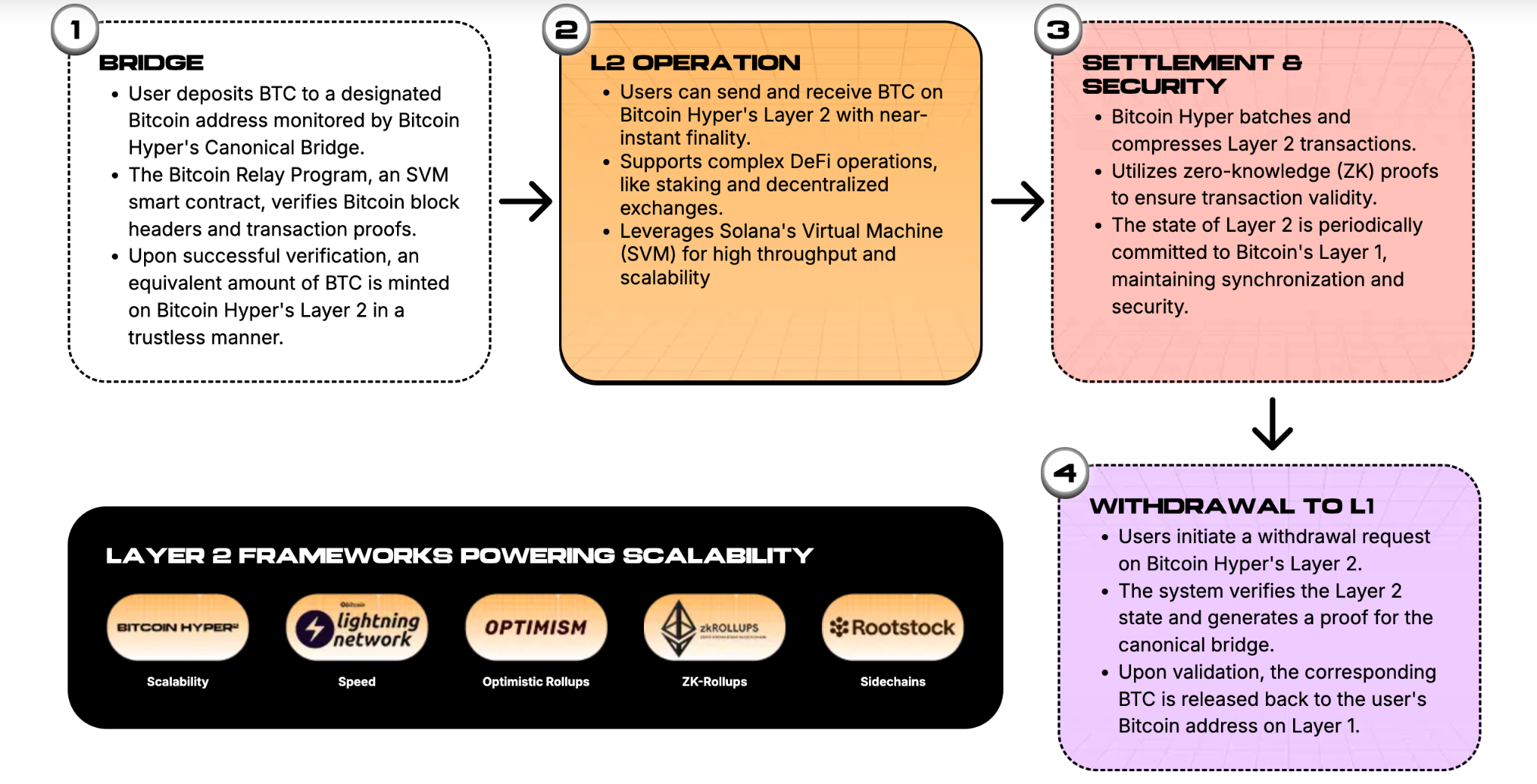

As such, many investors are moving away from XRP and ETH in search of alternatives with greater potential in the coming months. This shift is contributing to the surge in popularity of , which is developing the world’s quickest BTC Layer 2 blockchain to address the network’s longstanding issues.

significantly, it’s not just focused on payment transactions; BTC Hyper will unlock smart contract capabilities on the BTC network. This means it can support operations similar to those of ETH, but with enhanced security and speed. So could HYPER be the best crypto to purchase right now?

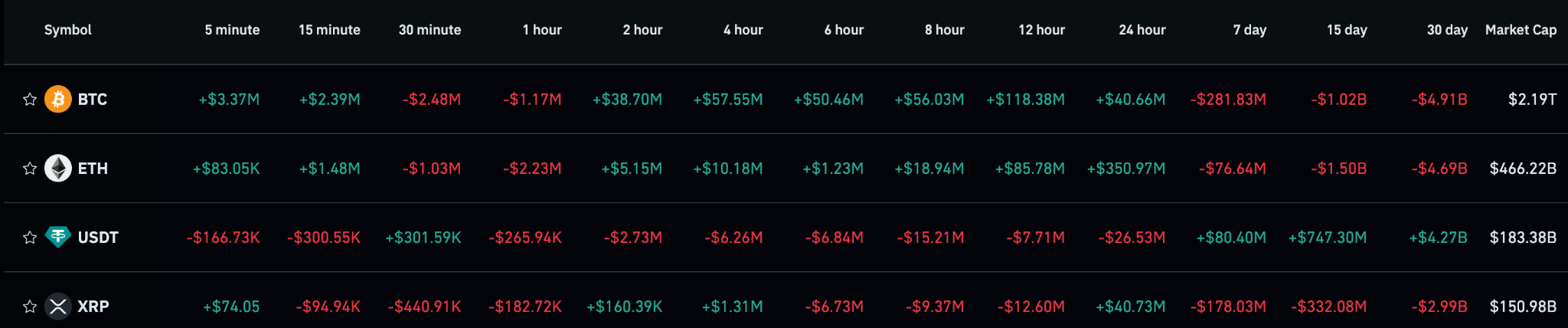

XRP, ETH Faced Huge Spot Outflows In October

ETH is trading at $3,862, up 0.6% over the past 24 hours. However, its price has declined 1.7% this week and 11% this month, highlighting a lack of enthusiasm among purchaviewrs.

While it might be tempting to attribute this downturn to the October 10 liquidation event, that doesn’t capture the full picture. According to CoinGlass data, ETH has viewn net spot outflows totaling $4.69 billion over the last 30 days, suggesting holders are offloading their assets.

XRP is also showing signs of fragileness, currently trading at $2.51. It has gained 1.5% today, but that provides little relief against a 15% drop over the month. Like ETH, XRP has faced heavy spot tradeing pressure, with $2.99 billion in outflows over the past 30 days.

But given that XRP’s market capitalization accounts for less than 30% of ETH’s, the strong tradeing indicates potentially fragileer sentiment within the community.

While both XRP and ETH are facing challenges, there’s been a notable surge of investor interest in BTC Hyper. Let’s explore what it’s all about.

BTC Hyper Raises $25.4M for SVM-Powered BTC L2

BTC can process only 7 transactions per second (TPS). Meanwhile, two of its leading smart contract Layer 2 answers, Stacks and Rootstock, improve this capacity to 50 and 300 TPS, respectively. Indeed, that’s a major step up, but they still fall short compared to other modern blockchains, such as Solana, which can handle 65,000 TPS.

This disparity has prompted to integrate the Solana Virtual Machine (SVM) into the BTC ecosystem.

It’s developing an SVM-powered BTC Layer 2 answer, aiming to handle thousands of TPS and support smart contracts, thereby enhancing BTC’s functionality. This paves the way for DeFi, RWAs, meme coins, AI, and practically any other use case that you can imagine, coming to BTC.

Simply put, BTC Hyper unleashes the full potential of BTC, underpinning modern blockchain capabilities with its market-leading speeds and $2.2 trillion liquidity. Unsurprisingly, industry experts have taken notice – prominent analyst has even predicted up to 100x gains once it lists on the open market.

Right now, BTC Hyper is in a presale, having raised $25.4 million so far. Around $150,000 of that came in over the past day alone, underscoring the market’s appeal. Its fundraising success has been nothing short of spectacular, especially considering it occurred at a time when the broader market has struggled.

Conclusion: Why HYPER Could be the Best Crypto to purchase Now

October brought challenges to projects like XRP and ETH, but BTC Hyper still thrived. And looking ahead, factors such as potential interest rate cuts, a US-China trade agreement, a more favorable regulatory environment, and the introduction of new altcoin ETFs may contribute to more positive market dynamics in November and December.

So, given ‘s ability to draw attention during adverse market conditions, it may continue to outperform well as the market shifts bullish, potentially positioning presale investors for large gains.

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.