XRP Eyes Breakout: ETF Launches and $1.39B Retail Inflows Boost Bullish Outlook

has become a key focus for market participants, drawing attention from both retail and institutional investors.

Recent liquidation patterns, capital rotation, and buildup suggest that liquidity could soon move into XRP. Strong fundamental and technical indicators also point to the possibility that the asset may be primed for a major price swing.

Analysts note that XRP’s short-term performance will depend on broader macroeconomic structures and global market conditions, while its long-term outlook hinges on product growth and ecosystem development.

Key Takeaways

-

XRP is viewing rising institutional interest, with Canary Capital planning to launch an XRP ETF on the NYSE.

-

Retail investors have quietly accumulated over $1.39 billion worth of XRP since September, signaling growing confidence.

-

The asset is trading in a consolidation phase, suggesting the potential for an upward breakout.

-

Technical indicators such as the A/D and MFI show consistent purchaseing pressure despite minor capital outflows.

-

Analysts project XRP could reach between $3.55 and $3.66, potentially setting a new all-time high if liquidity continues to build.

Institutional Capital Could Be the Catalyst

Institutional investors are expected to play a crucial role if XRP is to sustain a market rally. One indicator of this interest lies in platform-Traded Funds (ETFs).

In recent weeks, the push for XRP ETFs has intensified. A FinanceFeeds report revealed that traditional institutional investors have been actively bidding for exposure to the asset.

The latest case involves Canary Capital, which plans to leverage a “delaying amendment” in the SEC’s ETF on the New York Stock platform (NYSE), scheduled for November 13.

This ETF would allow investors viewking exposure to XRP to purchase it directly, potentially driving significant purchaseing activity and short-term price appreciation.

This isn’t the first instance of traditional financial players supporting XRP through ETFs. In September, an XRP ETF under the ticker symbol XRPR, taking advantage of the Investment Company Act of 1940.

Retail Investors Quietly Accumulating

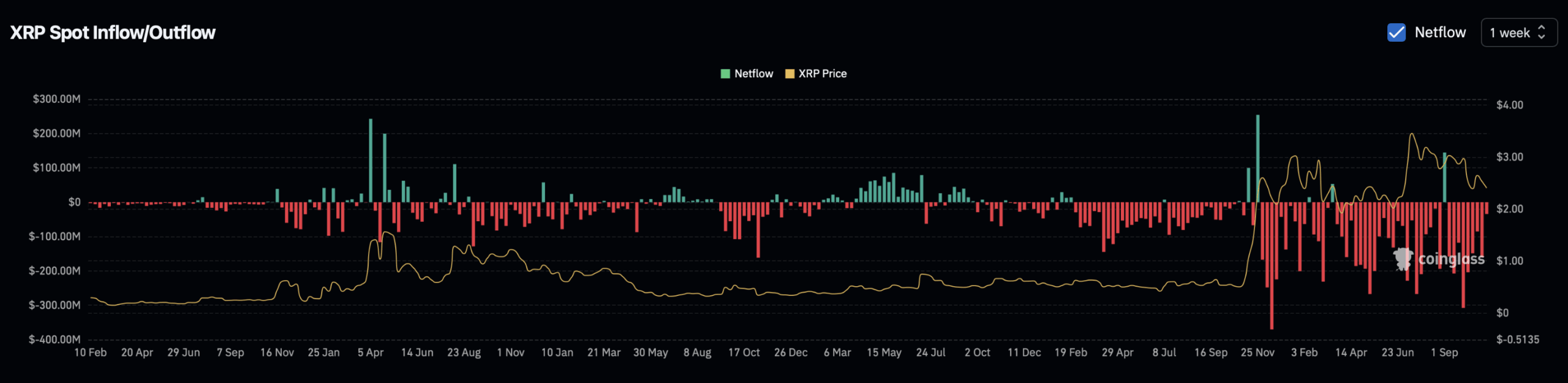

Retail investors have been steadily accumulating XRP, ending each week since September with consistent net inflows.

Throughout September, investors spent approximately $791.47 million accumulating XRP — an ahead bullish signal. In October, this group quietly added another $598.28 million worth of XRP, bringing the total to around $1.39 billion.

This level of sustained accumulation indicates growing confidence, with many investors viewing XRP as undervalued. Such accumulation patterns often precede a major rally, and if the bullish momentum viewn over the past two months continues into November, XRP could view a significant upswing in the coming days.

The combined strength of institutional and retail interest is promising for XRP’s short- and long-term outlooks, particularly if momentum remains consistent. However, what does the chart suggest? FinanceFeeds breaks it down based on current market patterns.

Technical Analysis: Consolidation Before a Breakout

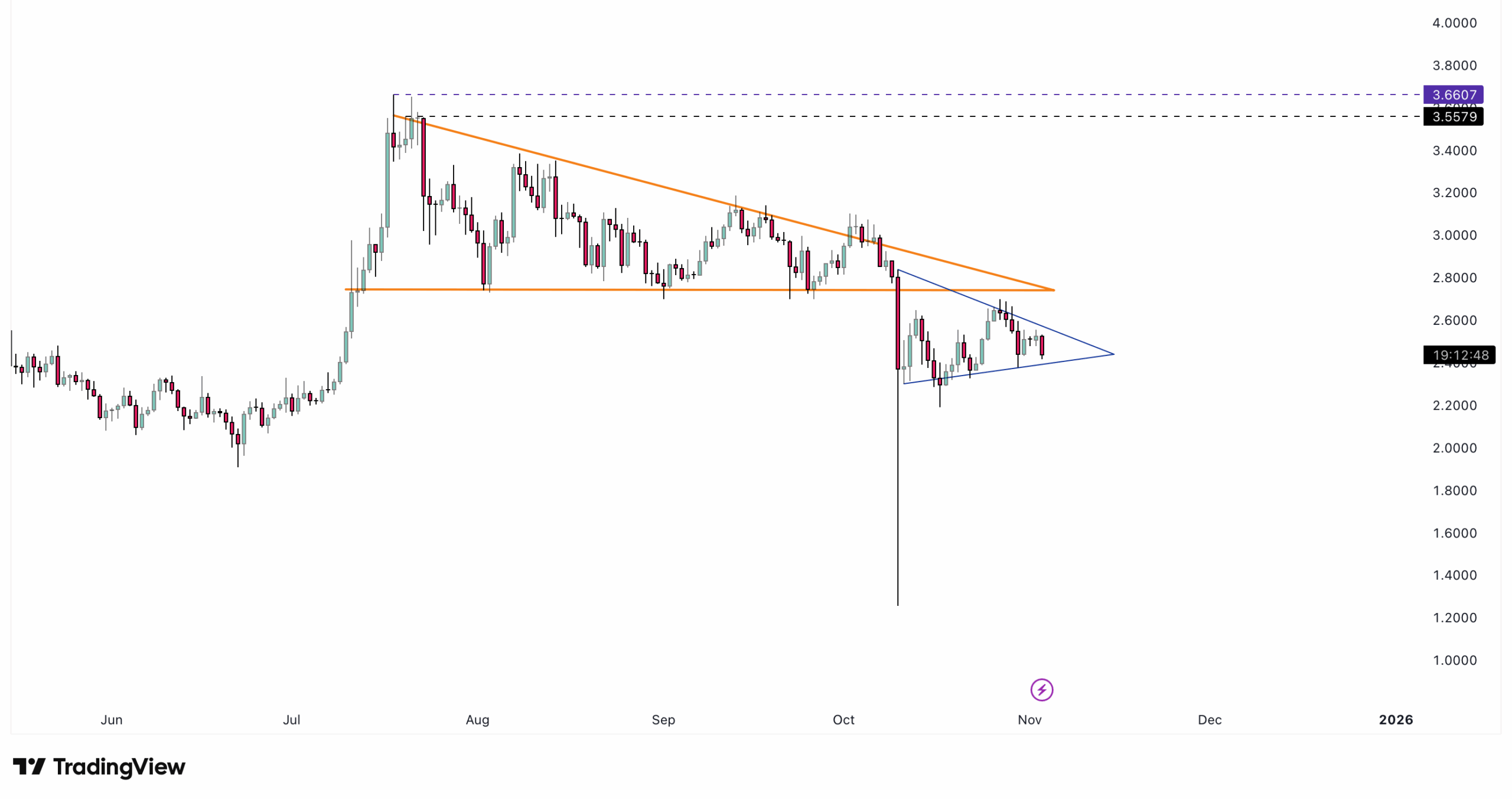

On the chart, XRP is currently trading within a consolidation pattern, highlighted in purple.

This phase typically precedes a broader rally, as investors accumulate the asset gradually. A closer look reveals a larger consolidation zone, where price movements remain tightly bound. Analysts expected a breakout rally from this range, but the broader market crash on October 10 triggered a decline instead.

Interestingly, this pattern aligns with earlier observations that retail investors have been accumulating XRP during the downturn.

The consolidation may persist, as investors continue to purchase at lower levels without initiating a full rally.

In a bullish scenario, XRP could target two key resistance levels — $3.55 and $3.66 — and potentially set a new all-time high if liquidity in the market continues to increase.

Further Consolidation or Rally Ahead?

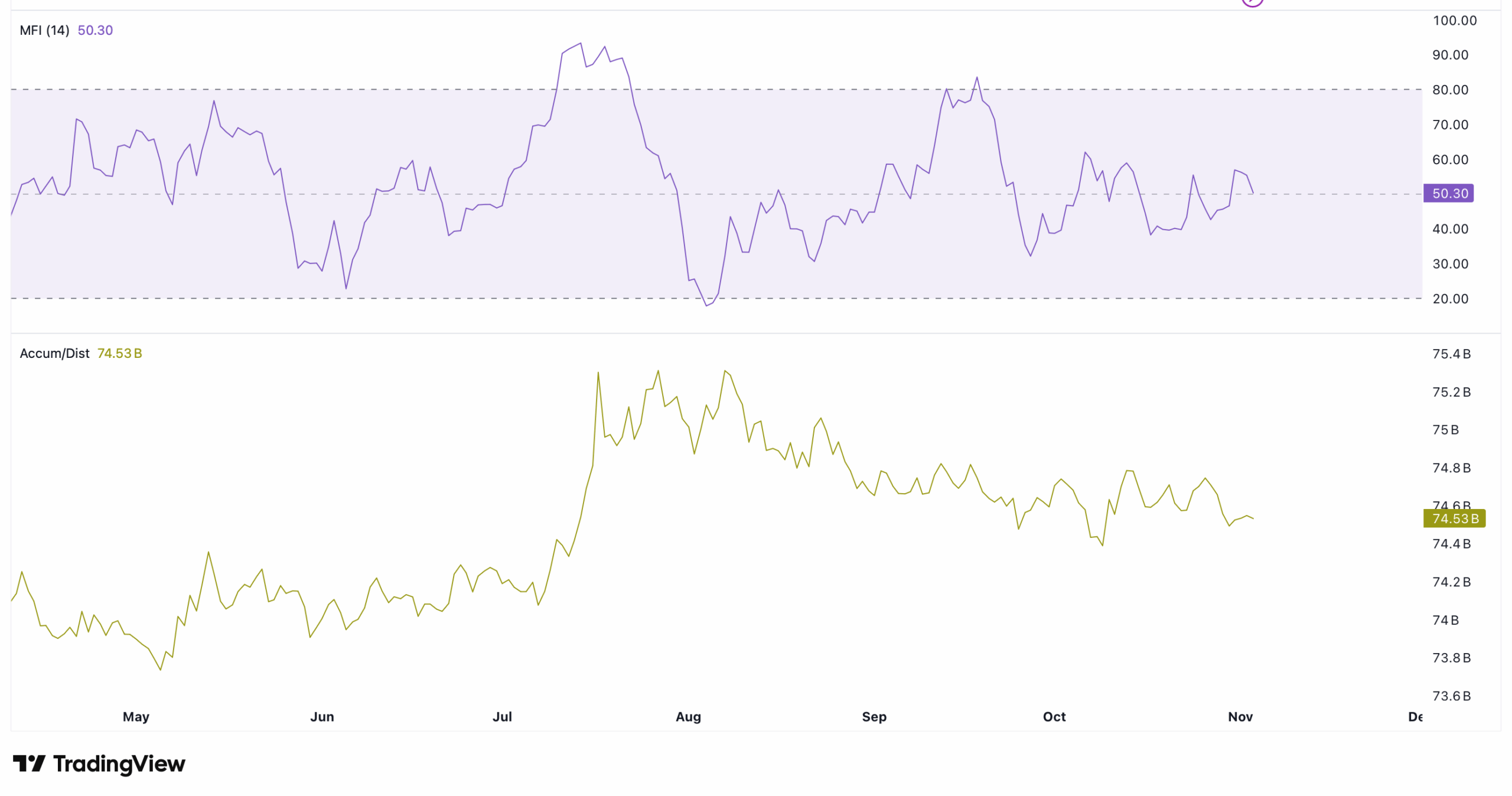

The most likely short-term scenario is continued consolidation, supported by several technical indicators.

According to the Accumulation/Distribution (A/D) pattern, signals remain bullish, indicating a sustained buildup within the current range.

The A/D indicator measures purchaseing and tradeing pressure — a positive reading suggests purchaviewrs are in control, while a negative one signals tradeing dominance.

As of this report, the A/D pattern shows 128 billion in positive volume, though it has slightly trended downward, implying mild bearishness and limited trade-offs.

This mirrors the Money Flow Index (MFI), which currently sits between 50 and 80, within the bullish zone but trending lower.

The MFI reflects whether investors are adding or removing capital from the market. Its current reading of 50.30, though declining, suggests that while capital remains in the market, outflows are modest and unlikely to trigger a major downturn.

This fluctuation between accumulation and minor capital outflows indicates that investors are still consolidating positions. In the short term, XRP could experience mild downward pressure before resuming upward momentum.

Given the scale of accumulation and overall capital inflow, there’s a strong likelihood that XRP will experience a major upswing soon — particularly as market metrics begin to shift in favor of renewed bullish momentum.

Frequently Asked Questions (FAQs)

1. Why is XRP gaining renewed investor attention?

XRP is attracting both retail and institutional investors due to strong fundamentals, ETF interest, and favorable technical indicators.

2. What is driving institutional interest in XRP ETFs?

Institutional investors, such as Canary Capital, are viewking exposure through ETFs as they anticipate regulatory clarity and rising demand.

3. How significant is retail accumulation in XRP’s market activity?

Retail investors have accumulated roughly $1.39 billion since September, a major indicator of growing long-term confidence.

4. What do the technical indicators say about XRP’s next move?

Indicators like the Accumulation/Distribution (A/D) and Money Flow Index (MFI) suggest a bullish setup with ongoing accumulation.

5. Could XRP reach a new all-time high soon?

Yes, if liquidity and institutional inflows continue, XRP could break above $3.55 and move toward setting new highs.