When Utility Wins: The Rise of BNB and XRP’s Slide

In recent weeks, BNB, the native token of the Binance ecosystem, briefly overtook XRP to become the third-largest cryptocurrency by market capitalization, trailing only BTC (BTC) and ETH (ETH). Although both assets have since retreated amid broader market volatility, the contrast between their performance is striking. While BNB’s price has eased only a few percentage points, XRP has fallen by double digits, widening the gap between the two.

Short-term pullbacks aside, BNB’s upward trajectory appears rather than speculation. Its strength lies in utility, a growing range of real-world applications and deep integration across the Binance ecosystem that continue to generate consistent demand.

XRP was once championed as the token poised for global institutional adoption. Yet as Binance’s platform has expanded to dominate both retail and institutional trading activity, has quietly emerged as the asset with broader usage and higher functional value. That divergence in practical utility has become a decisive factor shaping their market standings today.

How BNB Has Grown in Terms of Utility

When BNB launched in 2017, its value proposition was simple: users could use it to claim discounts on trading fees and pay for gas within Binance’s platform. Over time, however, its function has evolved dramatically to be woven into a broader blockchain infrastructure and growing DeFi ecosystem.

Expanding Ecosystem, Expanding Use

BNB’s utility growth mirrors the expansion of Binance’s ecosystem. The BNB Chain (a layer-1 blockchain supported by Binance) enables developers to deploy decentralized applications, issue tokens, and build financial primitives. Real-world indicators suggest this adoption is scaling quick:

- In the past week during its rally, BNB’s market capitalization jumped ~28% and hit roughly $182 billion, overtaking XRP to become the third-largest crypto by market cap at that time.

- The BNB Chain also recorded notable upticks in on-chain metrics: daily transactions, active wallet creation, and gas consumption all saw sharp rises, which is evidence of growing user engagement.

- One standout case: Aster DEX, a decentralized platform on BNB Chain, saw its Total Value Locked (TVL) surge over 500%, crossing $2.4 billion, driven by liquidity mining incentives.

These dynamics reveal that BNB isn’t just used for platform perks. It’s serving as the fuel and governance token for an expanding Web3 infrastructure, directly tying token demand to real application usage. This evolution of BNB along with Binance’s continued investment into their crypto ecosystem has resulted in massive user growth with over 300 million active users and the launch of DeFi products aimed at further mass adoption.

Recently, Binance CEO Richard Teng sat down with , “We introduced Binance Pay about two years back. By now, there’s more than $27 billion going through Binance Pay [since launch], and based on what remittance are charging we have saved our users more than $1.75 billion in terms of fees. We introduced with the Kingdom of Bhutan recently. Now people can use Binance Pay for anything from visa applications to accommodation to their meals to purchaseing things from local vendors.”

Tokenomics & Supply Control: The Burn Mechanism

Utility alone doesn’t fully explain BNB’s valuation. Its tokenomics play a critical role, too. Binance periodically executes quarterly token burns, permanently removing BNB from circulation. This mechanism exerts downward pressure on supply while aligning user incentives to hold the token.

Because Binance couples burns with ecosystem incentives (e.g. staking rewards, usage perks), , reducing trade pressure and assisting prevent oversupply. Over time, this supply control has assisted maintain value even during broader market corrections.

That said, the latest rally has also drawn scrutiny and controversy. Some in the community have questioned whether parts of the surge could reflect price manipulation or large coordinated inflows rather than purely organic demand.

Still, when you combine expanding on-chain utility, ecosystem growth, and supply discipline, you get a compelling structural case for BNB’s ascent. These elements assist explain why it has broken into new valuation tiers, and why it may continue climbing in the future.

Why XRP is Falling Behind

From late 2024 through ahead 2025, XRP, Ripple’s native token, was on a tear. Previously, the U.S. Securities and platform Commission’s litigation against Ripple severely impacted its price performance.

However, following President Trump’s victory in the 2024 Presidential election, and with it the emergence of both regulatory clarity as well as a more pro-industry regulatory climate, the market’s sentiment toward XRP experienced a sharp shift towards bullish once again. XRP experienced strong appreciation during this time frame.

Since then, however, sentiment toward XRP appears to have shifted back towards bearish. A large factor behind this may have to do with how the perceived utility of XRP has declined relative to native tokens from other ecosystems, including Binance’s BNB.

Moreover, with the traditional financial system begining to integrate blockchain technology into cross-border payments, XRP’s former perceived “edge” over other cryptocurrencies may have faded completely.

The Bottom Line

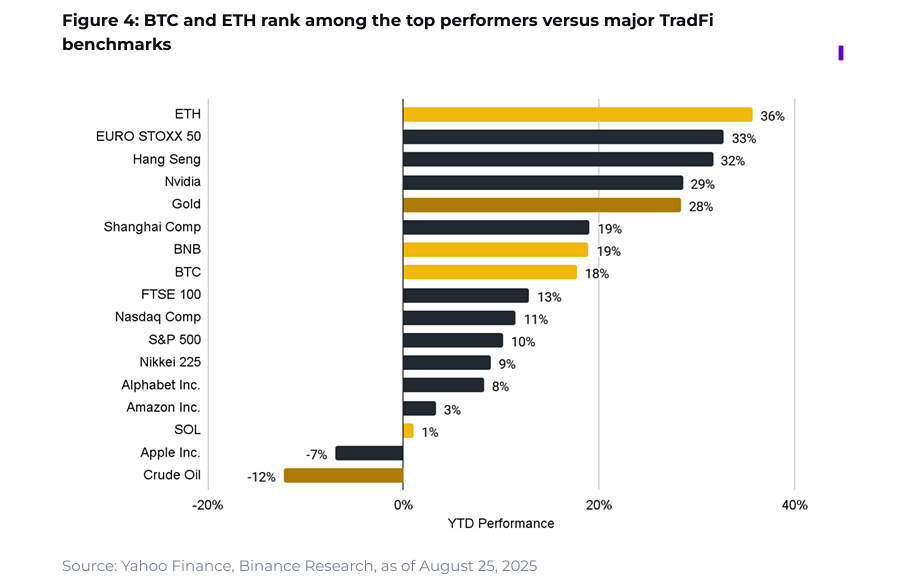

In Binance Research’s August 2025 edition of , one of the key topics discussed was how BTC and ETH continue to stand out relative to traditional asset benchmarks.

However, as viewn in the chart above, BNB has also been a standout performer, gaining by 19% between January and August. While pulling back somewhat in more recent trading days, BNB continued to rally in September, and during the first half of October.

Analysts and critics alike may cite a variety of factors behind this price performance, but again, much suggests that wider adoption of the Binance ecosystem, coupled with improved sentiment towards this Altcoin has likely played a role as well.

Meanwhile, despite a strong begin to 2025, not to mention a brief strong run during the summer, XRP has been underperforming lately. Market sentiment may be playing a partial role, but more substantial factors, including the diminishing reputation of XRP’s use case and utility, is the main factor at play.