Why BTC is falling? Institutional Exodus and Macro Jitters Drive BTC Below Key $100K Support

The cryptocurrency market has recently shifted into a phase of deep correction, culminating in a significant price drop for the world’s largest digital asset. , later than soaring to new all-time highs above $126,000 in ahead October, has faced a sharp drawdown, briefly breaching the psychologically critical $100,000 level. This recent volatility has ignited intense debate over the market’s trajectory, with investors urgently asking, Why BTC is falling?

This pullback saw BTC underperform the broader crypto market, which also faced headwinds. On Tuesday, November 4th, the price abruptly fell to four-month lows of $100,800, before stabilizing just above the six-figure threshold into Wednesday morning. For a brief period on major US platforms, BTC slipped below $99,000, touching multimonth lows at around $98,900. This swift and brutal correction has been characterized by a toxic mix of institutional de-risking, macroeconomic fear, and a massive deleveraging event across derivatives markets.

Why BTC is falling? Spot ETF Outflows Trigger Risk-Off Domino Effect

The primary catalyst for the sustained tradeing pressure is the decisive flip in institutional sentiment, evidenced by a prolonged streak of massive outflows from U.S. spot BTC platform-Traded Funds (ETFs). The very financial products once hailed as the ultimate bull market catalysts have become the leading indicator of a risk-off environment.

Spot BTC ETFs saw a sharp $566.4 million outflow on Tuesday, November 4th, which extended the five-day drain to roughly $1.9 billion. This is the largest single-day outflow since August 1st and a fresh high for redemptions in the second half of the year. Critically, this institutional exodus was concentrated and focused. Fidelity’s FBTC accounted for the majority of the exits, registering a substantial -$356.6 million, with ARKB following at -$128.1 million. No fund posted an inflow that day, a decisive sign of a coordinated institutional exit or reduction in risk exposure.

The softening institutional demand comes amid a broader risk aversion that has taken hold of global financial markets. Global markets retreated on escalating U.S.–China trade tensions and AI stock volatility, pushing the CMC Fear & Greed Index to 20 (“Extreme Fear”), its lowest point since March 2025. BTC’s price correlation with traditional risk assets rose as investors shifted capital toward securer holdings like Treasuries.

Gerry O’Shea, head of global market insights at Hashdex, provided crucial context, noting the convergence of these factors:

“Recent speculation that the FOMC may pass on another rate cut this year, as well as concerns over tariffs, credit market conditions, and equity valuations, assisted drive markets lower. BTC’s recent price trajectory has also been impacted by tradeing from long-term holders — an expected phenomenon as the asset matures.”

“$BTC is in absolute free fall right now,” crypto investor and entrepreneur Ted Pillows reacted on X. S

Long-Term Holders and Corporate Treasuries Amplify Pressure

Adding to the structural headwind, analysts have pointed to the sustained tradeing activity from large, long-term BTC holders. Bitfinex analysts observed that “persistent distribution from BTC long-term holders continues to exert structural pressure on the market.”. They warned that “this sustained outflow aligns with the broader signs of exhaustion visible across the market, as long-term holders continue to offload into declining demand.”.

This price exhaustion has translated into immediate, material losses for dozens of companies that adopted BTC as a treasury asset during the market’s ascent. As BTC trades close to the $100,000 mark, corporate treasuries are now “sweating,” sitting on paper losses.

At least 24 companies are currently in the red on their BTC holdings. The list includes high-profile names like Trump Media and Metaplanet. Topping the list of corporate unrealized losses is KindlyMD, which purchased 5,674.9 BTC at an average cost of $117,782 per coin, now sitting on a loss of 13.4%. The BTC bet, intended to bolster balance sheets, has rapidly become an uncomfortable waiting game for many corporate finance departments.

Technical Analysis: Why BTC is falling? And Where Does it Stop?

The aggressive downward momentum has led to a major technical breakdown and a significant deleveraging in the futures market, providing an answer to the question, Why BTC is falling? The breach of a key macro indicator has triggered fears of a long-term bear market, even as the market defends the major psychological support at $100,000.

Key Technical Breakdowns and Bearish Signals

The recent dip below $99,000 marked a critical technical failure: the price fell below its 365-day moving average (MA), which stood at about $102,000 as of ahead November. This metric is widely viewed as a strong bearish signal, having served as “the final confirmation to the begin of the 2022 bear market,” according to Julio Moreno, head of research at CryptoQuant. Moreno’s warning was stark: “The price needs to cross back above it rapidly.”.

Further technical analysis confirms the precarious position. Crypto media personality and trader Scott Melker posted a cryptic warning on X, noting that BTC “has definitively lost the weekly 50-MA as support 4 times in history,” and every time this occurred, “price went on to test the 200-MA.”. The 200-week MA is currently “sitting around $55,000 (and rising),” signaling the potential for a severe downside if the current consolidation fails.

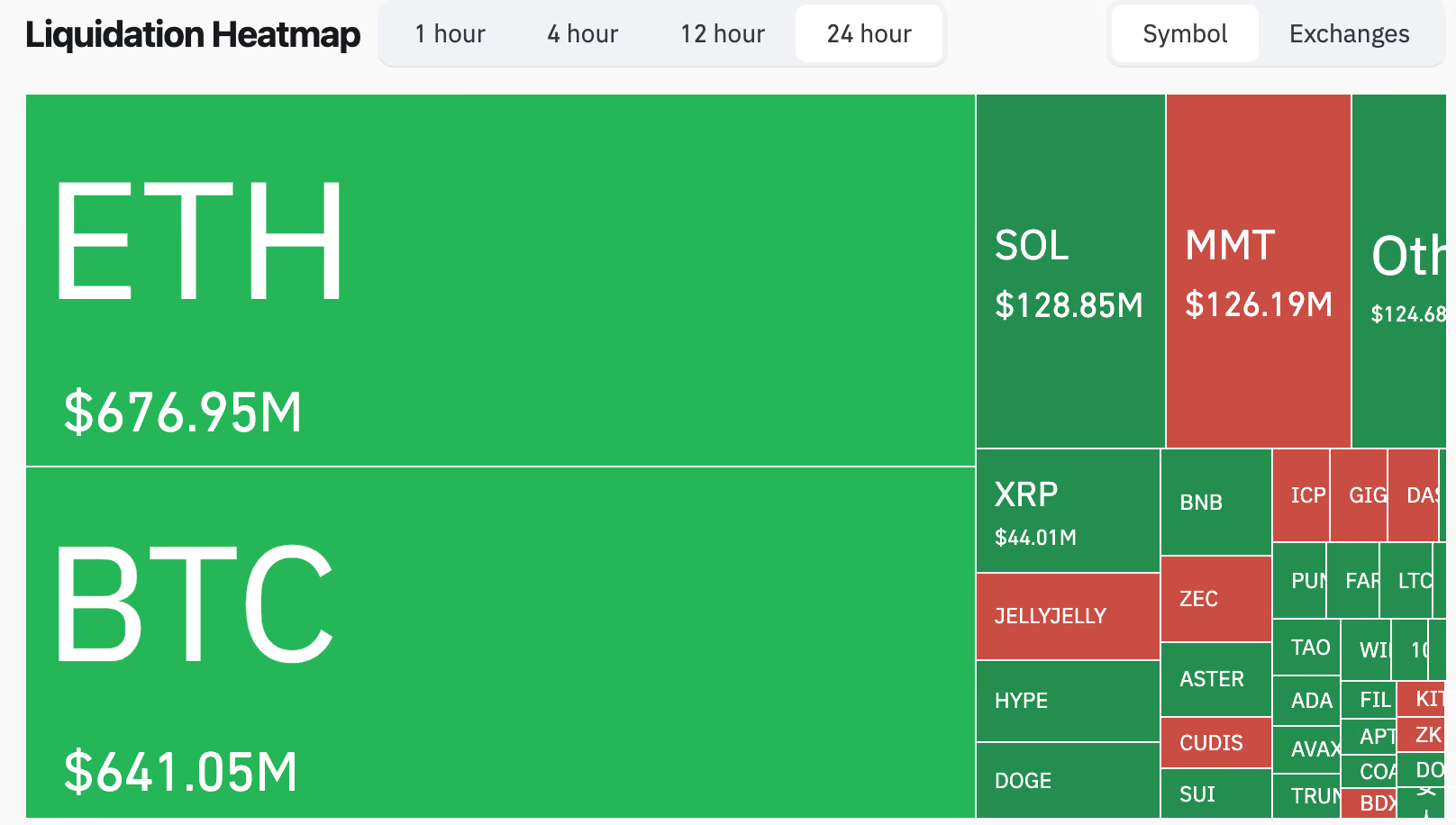

Liquidation Cascade and Capitulation

The price drop was violently amplified by forced liquidations. Over $1.7 billion in crypto positions were liquidated in 24 hours, including $1.3 billion in long positions. The total liquidation figure across futures contracts topped $2 billion, with long traders absorbing nahead 80% of the losses at $1.6 billion. This leverage flush, or “capitulation,” intensified the cascading trade-off.

The scale of the tradeing pressure has led some analysts to speculate that major institutional funds were the source. The prevailing theory suggests that professional-level entities saw their portfolios crippled by the massive $20 billion in BTC positions being liquidated during the initial October 10th trade-off, and these fragileened funds are now the source of the recent overwhelming tradeing.

Technical Analysis Summary and Forecast

At the time of writing, BTC has bounced off the round support level of $100,000, which served as a major psychological barrier. However, the technical structure remains heavily fractured.

The $100,000 level is the immediate “line in the sand”. Trader Ted Pillows noted that the asset was in “absolute free fall right now,” and that outside of the major round number, “There’s no strong support until the $100,000 level, which means it’ll most likely get retested.”.

My technical analysis suggests that while the defense of the $100,000 level offers a glimmer of hope, the bearish targets are now more clahead defined:

- Immediate Support: The key support range is between $98,000–$104,790. A break here validates the bear case.

- Downside Targets: The next major technical targets are the $95,000 level, which many traders pinpoint as a potential short-term bottom , and the large unfilled weekend CME futures gap at $92,000. Liquidation heatmap data from Hyblock further shows that leveraged long positions at $100,000 are at risk of absorption, with relatively thin liquidity until the $88,000 level.

- Ultimate Resistance: To stabilize prices and signal a potential recovery, BTC must rebound and hold above the $104790 (Fibonacci 78.6% retracement) level.

The short-term outlook is now defined by extreme fear, with data from onchain analytics platform Glassnode showing the Net Unrealized Profit/Loss (NUPL) indicator for short-term holders entering “capitulation” territory, a sign of intense stress but also, historically, an “attractive accumulation opportunities for patient investors,”.

Expert Outlook and Twitter Links

Despite the current market trauma, not all analysts are calling for a prolonged crypto winter. Bitrue research analyst Andri Fauzan Adziima offers a more measured, historical perspective:

“Yet this is merely the fourth correction in the 2025 bull cycle, a routine cleanse, not the onset of a prolonged winter,”

Adziima pointed to historical data supporting 40% rebounds within 60 days later than 20% drawdowns in a bull market. Similarly, Tom Cohen, head of investments and trading at Algoz Technology, set a clear condition for the bear market thesis:

“In order for this to be a bear market for BTC we think the line in the sand at $100,000 would have to be well broken before that scenario comes into play,”

Cohen added that the immediate future is highly sensitive to macro policy: “Much of that of course is dependent on macro events and what President Trump has up his sleeve in the coming weeks and of course the US Rate Decision in December.”.

Meanwhile, derivatives traders were watching for the $100k defense to turn into a full reversal. The key focus was the liquidation wick from a previous trade-off:

Ardi (@ArdiNSC) on X noted: $BTC 10/10 liquidation wick now getting filled. Back into the $103K range.

– Ardi (@ArdiNSC) November 4, 2025

This level features confluence with BTC’s 50-week exponential moving average (EMA), a level untouched for seven months.

Broader Market Performance: Altcoins Under Pressure

The risk-off sentiment has not been isolated to BTC. The total crypto market capitalization slipped back toward $3.5 trillion, its lowest level in over a month. ETH and Solana ETFs also mirrored the institutional pullback, with ETH logging $219M in outflows.

Altcoins experienced severe losses, with Ether (ETH), Solana (SOL), and Avalanche (AVAX) all sliding between 7% and 10%. XRP, Dogecoin, and Cardano saw slides between 5% and 6%. The synchronized drop across the market confirms that the recent price action is a system-wide deleveraging event driven by macro factors and institutional de-risking, rather than a single asset phenomenon.

BTC Price Fall FAQ

Is BTC heading for a full bear market?

The consensus is divided. Some analysts, citing the drop below the 365-day moving average, view it as a strong bearish signal that could confirm a bear market if the price does not rapidly reclaim the $102,000 level. However, others argue this is merely a “routine cleanse” in the 2025 bull cycle. The $100,000 psychological support is the critical “line in the sand” that must be decisively broken for the bear market scenario to be fully validated.

What is the next major downside target for BTC?

If the $100,000 support fails, the next major downside target is the CME futures gap at $92,000. A failure to hold this level could open the door to the liquidity zone around $88,000. In the most extreme bear case, and if the historical pattern of losing the weekly 50-MA repeats, the price could eventually test the 200-week MA, currently sitting around $55,000.

Are long-term holders still tradeing?

Yes, Bitfinex analysts confirmed “persistent distribution from BTC long-term holders”. This group, which typically holds through market volatility, is continuing to offload assets, suggesting “broader signs of exhaustion” in the current market cycle and applying structural pressure that answers Why BTC is falling?.

Does the price fall invalidate the all-time high forecast for 2025?

Yes, the sustained pressure has tempered the most optimistic forecasts. ShapeShift analyst Houston Morgan stated, “We don’t expect crypto to go any higher than $125K USD in 2025,” placing a ceiling just below the previous all-time high of $126,000. The renewed bullish momentum required for new highs is now highly dependent on a swift reversal of ETF outflows and a softening of the current macroeconomic headwinds.

BTC’s latest plunge below key technical and psychological supports reflects a high-beta risk asset caught in a global risk-off storm, amplified by excessive derivatives leverage and a pronounced institutional pullback via the Spot ETFs. While the immediate battle to hold $100,000 has been won, the combination of ETF redemptions, macro uncertainty, and “capitulation” signals means the market remains in an extremely fragile state, testing whether this is a “routine cleanse” or a decisive signal that the 2025 bull run has concluded.