AAVE Reclaims $200 as Bullish Momentum Builds—Data Points to a Run Toward $245

AAVE has remained on investors’ radar as one of the standout DeFi products in the market.

Over the past 24 hours, the asset has mirrored the broader bullish sentiment, rallying nahead 10% and recovering above the $200 mark once again.

Fundamental indicators suggest growing investor speculation, with 90% of 55,300 participants voting that AAVE could stage a major rally. But what factors are driving this optimism? FinanceFeeds breaks it down.

Key Takeaways

-

AAVE has regained the $200 level, posting a 10% gain in the past 24 hours.

-

Protocol earnings hit $13.15 million, with Q4 on track to surpass previous quarterly highs.

-

Network activity is surging, with user count and transaction volume both rising significantly.

-

Derivatives data shows a bullish tilt, as traders maintain long positions and liquidations favor shorts.

-

Technical indicators support further upside, with accumulation strengthening and the next resistance at $245.

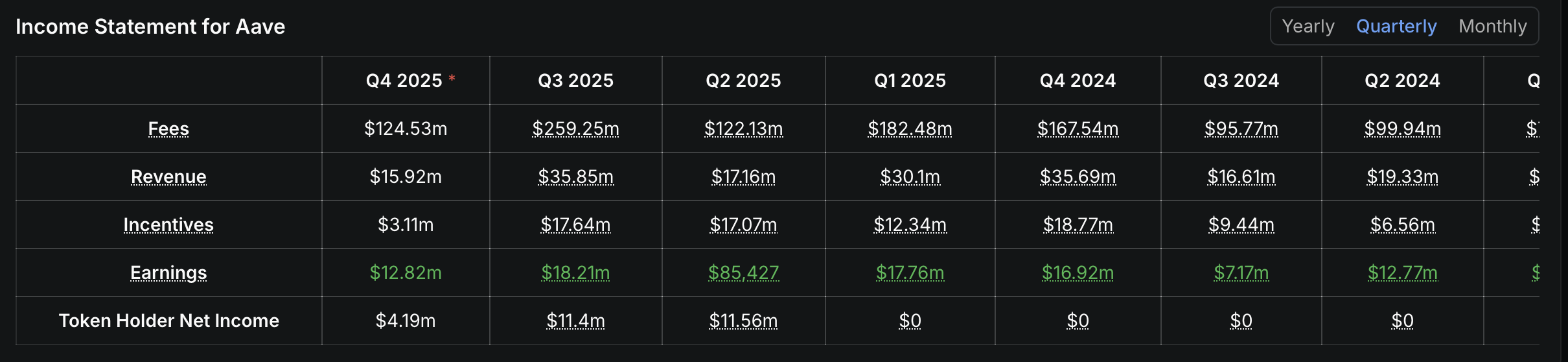

Earnings and Revenue Data Strengthen Bullish Case

The fundamentals behind the AAVE protocol show that the asset is well-positioned for growth. Based on analyses of earnings, revenue, and fees, the data remains net positive and tilted toward the bullish side.

Between October 1 and now, total earnings for the protocol — calculated as revenue minus incentives distributed to users — have reached $13.15 million.

This figure, achieved in just over a month, represents AAVE’s fifth-highest earnings since its launch in 2020. For 2025 alone, it ranks as the third-highest, standing only about $5 million away from surpassing Q3 earnings — the peak quarter so far this year.

The has also been growing slightly, signaling improving confidence among investors.

At the time of reporting, AAVE’s TVL had risen to $33.29 billion, reflecting more deposits being locked in the protocol for rewards.

This development is notable because it coincides with incentives in the market remaining at $3.11 million — the lowest level since Q4 2020. Despite this, investor participation remains high, showing strong conviction in AAVE’s potential for higher returns.

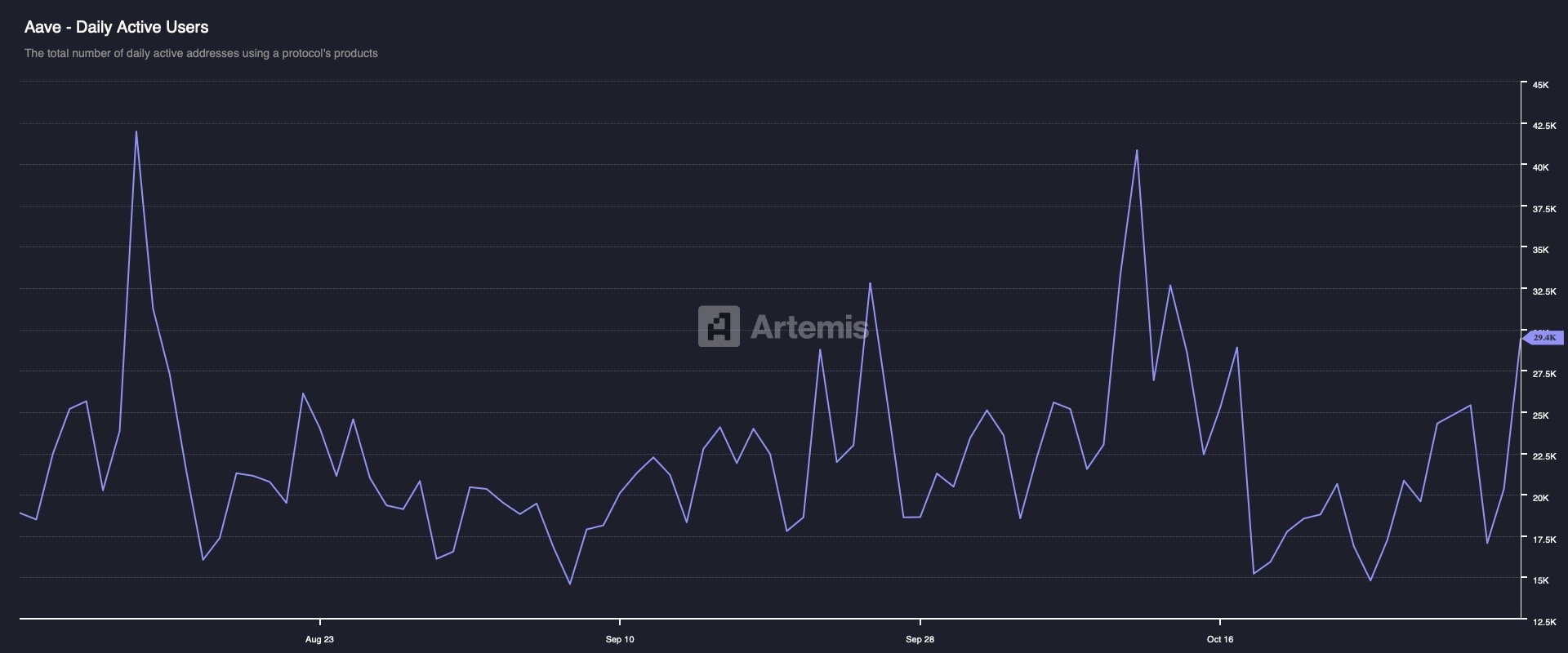

Rising User Activity Points to Growing Network Demand

Usage of the AAVE protocol has surged sharply, confirming growing interest and engagement. Analysis of user activity and transactions points to a strengthening market outlook.

Daily Active Users have jumped by 55% in the past three months, now reaching 29,400 — the highest level since October 13, when the market was on a decline.

Unlike previous periods, this surge aligns with solid volume levels of $495 million, while the asset maintains double-digit gains over the last 24 hours.

Additionally, transactions on the network have climbed to 65,200, a 21% increase. Such growth in both activity and transaction count, especially during a price rally, signals that investors are trading with bullish intent and increasing purchaseing volume.

Derivative Markets Signal Strong Bullish Bias

Derivatives data also points toward a bullish trend, with purchaseing volume outpacing tradeing activity.

The Taker purchase/trade Ratio (also known as the Long/Short Ratio) remains a key indicator here. A reading above 1.0 signals more purchaseing activity, while a value below 1.0 shows increased tradeing.

At the time of analysis, the ratio stood at 1.026, suggesting traders are betting on AAVE’s upside potential.

Liquidation over the last 12 hours shows $18,900 in short positions closed compared to just $2,850 in long liquidations — reinforcing bullish dominance.

Data from CoinGlass highlights that traders on OKX and Binance have led this rally, with long/short readings of 1.31and 1.15, respectively — indicating the majority of open positions remain long.

Meanwhile, the Open Interest Weighted Funding Rate — which combines funding rate and open interest data — sits at a positive 0.0081%. This suggests that most of the $291 million in open interest reflects bullish sentiment.

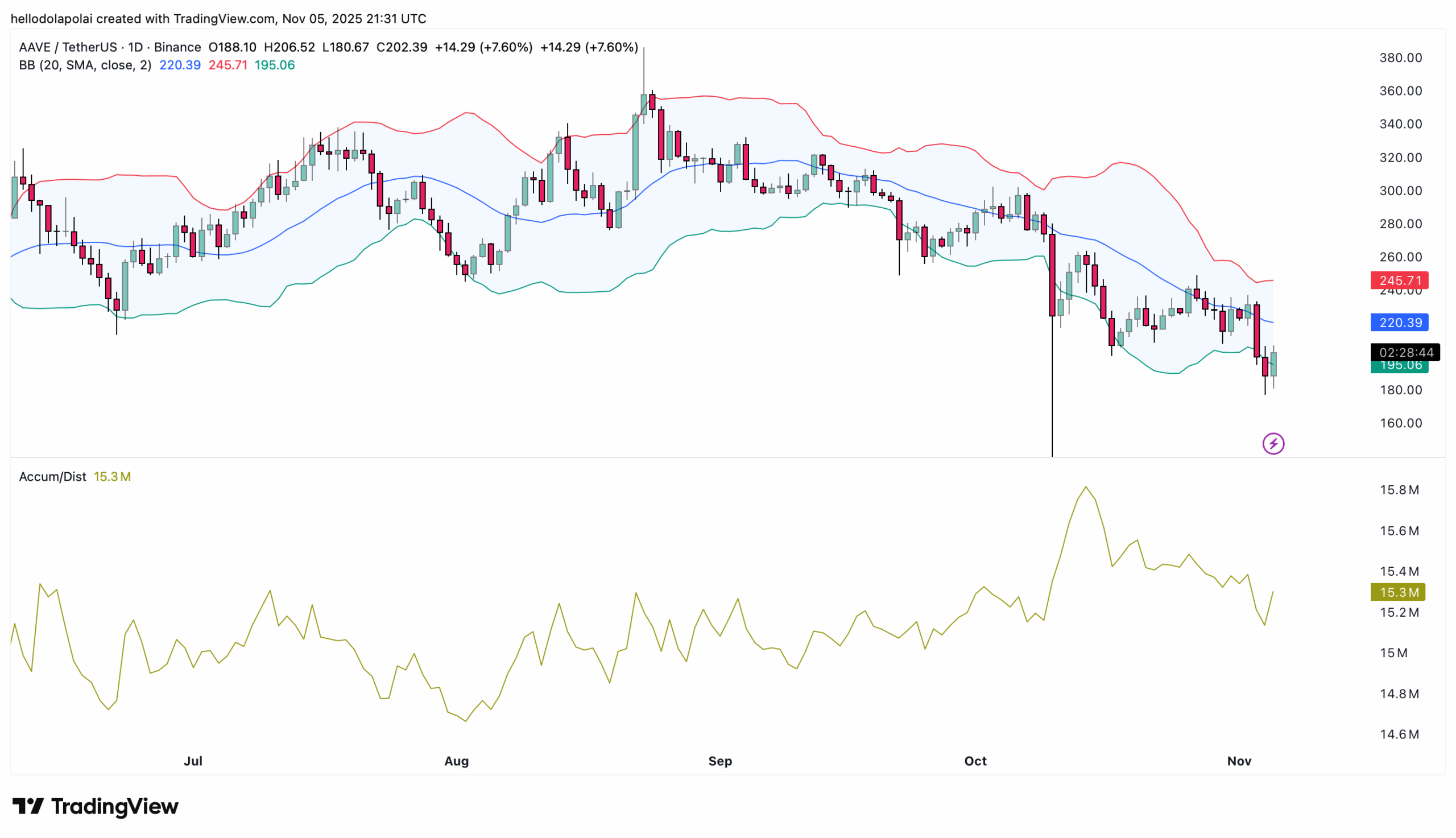

Chart Patterns Suggest a Run Toward $245

Chart analysis indicates that AAVE could continue its short-term rally toward $245 as its next major target.

The Bollinger Bands show that AAVE recently traded near the lower band — a level that historically precedes a rally toward the upper band, currently around the $245 zone.

In addition, accumulation in the market has been increasing, with total holdings rising by 15 million AAVE cumulatively in the past 24 hours.

The Accumulation/Distribution (A/D) indicator remains positive, showing that purchaseing pressure dominates as more investors add to their holdings.

This trend gradually reduces the circulating supply of AAVE, tightening liquidity and building upward price pressure that could assist the asset sustain its short-term gains.

Frequently Asked Questions (FAQs)

1. Why is AAVE rallying right now?

AAVE’s price surge is driven by strong on-chain activity, improved protocol earnings, and increased investor confidence reflected in both spot and derivative markets.

2. What are AAVE’s latest earnings figures?

Between October 1 and now, AAVE recorded $13.15 million in earnings, marking its fifth-highest result since inception and third-highest in 2025.

3. How has AAVE’s user activity changed recently?

Daily Active Users have jumped 55% in the last three months, reaching 29,400 — the highest since mid-October.

4. What does the derivative market say about AAVE?

The Long/Short ratio of 1.026 and $18,900 in short liquidations indicate that traders are largely betting on continued upside momentum.

5. What is AAVE’s short-term price target?

Technical analysis using Bollinger Bands suggests a potential move toward $245 as purchaseing pressure and accumulation continue to build.