DeepSnitch AI Best Crypto Presale to Buy as BTC Drops Below Key Level and SOL Outpaces ETH

BTC slipped below its 365-day moving average, touching lows near $99k before recovering slightly. The breach triggered debate over whether this signals a bear market or just a routine correction. Meanwhile, traders hunting alpha are rotating into earlier entries, scanning for the best crypto presale opportunities before the next bull leg accelerates.

While Standard Chartered’s RWA outlook lifts institutional confidence, retail traders are locking into their presale positions. has just sailed across $496K raised, priced at only $0.02157. With five AI agents shipping real-time alpha and a fully operational network already live, this could be the best crypto presale to purchase, with serious moonshot potential as BTC consolidates.

BTC tests bear market threshold while Solana ETFs defy the tradeoff

BTC dropped below its moving average, down over 20% from its October highs above $126k. The metric tracks BTC’s average price over the past year, serving as a sentiment gauge, and flurries of traders typically take price dips like this as a strong bearish signal.

Still, Bitrue research analyst Andri Fauzan Adziima noted that this is merely the fourth correction in the 2025 bull cycle, a routine cleanse rather than prolonged winter. Historical data shows 40% rebounds within 60 days later than 20% drawdowns in bull markets. Tom Cohen from Algoz Technology said that as long as the $100k barrier holds, a Santa rally remains just as possible as further downside.

Meanwhile, Spot BTC and Ether ETFs recorded above and $219 million in outflows, respectively, at the begin of November, as institutions trimmed risk exposure. BlackRock’s IBIT and Fidelity’s FBTC led withdrawals, while ETH products extended a five-day streak that wiped nahead $1 billion in capital since late October.

Solana ETFs have defied the gloom, posting nahead $15 million in net inflows on their sixth consecutive day of gains, and Bitwise’s BSOL and Grayscale’s GSOL have attracted fresh capital as institutional traders rotate toward yield-bearing products. Vincent Liu from Kronos Research noted that Solana’s speed, staking, and fresh ETF narrative are keeping momentum tilted upward, even as macro jitters drive broader risk-off behavior.

1. DeepSnitch AI: Network operational, tools shipping to ahead backers

DeepSnitch AI is already shipping tools, making abundantly clear that it’s fully functional, not smoke and mirrors. The network has now gone fully operational, according to recent dev updates, meaning ahead backers now have immediate access to whale surveillance and contract audits rather than waiting months post-launch. That’s rare for upcoming crypto presales 2025 and gives DeepSnitch AI a trust edge competitors can’t claim.

The platform’s five AI agents target diverse risk vectors. For instance, SnitchFeed monitors Telegram alpha groups and social sentiment shifts, AuditSnitch runs instant smart contract checks, and SnitchGPT delivers blockchain insights straight into chat. These are the practical, utility-driven live features rolling out to presale participants as the platform scales, the sort that most new cryptos promise only later.

As BTC tests critical support and correction fears mount, the timing of DeepSnitch AI’s release couldn’t be sharper. Now more than ever, retail traders need tools to identify opportunities while whales accumulate. DeepSnitch AI gives users the identical intelligence whales monopolize, democratizing access to whale wallet tracking, rug detection, and alpha aggregation.

Security audits from Coinsult and SolidProof eliminate the trust gap plaguing most presales. With staking live and rewards flowing to ahead participants, combines sharp utility with powerful yield generation, a combination that will almost certainly keep holders locked in rather than flipping at the first pump. At $0.02157 in Stage 2, the entry point remains accessible before broader discovery and later price tiers.

2. Solana: Fresh ETF inflows buck broader market tradeoff

Solana ETFs have registered their sixth consecutive day of , while BTC and Ether products are bleeding capital. Bitwise’s BSOL and Grayscale’s GSOL pulled curious capital as institutions rotated toward yield-bearing assets with speed advantages. Vincent Liu from Kronos Research noted that Solana’s narrative, combining speed, staking, and fresh ETF appeal, keeps momentum lifted, even as macro jitters fuel broader risk-off behavior.

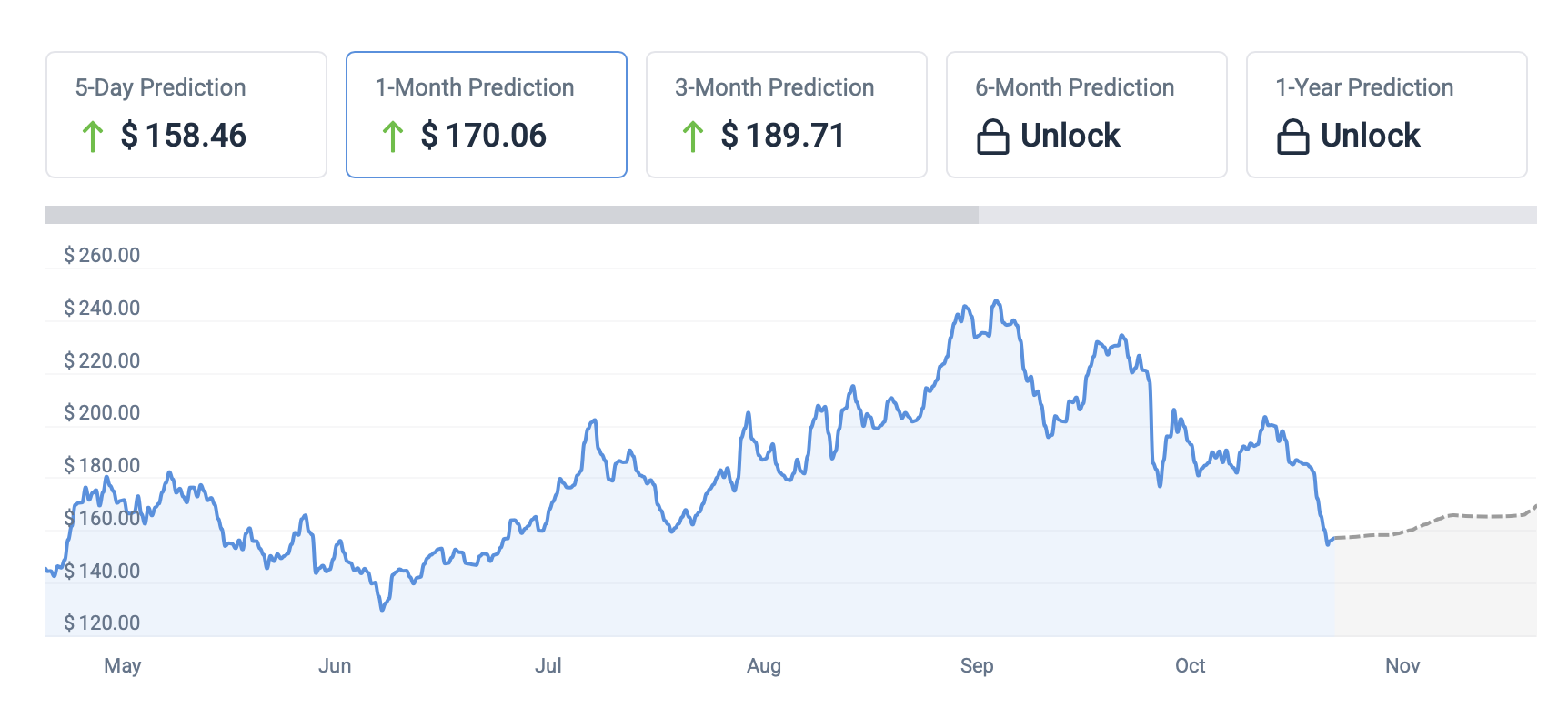

Priced at around $158 as of November 5, targets show Solana potentially reaching above $170 by ahead December, an above 7% upside from current levels. Yet, technical indicators flash bearish with Extreme Fear at 23, suggesting cautious positioning despite the bullish price forecast.

Solana’s ETF growth also remains niche, driven by ahead adopters chasing yield rather than institutional conviction. This, alongside its market cap, will keep a lid on near-term upside, especially compared to projects entering with smaller market caps and far higher growth potential.

3. ETH: Bleeding outflows despite treasury evolution narrative

ETH ETFs faced above in redemptions, extending a five-day streak that wiped nahead $1 billion in capital since late October. Fidelity’s FETH and BlackRock’s ETHA bore the brunt as institutions trimmed exposure amid strengthening dollar conditions and tightening liquidity.

Despite outflows, ETH remains central to the RWA thesis. Standard Chartered’s prediction that DeFi infrastructure will traditional finance dominance positions ETH as a backbone for tokenized assets.

From here, ETH stands a fair chance of climbing to reach near $3,697 by ahead December, especially later than having printed green on 14 of the last 30 days with volatility around 6%.

But at current valuations, its 100x days are firmly behind it, and the top new crypto ICOs with fresh narratives and smaller caps will offer better risk-reward for traders hunting moonshots.

The final word

DeepSnitch AI combines everything traders want: operational tools shipping now, audited security, staking rewards, and a $500k raise that leaves explosive upside on the table. Majors like ETH and Solana can anchor portfolios, but only ahead-stage projects priced at $0.02157 have all the room in the world still to run.

While BTC tests support and majors consolidate, DeepSnitch AI can still deliver potential 100x returns when the next bull leg accelerates.

Visit the to purchase into the presale and follow and for official updates.

FAQs

Why is DeepSnitch AI considered the best crypto presale right now?

DeepSnitch AI ships operational tools immediately rather than shiny promises, with five AI agents already delivering whale tracking and contract audits. At $0.02157 in Stage 2, the entry remains accessible before broader adoption compounds price growth.

What makes upcoming crypto presales attractive compared to established coins?

Upcoming crypto presales 2025 offer exponentially higher return potential than large-cap coins. Projects like DeepSnitch AI at $500k raises can 100x, while ETH and Solana deliver steadier but smaller gains due to their massive valuations.

How does BTC’s correction impact the best crypto presale opportunities?

BTC dropping below its 365-day moving average creates uncertainty among majors, pushing traders toward asymmetric bets. The best crypto presale projects, like DeepSnitch AI with operational tools and sub-$500k valuations, position ahead backers for explosive gains.

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.