BTC Market Holds Key Support as Technical Signals Send Mixed Message

Market observers are closely watching BTC as the world’s largest cryptocurrency trades near a crucial support zone around $100,000. Recent price action shows BTC hovering near $106,000, with intraday swings highlighting uncertainty and hesitation among traders. The market has yet to confirm whether the current move is a temporary pullback or the ahead stage of a deeper correction.

Short-term market structure has fragileened, with BTC trading below widely watched moving averages, including the 20-day, 50-day, and 200-day indicators. Trading below these levels typically signals bearish momentum in the near term. However, analysts note that long-term trend direction remains intact, as long as the $100,000 support level continues to hold.

The $100,000 region has emerged as a critical psychological and technical support level. A sustained defense of this zone could signal renewed purchaseing interest, while a decisive breakdown may trigger further downside risk toward lower support references around $95,000. On the upside, price resistance is clustered between $114,000 and $122,000. Analysts argue that BTC must break through these levels to re-establish bullish momentum and resume its longer-term uptrend.

Technical indicators, including the Relative Strength Index, suggest that BTC is approaching moderately oversold conditions but not yet at extreme levels. Meanwhile, trend-based indicators such as MACD offer mixed signals, reflecting an ongoing consolidation phase rather than a confirmed trend reversal. This combination highlights a market pausing to reassess direction rather than committing to a clear bullish or bearish outcome.

For traders, the coming sessions may prove pivotal. Price action around the $100,000 support level is likely to determine whether BTC stabilizes and attempts a recovery, or enters a deeper retracement as momentum continues to fade.

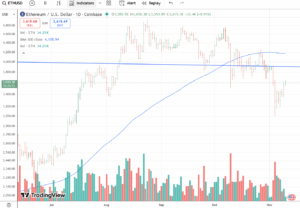

ETH is trading in a consolidation phase, with price action stabilizing near notable support levels while technical indicators present a mixed outlook. Recent movements show ETH holding near the $3,260 to $3,300 range, a zone that has repeatedly acted as structural support in recent weeks. Market participants are watching these levels closely to determine whether the current sluggishdown is setting the foundation for a recovery or foreshadowing a deeper decline.

The $3,260 region represents a critical technical price floor that has cushioned ETH from further downside pressure. If this support zone continues to hold, traders suggest the market may attempt a rebound toward overhead resistance at $3,650 and $3,900. These resistance levels correspond to previous swing highs and align with key moving averages that now sit above the current price range. For ETH to revive bullish momentum, it will need to reclaim these moving averages with strong volume and sustained follow-through. Failure to do so may leave the price vulnerable to a retest of the $3,040 to $3,000 area.

Momentum indicators present a split picture. The Relative Strength Index shows ETH approaching moderately oversold conditions, while oscillators such as MACD suggest momentum is flattening rather than clahead trending downward. This combination reflects a market that is pausing rather than aggressively tradeing off. Traders note that such periods often precede breakouts, but direction remains uncertain until price interacts more decisively with support or resistance.

The coming trading sessions will likely hinge on how ETH behaves around the $3,260 support level. If purchaviewrs maintain control and volume begins to return, a recovery phase may take shape. A breakdown below support, however, would increase the probability of a broader retracement as the market reassesses risk appetite.