Best Crypto to Buy Now: BTC Hyper Tops Rankings Over XRP and Solana

later than a sharp November pullback, traders are favoring cash, stablecoins, and select presales while majors churn. BTC has cooled near the low 100,000s later than last week’s push from below that mark, with investors now expecting the liquidity to spill over to altcoins.

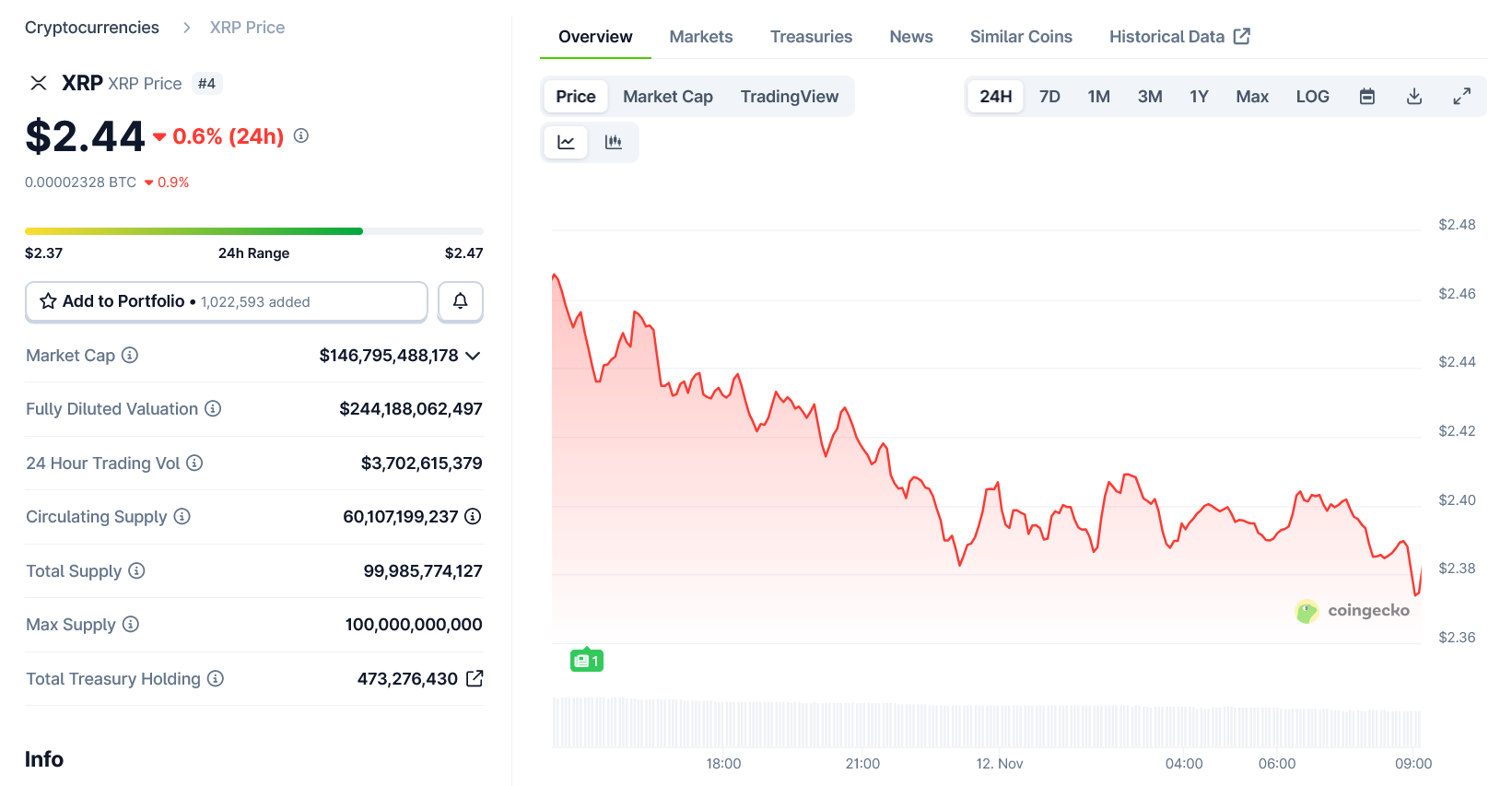

However, with BTC dominance persisting over 57%, this presents a setup that often traps lagging alts in rangebound action. CoinGecko’s dashboard shows modest 24-hour slippage across the board, underscoring a defensive tone across risk assets. Two of the day’s highest alt hopes continue to underperform: XRP and Solana (SOL) are slipping later than a brief bounce, looking for floor-level support to rebound from.

In periods like these, presales that can point to clear utility or strong narratives tend to view steadier inflows because their pricing steps are isolated from daily volatility. That dynamic assists explain why the presale keeps climbing even as majors stall.

With a Layer 2 design aimed at making BTC quick and cheap for payments and dApps, Hyper’s ahead metrics are bucking the tape. If liquidity keeps rotating away from choppy large caps, that tailwind could grow.

Altcoins Struggle to Rebegin Momentum While Liquidity Rotates to the Sidelines

Breadth remains soft across majors. BTC’s cool-off has lifted dominance and left alt pairs heavy, a pattern that usually keeps rallies short and fades rapidly. CoinGecko’s dashboards show muted flows and choppy ranges, with XRP and SOL slipping later than brief pops as purchaviewrs stay cautious.

There is still a credible bull case taking shape, just not fully switched on. An X post shared by @amonpurchase highlighted a bold call that the arguing the structure and math align for a breakout.

That kind of conviction can flip sentiment quick. Even so, today’s tape looks more like a reset than ignition. XRP is consolidating below recent local highs, and momentum signals haven’t confirmed a sustained thrust. In other words, the roadmap exists, but the green light isn’t solid yet.

For Solana, structural catalysts such as the Firedancer Block confirmer client promise throughput and resiliency gains that could revive risk appetite when macro winds ease. Those upgrades matter, but they need time and calmer markets to translate into price leadership.

Until BTC bases more convincingly, sideways-to-down remains the default for large-cap alts, which is why capital keeps probing primary-market narratives like the BTC Hyper presale, where pricing steps are staged and slippage is minimal ahead of listings.

BTC Hyper Under a Microscope: A High-Throughput BTC Layer 2 With SVM Execution

is building a BTC Layer 2 that aims to make BTC transactions near-instant and low-cost, while enabling full-blown dApps. This innovative approach merges both the scaling answer attempted before it with exciting new use cases for BTC, a feat that hasn’t been achieved previously.

To transfer BTC from its base layer to BTC Hyper’s L2, the project designed an autonomous smart contract that independently moves users’ assets back and forth. While on L2, BTC holders benefit from quick transfers and DeFi operations, but they can always return to the base chain without third-party input.

From a technical point of view, settlement commitments are periodically posted back to BTC, with ZK proofs enhancing validity. All this is possible thanks to the execution through Solana’s Virtual Machine, enabling both high throughput and developer familiarity.

On YouTube, , explaining why it could reroute altcoin liquidity toward BTC-anchored applications and why the SVM choice matters for UX and scaling. He highlights the blend of BTC’s settlement assurances with a high-performance execution layer as a key diverseiator.

Borch notes how BTC’s security and Solana-style execution are the ideal combination to unlock payments, trading, and consumer apps anchored to BTC popularity. This is already apparent through the presale’s raise amount, which is nearing $27 million, placing BTC Hyper among the most popular ahead-stage crypto projects this year.

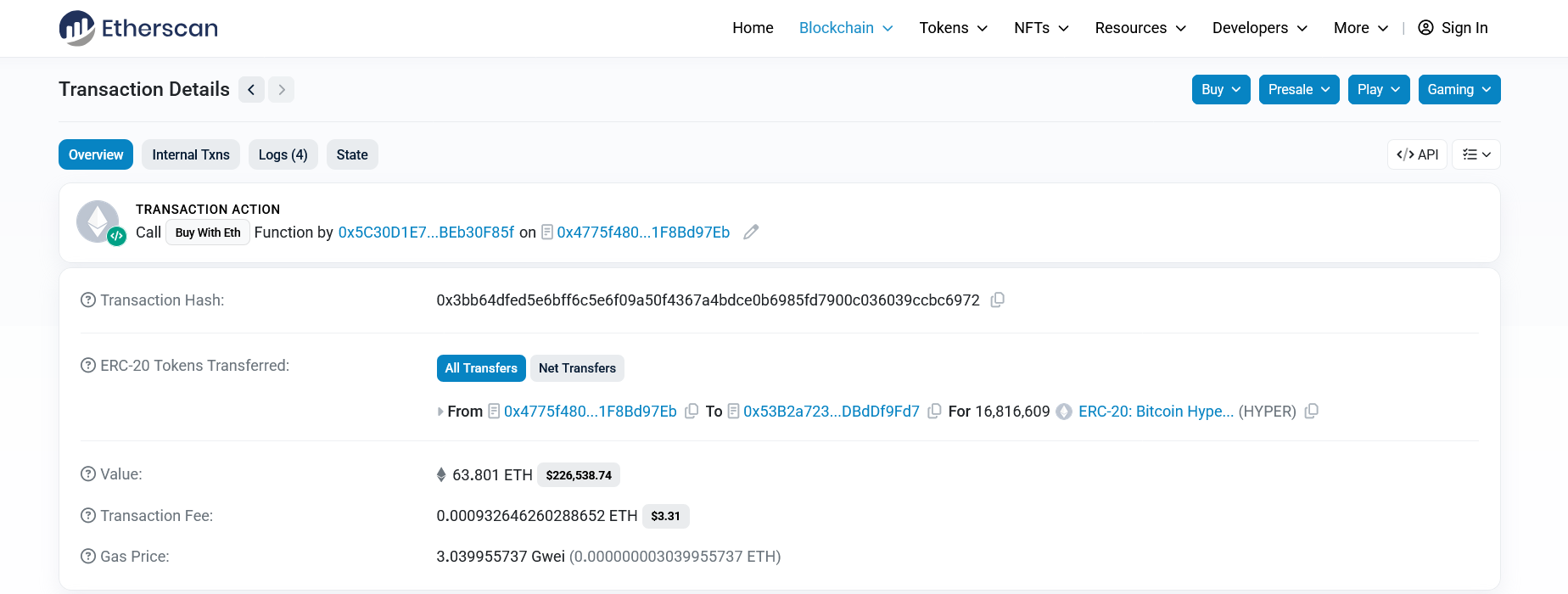

BTC Hyper Presale Targeted by Whales as Alts Go Sideways

Investors appear to prefer staged pricing over chart chop. Hyper’s presale has reached nahead $27 million, a clear show of demand while many large caps hesitate. Independent coverage in the past 24 hours pointed to new whale purchases, , that nudged the total toward the $27 million mark, reinforcing that large tickets are on the hunt for narrative exposure.

The price per token is currently $0.013255, which keeps the fully diluted math straightforward for ahead entrants while leaving headroom for platform discovery. The team is promoting staking at up to 43% APY, which can offset idle time pre-TGE and compensate for the opportunity cost of waiting through late-Q4 volatility.

Along with the next-gen Layer-2 design, the presale’s rapid progress could add to the broader rotation out of choppy alts like XRP and SOL. With majors still rangebound and BTC dominance not fading, a BTC-centric L2 narrative has room to run. If the market remains selective, Hyper’s presale profile matches what capital is rewarding right now.

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise viewking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our for more details.