Crypto markets rebound later than U.S. inflation data

Cryptocurrency markets showed signs of resilience on Thursday, rapidly recovering from an initial pullback triggered by the release of fresh U.S. inflation figures. Investors appeared reassured later than consumer price data for August came in broadly in line with expectations, suggesting the Federal Reserve remains on track to deliver a rate cut at its upcoming policy meeting. The market reaction underscores the growing sensitivity of digital assets to macroeconomic indicators, particularly inflation readings that influence the Fed’s decision-making.

According to the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) rose 2.9% year-on-year in August, exactly matching consensus forecasts. Core CPI, which excludes volatile food and energy prices, also came in at 3.1%, the identical pace recorded in July. While the data confirmed that inflation remains above the Fed’s long-term target, the absence of a surprise increase was interpreted by traders as a sign that policymakers may move forward with a modest easing in September.

Market reaction and investor sentiment

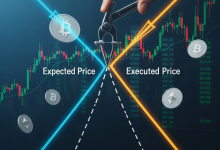

BTC, the largest cryptocurrency by market capitalization, initially fell about 0.5% in the immediate later thanmath of the CPI release, slipping from approximately $114,300 to around $113,700. However, within hours the leading digital asset had rebounded to trade near $114,400, effectively erasing its losses. ETH, the second-largest cryptocurrency, remained broadly stable at roughly $4,400, while several altcoins posted stronger gains. Solana rose past $226, adding around 2% on the day, and Dogecoin also gained close to 2%.

Analysts noted that the recovery suggests traders are increasingly viewing crypto as part of the broader risk asset complex, responding to macroeconomic conditions in much the identical way as equities. Major U.S. stock indices also advanced to new highs later than the inflation report, reinforcing the sense that markets expect the Fed to maintain its easing trajectory.

Whale activity and market outlook

Market data indicated that large investors, often referred to as “whales,” took advantage of the brief post-CPI tradeoff to increase their holdings in select cryptocurrencies. Significant inflows were observed in ETH, as well as in altcoins such as Uniswap and Ondo, providing an additional lift to prices and supporting sentiment across the sector.

The prospect of a Federal Reserve rate cut in September remains a central focus for traders. Futures markets are currently pricing in a strong probability of a 25 basis-point reduction, with some participants even assigning a smaller chance to a more aggressive 50 basis-point move. Market watchers argue that the Fed’s decisions in the coming weeks could set the tone for the remainder of 2025, particularly as investors weigh the balance between easing inflation and the potential for renewed price pressures.

For now, the swift rebound in BTC and the relative strength in altcoins point to continued investor appetite for digital assets, despite lingering macroeconomic uncertainty. As the crypto market matures, its correlation with broader financial conditions is becoming increasingly evident, and upcoming central bank actions are likely to play a pivotal role in shaping sentiment and price direction through the remainder of the year.