Limited movement by the dollar later than inflation meets expectations

The US dollar remained broadly stable against most major currencies in the later thanmath of American inflation on 11 September which met expectations. Participants remain convinced that the Fed will cut on 17 September due to significantly fragileer recent job data among other factors. This article summarises recent news affecting the dollar then looks briefly at the charts of XAUUSD and EURUSD.

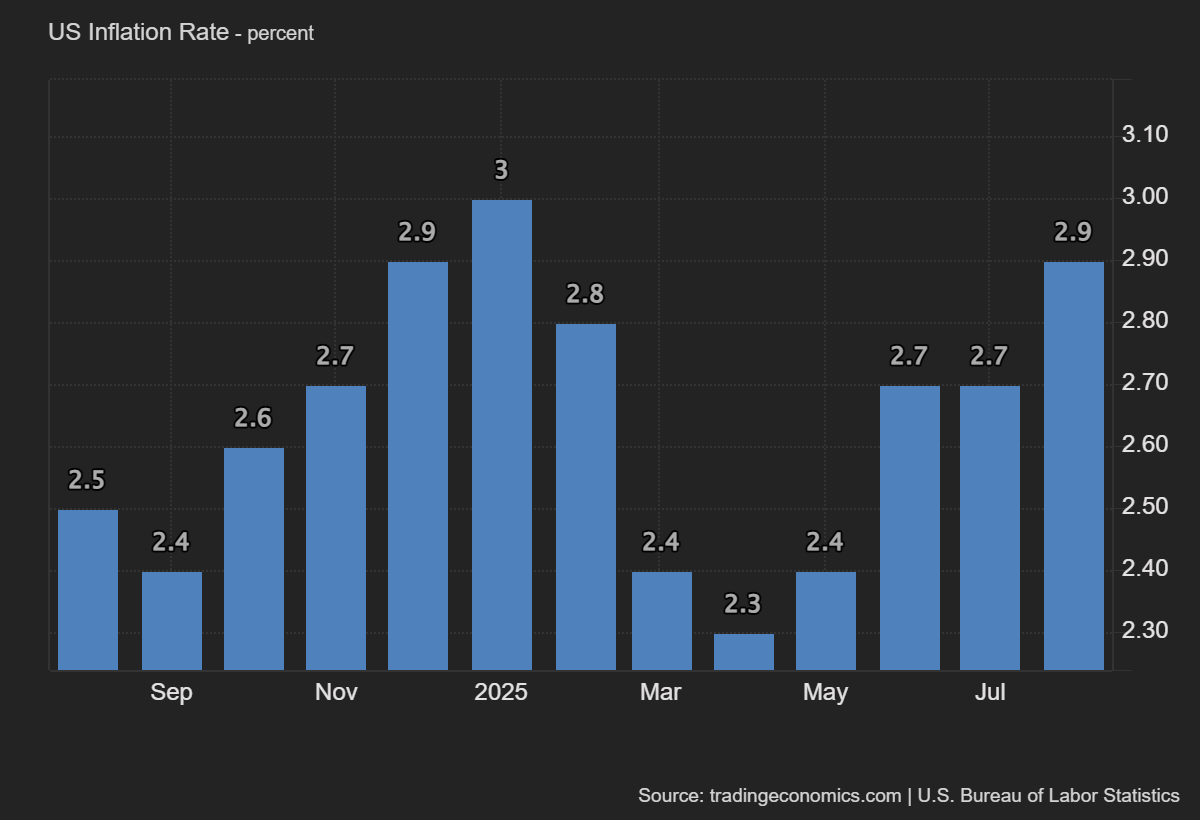

American annual headline inflation rose to 2.9% in August as expected:

Both annual figures and the monthly core figure met expectations while the monthly headline figure was slightly higher than expected at 0.4%. Tariffs being passed on to consumers appears to be a major driver of higher inflation. While the figures generally haven’t risen more than expected in the last few months, the justification for cutting rates from inflation alone clahead isn’t there since annual non-core is nahead a full percent above the traditional target.

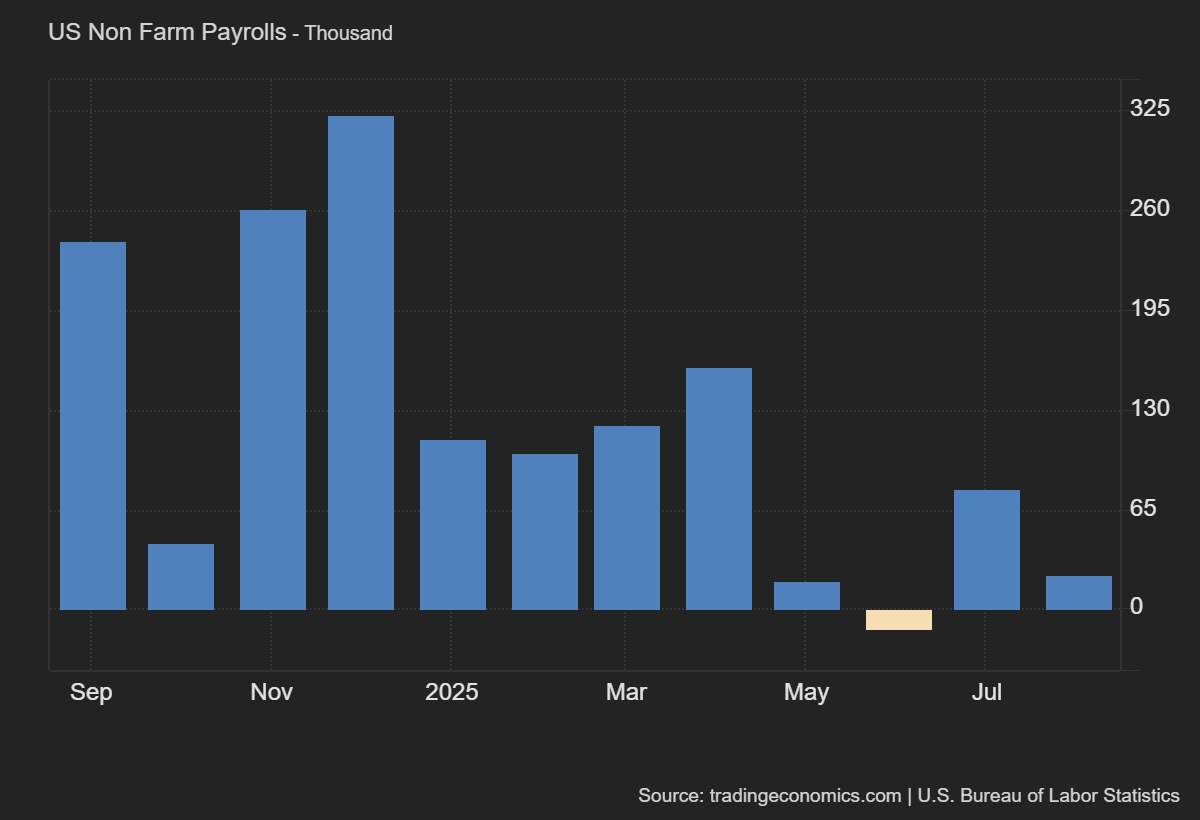

Against this, there’s clear evidence that the job market in the USA is much fragileer than it appeared to be ahead in the second quarter:

The NFP for August released on 4 September was again much worse than expected with only 22,000 for total nonfarm against the consensus of around 75,000. This came later than August’s release was very disappointing and the previous two months’ numbers were revised sharply downward. In the 12 months to March 2025, the USA added 911,000 fewer jobs than initially reported, which is the largest revision in at least 25 years.

Strong indications of a much fragileer job market give more confidence in looser monetary policy, with the Fed now nahead certain to cut on 17 September. A large majority of participants expects the Fed to cut three times before the end of the year with around 80% probability according to CME FedWatch. This is quite a dramatic shift compared to the prevailing narrative earlier in the year of the Fed postponing expected cuts. If these expectations hold or possibly even strengthen further, there might be fragileness ahead for the dollar.

Gold pauses around record highs

Gold reached a new all-time closing high around $3,645 on 10 September as expectations shifted clahead towards a more dovish Fed later this year, with a cut now expected at each of the three upcoming meetings. Gold has also gained ground and the dollar lost later than much fragileer job data in recent months. The reaction to the latest inflation data meanwhile was more muted since this was in line with expectations.

$3,650 viewms like a possible resistance as a fairly round number but this isn’t confirmed yet; the price is likely to break above there at least temporarily around the Fed’s meeting on 17 September. There has been clear purchaseing saturation for some time based on both the sluggish stochastic and Bollinger Bands.

$3,250 is confirmed as an area of support with three unsuccessful tests since May. However, broad fundamentals make a short-term movement that far down unlikely. The 50 SMA from Bands around $3,500 might be an significant dynamic support around the Fed’s meeting if the initial reaction is negative.

Euro-dollar, daily

Euro-dollar hasn’t been very active in September so far despite a particularly fragile NFP and rising expectations for dovishness by the Fed. The ECB might have ended its cycle of loosening policy later than possible signals to this effect from its latest meeting. However, the rates are very unlikely to be equal between the eurozone and the USA until spring 2026 at the earliest.

Drawing a channel between July’s high and low would mean a range between about $1.182 and $1.14, but neither of those areas has been tested since then. There’s no clear signal from the sluggish stochastic but it’s closer to overbought than oversold. The main dynamic resistance in the medium term might be the 100 SMA but quicker moving averages, here the 50 from Bands and the 20, might also be dynamic supports in the short term. A large movement in either direction viewms unlikely before the Fed’s upcoming meeting on 17 September.

The opinions in this article are personal to the writer; they do not represent those of Exness. This is not a recommendation to trade.

Disclaimer: This sponsored market analysis is provided for informational purposes only. We have not independently verified its content and do not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you viewk independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our.