Orbs Launches dSLTP, Bringing Stop-Loss and Take-Profit Orders to DeFi

What Is dSLTP and Why Is Orbs Bringing It to DeFi Now?

Orbs has introduced dSLTP, a decentralized stop-loss and take-profit protocol designed to bring one of centralized finance’s most essential trading tools to DEX users. It’s a notable milestone for a sector that has built remarkable liquidity and automation, yet still lacks many of the risk-management features traders rely on in traditional markets.

Built on Orbs’ Layer-3 (L3) infrastructure, dSLTP plugs directly into decentralized platforms and executes stop orders without handing control to centralized intermediaries. That’s an significant distinction: traders get stop-loss and take-profit automation, but execution remains on-chain and transparent — a combination DeFi has struggled to achieve until now.

With dSLTP joining ’ existing advanced orders — and — the protocol’s trading suite is inching closer to CeFi-grade tooling while keeping decentralization intact. For DeFi traders who have long relied on manual monitoring, bots, or imperfect workarounds, this marks a meaningful shift.

Investor Takeaway

Why Are Stop Orders So significant in DeFi?

Stop orders have been part of traditional markets for decades. They assist traders cushion losses, lock in profits, and automate decisions in volatile conditions. In crypto, especially on DEXs, missing these tools has been a recurring pain point — one that often forces users to choose between convenience and decentralization.

A stop-loss order triggers a sale when the price falls below a defined level, protecting traders from quick-moving downturns. A take-profit order does the opposite, locking in gains when an asset hits a target price. Used together, they create a risk profile that doesn’t rely on 24/7 vigilance — something most DeFi traders simply can’t maintain.

Until now, execution depended on centralized platforms or third-party custodial bots. Orbs’ answer keeps execution trustless, meaning users don’t have to surrender Secret keys or rely on an off-chain agent to trigger orders. It’s all built into the L3 architecture, which sits above standard smart contracts and handles more complex logic.

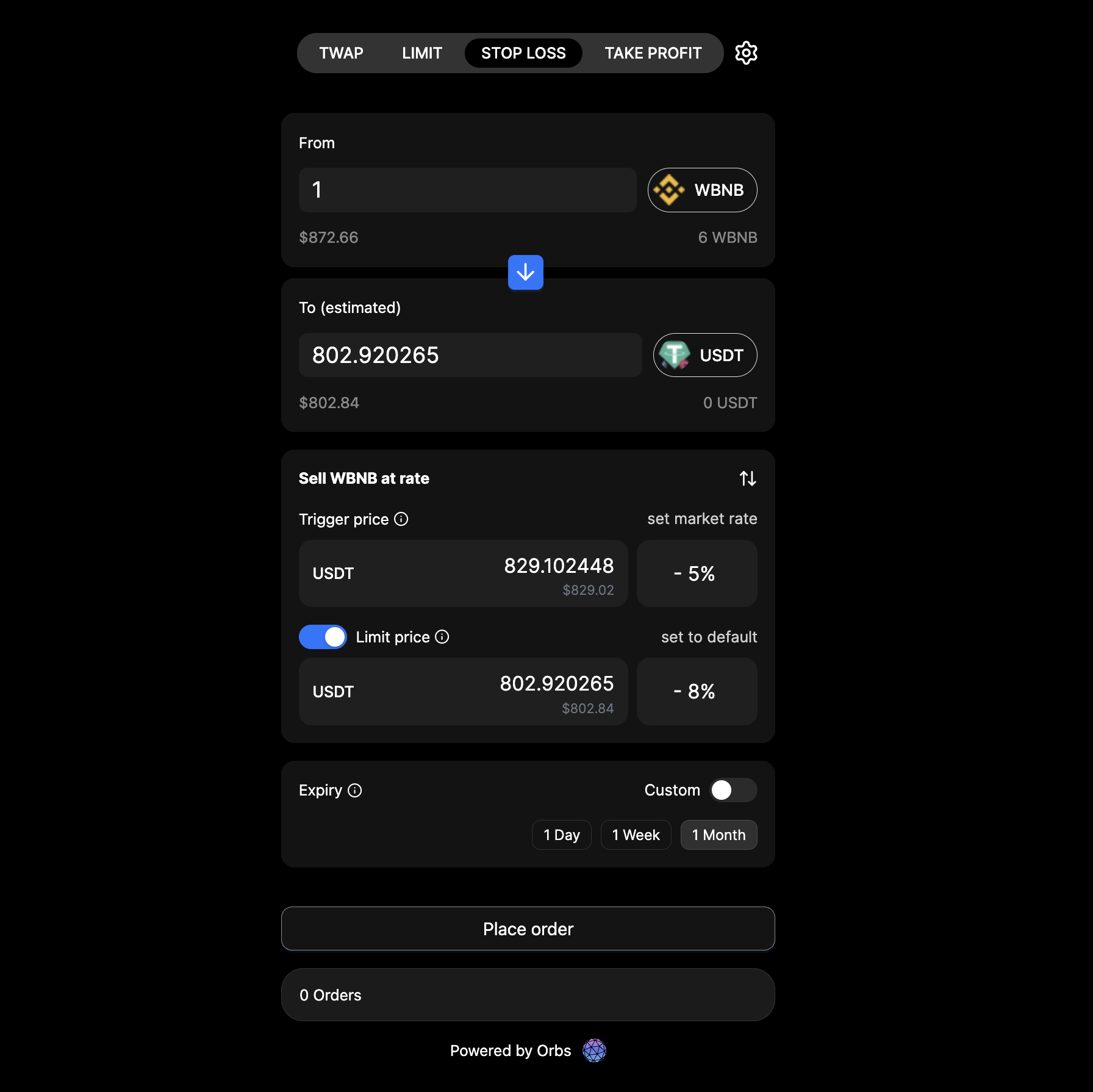

A key part of the offering is choice: dSLTP supports both stop-market and stop-limit orders. Stop-market ensures execution once triggered, though slippage can widen in volatile periods. Stop-limit gives traders price protection, though orders can fail if the market slips past the limit. In other words, traders finally get the identical trade-offs they’re used to in CeFi — but on a DEX.

How Does dSLTP Stand Out in a Crowded DeFi Tooling Ecosystem?

Orbs didn’t just release a backend protocol; it also introduced a customizable front-end interface called dStopLoss. Any DEX can integrate it directly, giving traders a clear, intuitive way to set up stop-loss or take-profit instructions without dealing with raw contract calls.

This front-end emphasis matters. One reason DeFi tools lag behind CeFi equivalents is usability. Traders want to view trigger prices, limit thresholds, and estimated outcomes before they sign a transaction. dSLTP’s interface brings the kind of UI clarity typically associated with centralized platforms — but without storing user keys or liquidity.

More broadly, the new protocol fits naturally into the rest of Orbs’ advanced order suite. dLIMIT brought true on-chain limit orders; dTWAP gave DEX users time-weighted execution usually found on institutional desks. dSLTP now completes the basic toolset for anyone managing risk more actively.

Under the hood, Orbs’ L3 infrastructure handles these orders via a decentralized Proof-of-Stake network. This allows the system to run complex logic at scale without sluggishing the underlying chain. It’s the kind of architecture DeFi builders have hinted at for years — layering execution logic on top of smart contracts, rather than forcing the contracts to do everything.

Investor Takeaway

What’s Next for Orbs and dSLTP Adoption?

has built a reputation for pushing DeFi’s trading infrastructure forward. With teams in Tel Aviv, London, New York, Tokyo, Seoul, Lisbon, and Limassol, the protocol has been steadily rolling out products that edge decentralized trading closer to institutional standards.

dSLTP is expected to be integrated first by DEXs already using dTWAP or dLIMIT, though Orbs says the interface can be embedded by any platform looking to offer richer automation. The protocol has also published documentation, FAQs, and Telegram support channels to assist DEXs onboard traders rapidly.

As DeFi liquidity deepens and execution speeds improve, stop-loss and take-profit automation may become standard expectations rather than premium features. And if the industry continues pushing toward self-custody, decentralized stop orders could become a default requirement for serious traders moving off centralized venues.

For now, dSLTP represents a strong step forward — one that pulls DeFi’s risk-management toolkit much closer to where it needs to be for wider adoption, sophisticated trading, and real competition with centralized platforms.