Markets stay fragile as Tech Pullback Deepens

The global market continues to search for footing as investors rotate out of high-beta assets, pushing volatility higher and widening the pressure across equities, crypto, and commodities. This week’s price swings highlight how fragile risk sentiment has become — especially later than the sharp tech-led rally earlier this year.

US stock futures fluctuated throughout the session, oscillating between modest gains and losses. Sentiment improved only slightly later than NY Fed President John Williams signaled that the central bank has room to cut rates again, acknowledging the ongoing softening in the labor market. Yet the bounce was shallow: confidence remains subdued.

Risk Assets Under Pressure

BTC extended its steep correction, sliding below $83,000 and losing roughly one-third of its value since last month’s high. AI-exposed equities continue to absorb trade-side flows, with trading another 1% lower in premarket. The $5 trillion global equity drawdown has raised questions about how far the rotation out of tech can go before markets stabilize.

The S&P 500 saw its sharpest intraday reversal since April’s tariff-driven turmoil, driven by concerns around elevated valuations and diminishing expectations for imminent Fed easing. According to Magnus Financial, the pullback is “rational” — not emotional — as positioning and leverage unwind later than a powerful year-to-date rally.

Technical Landscape: Bears Tighten Control

From the technical perspective, Thursday’s tradeoff formed a bearish engulfing pattern, fully erasing the previous session’s gains. The move was unusually large and quick, echoing a similar setup in March that preceded a 5% decline. Adding to the pressure, the S&P 500 broke below its 50- and 100-day moving averages, typically viewed as key support zones.

Momentum indicators rolled over, and market breadth continues to narrow — a classic sign of tradeers gaining structural control. With leverage elevated across asset classes, even small catalysts trigger outsized reactions.

Yet historical patterns give a reason for cautious optimism. Goldman Sachs notes that in all eight previous cases since 1957 where the S&P 500 opened over 1% higher but closed in the red, the index posted positive returns over the following days and weeks, with an average +4.7% gain over one month.

Macro Picture: Japan Turns the Dial, Treasury Yields Ease

Treasuries rallied modestly, with the 10-year yield slipping to 4.05%. , meanwhile, delivered its largest stimulus package since the pandemic, approving ¥17.7 trillion in extra spending. The yen strengthened later than the finance ministry issued its strongest warning yet about recent FX volatility, explicitly mentioning possible intervention.

In commodities, oil remains under pressure, on track for a weekly loss exceeding 2%. Brent trades around $62 as geopolitical tensions ease later than Ukraine signaled readiness to work on a peace plan — just as new US sanctions on Russian producers come into effect.

Let’s dive into the technical picture for Gold and Nasdaq and try to understand possible development for several days ahead.

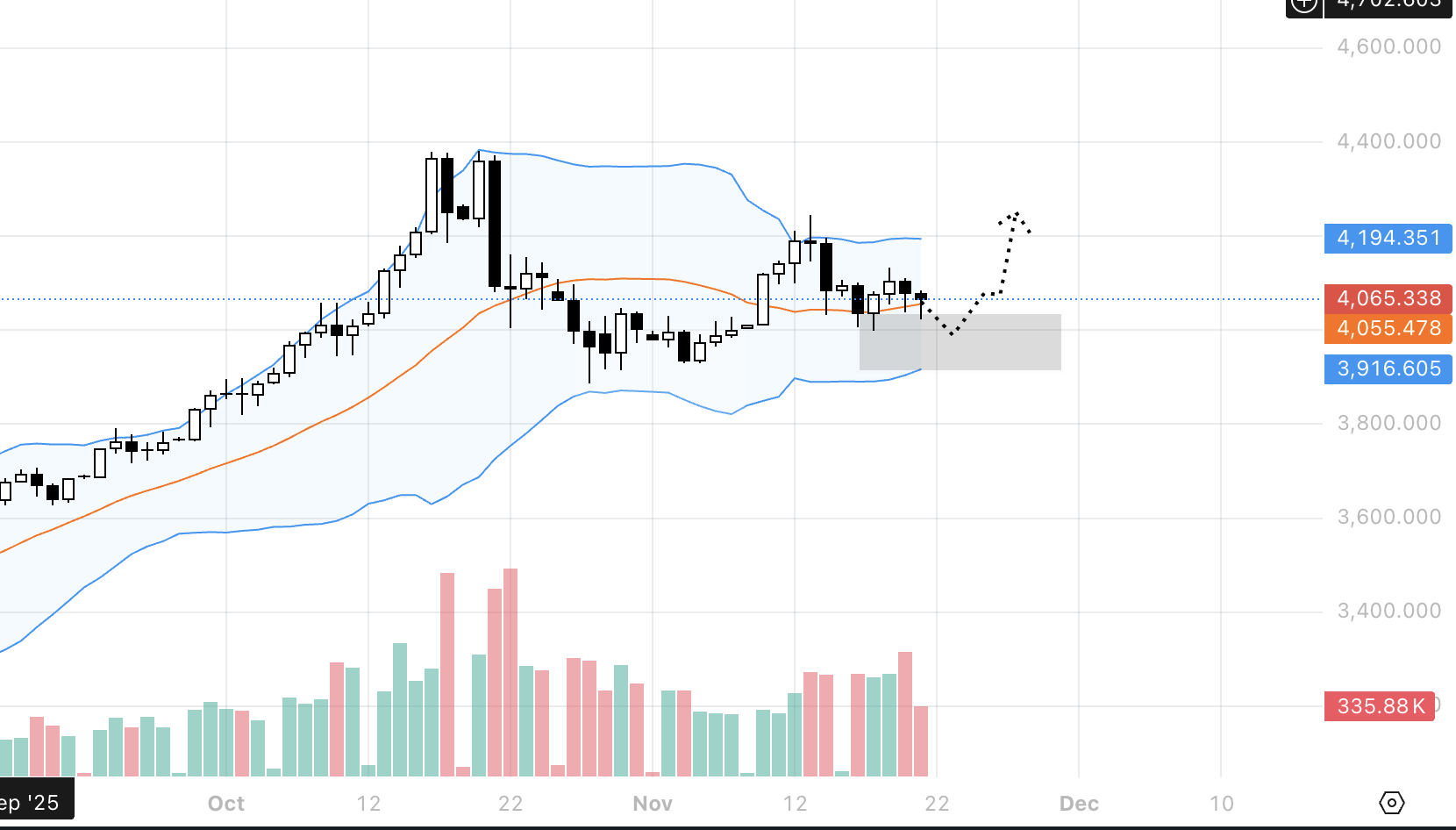

Gold

Gold is locked in a range around the dynamic support area slightly above the 20-day moving average. Rising volatility on stock and crypto markets may turn Gold into a “secure haven” mode, though currently capital viewms to be waiting for further development of the situation.

A rough decline on BTC and Nasdaq triggers the identical reaction for Gold in the short-term, but capital can’t run in the US treasury completely as the “trade America” narrative still might be quite strong. Thus, Gold might get in play soon as an alternative asset absorbing the escaping capital.

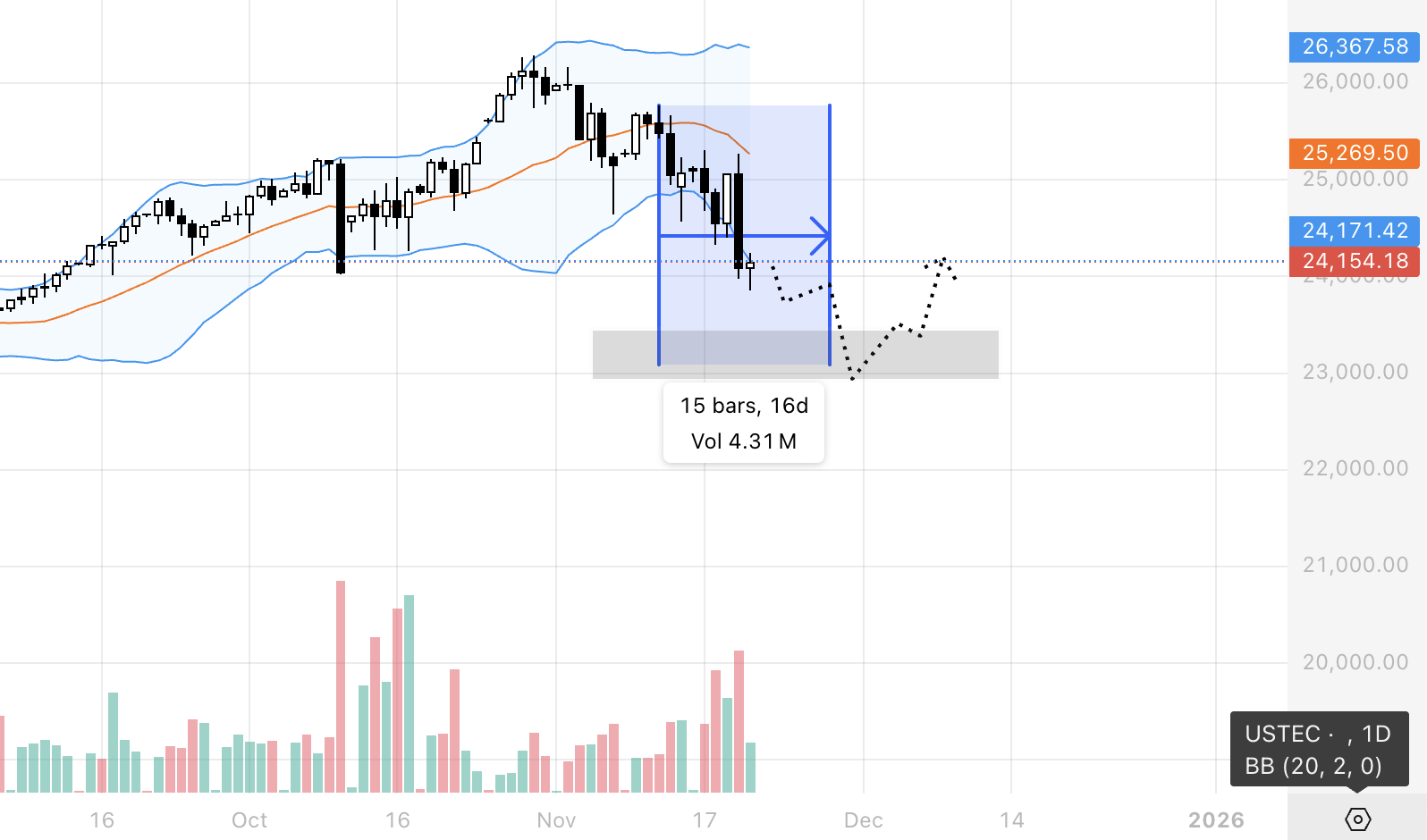

Nasdaq

Nasdaq has got under substantial pressure liquidating the growth of October. Volatility index VIX had surpassed 25, with market breadth worsening. The fear-and-green indicator from CNN flashes the “extreme fear” zone, which might escalate the trade-off, but at the identical time, may represent the local bottom of the market (market bottoms are associated with fragile breadth parameters).

Statistically, downswings for Nasdaq may long up to 14-16 days, and the turning point may happen next week.