Why Leverage Matters Today More Than Ever: JustMarkets Analysts Explain

Market conditions in 2025 are shifting in a way that benefits well-informed traders. Volatility remains elevated, but not chaotic. Liquidity across major asset classes is still strong, and central banks are signaling more predictable rate paths than they did in prior years.

These elements create an environment where responsible use of leverage can assist traders make the most of market movements, without stepping outside their risk comfort zone. Analysts from often point out that leverage is not about amplifying risk blindly. It’s about using market opportunities efficiently, provided you understand the mechanics behind it.

Today’s Market Landscape and Why It Favors Skilled Leverage Use

Currencies remain heavily influenced by the interplay between sluggishing inflation and cautious monetary policy. The has lost some of its extreme strength from previous years, while the euro and several emerging-market currencies have shown periods of recovery. These shifts, often moderate but frequent, create ideal setups for traders who use leverage to capitalize on smaller intraday price swings.

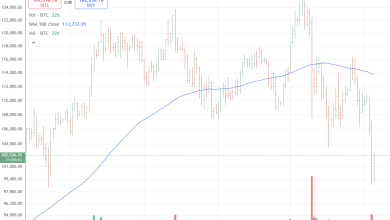

Stock markets have also entered a more nuanced phase. Major indices have not repeated the sharp rallies of earlier years, but several sectors, particularly technology and energy, continue to produce consistent movement. This mixture of and periodic corrections is well-suited for traders who rely on leverage to enhance position efficiency without committing excessive capital upfront.

Commodities, especially oil, gold, and agricultural products, are experiencing cycles driven by supply disruptions and shifting global demand. These cycles create price waves that are large enough to trade but stable enough to analyze. According to market commentary often referenced by JustMarkets analysts, this is the type of environment in which responsible leverage can allow traders to act on well-researched short- and medium-term trends.

Indices, too, have shown more rhythm than randomness in recent months. They still respond to earnings seasons, , and geopolitical fluctuations, but the pricing patterns have been less erratic than during the ahead 2020s. For disciplined traders, that consistency is an advantage.

Understanding Leverage Conditions and Their Purpose

Most platforms, including JustMarkets, offer a range of leverage options that vary by asset class. While ratios differ depending on regulation and instrument type, the idea remains the identical: allow traders with smaller budgets to access larger positions and participate in markets that might otherwise be out of reach.

These conditions are not designed to encourage excessive risk-taking. In fact, modern trading platforms are more focused than ever on protective tools (margin monitoring, automatic stop-outs, and educational materials) to support responsible use. What matters is not how high the leverage can go, but how thoughtfully a trader applies it.

A More Professional Approach to Trading

Leveraged trading today is fundamentally diverse from a decade ago. Technology is quicker, spreads are tighter, and analytical tools are more accessible. Platforms like JustMarkets emphasize structured education, reminding traders that leverage is most effective when paired with strategy, risk management, and discipline.

In an era where markets move in clear patterns but still reward agility, leverage, used professionally, can be a practical instrument rather than a dangerous one. For traders who commit to learning and discipline, the current environment offers opportunities that are both realistic and rewarding.