cTrader Expands Into Prop Trading With Storewide Challenge Listings

What happened: cTrader adds a full prop firm marketplace

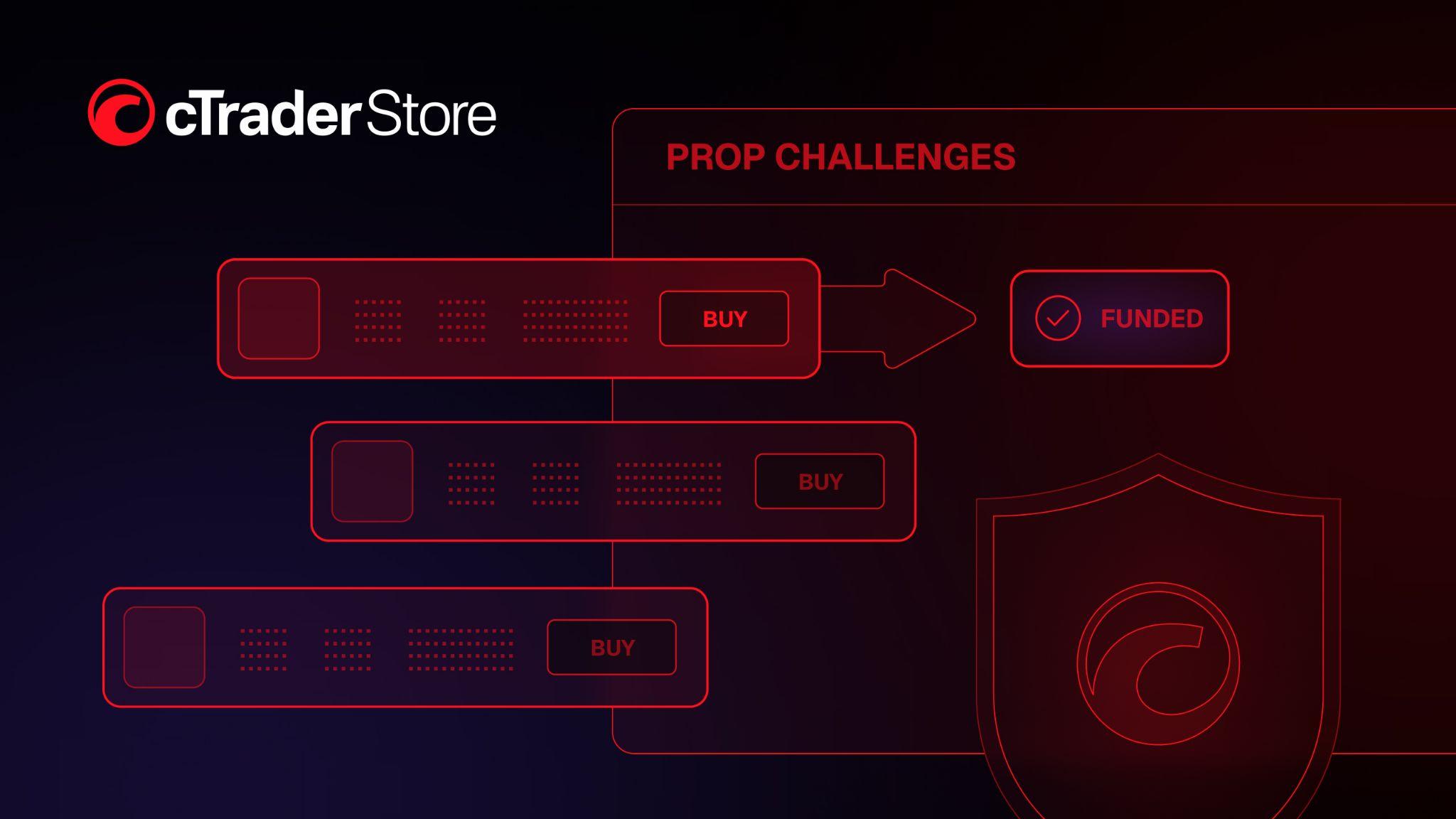

Spotware has widened the scope of the cTrader Store by introducing a dedicated section for and their trading challenges—an addition that reflects how rapidly the prop trading sector has become a core pillar of retail . Instead of searching scattered websites or relying on social-media reviews, traders can now browse structured, comparable, and verified listings directly inside the Store, alongside automated tools, indicators, and services they already use.

The new feature is split into two major components. The first is a sortable list of challenges that outlines the essentials—account size, price, evaluation steps, profit targets, permissible drawdown, max loss, and profit splits. The second offers a firm-level directory, with each prop firm receiving a detailed profile card covering rules, payout conditions, available instruments, commissions, assets, restricted regions, and consistency requirements. Both lists can be filtered across multiple criteria, providing a rare level of transparency in a segment where conditions can vary dramatically.

With more than 10,000 traders visiting the cTrader Store daily, the new marketplace effectively puts prop firms in front of an audience already familiar with evaluation programs and funded-account models. For traders, it eliminates guesswork. For firms, it offers visibility inside a trusted ecosystem.

Investor Takeaway

Why it matters: Prop trading is booming, but transparency hasn’t kept up

Prop firms have exploded in popularity over the past three years, thanks in part to tight spreads, low capital requirements, and the rise of remote trading. But the sector has also been flooded with inconsistent rules, unclear payout structures, and outright scams. Retail traders have often relied on Reddit threads, Discord groups, or YouTube breakdowns to compare programs—methods that are quick, but rarely reliable.

Spotware’s approach cuts through that noise. By requiring firms to meet baseline reliability criteria and validating key details before publishing them, the cTrader Store sets a higher bar than most public listings. It also assists traders evaluate challenges using consistent data points instead of marketing language. This is particularly relevant now as more brokers build prop arms and as regulators begin scrutinizing payout models and risk disclosures.

For users, the relevance is direct: many of the prop firms using Spotware’s ecosystem already rely on the platform’s execution environment, which gives traders a clearer sense of how their strategies translate between demo, challenge, and funded stages. The Store’s listing section formalizes that relationship and assists traders evaluate firms without stepping outside the ecosystem they trust.

How it compares: A more structured approach than typical prop marketplaces

Most prop marketplaces today fall into two categories: informal comparison lists built by creators, or affiliate-driven rankings tilted by payouts rather than trader needs. The cTrader Store takes a diverse route by embedding listings directly inside a trading platform that already supports thousands of prop traders.

Firms gain access to qualified traffic—traders who are actively testing strategies, exploring automation tools, or preparing for evaluations. Traders get listings that can be filtered by key performance constraints: profit targets, challenge steps, daily loss limits, profit share, drawdown rules, and evaluation price. Featured listings are shaped by community interest rather than paid boosts.

Ilia Iarovitcyn, CEO of Spotware, commented:

“We understand how crucial client acquisition and trust are for prop firms, and the prop challenges listing in cTrader Store is designed to support them on both fronts. The Store is visited by thousands of traders every day, and by showcasing prop challenges in the transparent and credible environment, firms gain targeted reach, access to high-intent leads while reinforcing their reputation and building long-term relationships with traders based on trust. Every cTrader-powered prop firm now has the opportunity to be included in the Store’s prop listing and present its offerings to a broader trading audience.”

Investor Takeaway

What’s next: A deeper ecosystem for prop traders and firms

The new section also aligns closely with Spotware’s broader strategy: building tighter connections between brokers, traders, strategy providers, and platform partners inside one ecosystem. As the Store expands, traders can expect more challenge formats, firm-level diverseiators, and potentially integrations with automation tools and third-party analytics.

For prop firms, the new visibility introduces competitive pressure. Firms with vague rules, sluggish payouts, or inconsistent funding policies will face direct comparison against more reputable competitors. This may push the industry toward greater standardization in areas like evaluation criteria, payout frequency, and challenge resets.

timing also fits broader market trends. As funded trading attracts more global participants—and as some regulators explore guardrails around evaluation programs—platform-backed transparency could become a defining advantage. If that happens, the firms positioned inside the cTrader Store could view a meaningful boost in both credibility and conversion.

For now, the update reinforces Spotware’s long-standing TradersFirst™ philosophy: building tools that cut through noise and give traders clean, consistent information about products that affect their real capital. And in an industry where trust is often the hardest currency to earn, that makes the move significant for both sides of the prop trading equation.