How Crypto is Transforming Remittances

Effective cross-border money transfers are more crucial than ever in light of the current increase in international migration because of work, business engagements, or in search for a better livelihood.

Remittances (from the Latin word remittere, which means to “send back”) allow individuals who live overseas to fulfill their financial commitments to their relatives, businesses, or communities in their home country. However, there are a number of drawbacks to sending money through traditional banks, including high transaction costs, lengthy processing periods, restricted accessibility, and a lack of transparency.

Key Takeaways

- Traditional remittances are costly, time-consuming, and not easily accessible to everyone.

- Crypto remittances reduce costs, speed up transfers, and run 24/7.

- Normal transfers become routine and guaranteed due to stablecoins.

- Real-time global payments at minimal cost are achievable due to the BTC Lightning Network.

- Fraud and regulation woes remain, but answers are emerging.

How Crypto is Solving the hardy of Remittances

Global remittances to low- and middle-income countries (LMICs) were estimated at $685 billion in 2024, outpacing foreign aid and often supporting essentials such as food, rent, and school fees. The typical cost to send $200 still sits around 6%–6.5%, with some regions paying even more. However, crypto is changing the narrative by making transfer through:

1. Reduced Transaction Fee

By eliminating intermediaries, including corresponding banks, public blockchains replace layers of correspondent banks and closed networks with direct settlement. Therefore, crypto affords the recipient more money and the sender a lower transaction fee, since the extra charges incurred from using third-party channels are no longer required.

2. quick transaction

This is one of the tradeing points of blockchain-based remittances. While it may take multiple days for conventional banks to complete a transfer, crypto ensures near-instant transactions. Transactions are clear 24 hours a day, 7 days a week, and all year round. This eradicates delays involved with physical financial institutions that operate within a particular period.

3. Increased accessibility

Crypto allows anyone with a smartphone and an internet connection to initiate transactions. This offers people living in remote areas where there is no physical financial institution to be able to receive money from the comfort of their home with no hassle.

4. Better transparency and security

Unlike traditional remittances, crypto uses Blockchain technology to record transactions on a distributed ledger. This clarifies any gray area regarding extra charges or the actual fund for both the sender and recipient. It utilizes strong cryptographic security to protect funds and reduce the risk of fraud.

Crypto Strategies for Remittance

Stablecoins for Everyday Transfers

Stablecoins such as USDC are designed to maintain a stable value, unlike . They can move across public blockchains at any time, making them ideal for quick and reliable transactions. Current data shows that stablecoins now process tens of billions of dollars in on-chain activity every day. Beyond being used for trading, they are increasingly becoming a practical tool for payments, settlements, and, most significantly, remittances. Their stability makes them well-suited for families who need predictable, everyday money transfers.

Instant BTC Payments with Lightning Network

The . With Lightning-powered apps including Strike, Paxful, and SoFi, users can send value across countries in seconds. On arrival, the funds can be converted into the local currency, reducing delays and cutting out expensive intermediaries. This system is gaining traction in regions like Africa, where specialized providers are building services that make sending and receiving BTC quick and affordable.

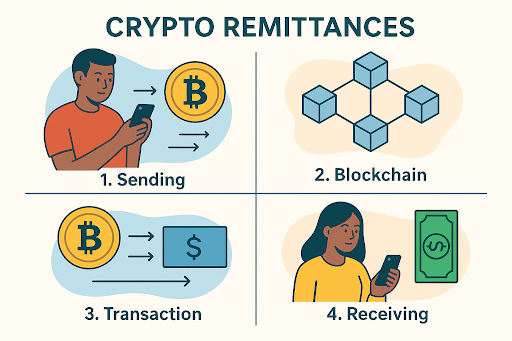

How Crypto Remittance Works

- Sender loads a wallet with USDC (or funds a Lightning app).

- Transfer moves on-chain in minutes (or seconds on Lightning), with a transparent fee.

- Recipients either keep digital dollars, spend them via a local crypto app, or cash-outs at a participating agent or bank partner.

This workflow turns cross-border payments into near-instant domestic transfers at both ends.

ahead Evidence and Scale

Following independent research, stablecoins support $20–$30 billion in daily real on-chain activity. Visa’s public dashboard displays steady, around-the-clock usage, even on weekends, which is assistful for emergencies that cannot wait until the next business day. Conversely, the World Bank keeps reporting consistently high average fees in traditional corridors. This is one reason why digital platforms with lower costs are becoming more popular.

For crypto-based transfers to work at scale, people need simple ways to switch between digital assets and local cash. Major remittance providers are now making this simple. Using USDC as an example, MoneyGram Wallet lets users add stablecoins and get cash at physical places that accept the service. This “crypto in, cash out” method is a game-changer for communities where families still rely heavily on cash for everyday needs.

Economic Impact of Crypto Remittances

The reports that remittances to LMICs increased by 3.8% to $669 billion in 2023, underscoring their significant influence of crypto transactions on the stability of the world economy.

- Lower fees translate into more money in the recipient’s pocket.

- With quick transactions, urgent needs (such as repairs or medical bills) that cannot wait days are .

- Holding a dollar-pegged stablecoin can assist preserve value until conversion in nations with high rates of inflation. (Note: local and FX regulations remain in effect.)

Challenges of Crypto Remittances

- FX and cash-out spreads: Even if the blockchain fee is small, local conversion rates can vary.

- Fraud and scams: As with any financial tool, users need basic security routine.

- Regulation and compliance: Authorities worry about consumer protection, AML/CFT, and macro risks. Global bodies (IMF/FSB) urge robust rules; some research warns crypto can be used to bypass FX controls. These concerns are pushing for clearer frameworks that legitimate providers follow.

Bottom Line

The integration of crypto for global transactions has begun to fix the limitations of traditional remittances. Transfers can clear in minutes, settle any time of day, and often cost less, while new “crypto-in/cash-out” options bridge the gap to local currency.

With stablecoins, Lightning, and stronger on/off-ramps, families can move money across borders with less friction. The transformation is already happening at scale through and openness with clear fees, strong compliance, and simple cash-out in local currency.