Weekly data: Oil and Gold: Price review for the week ahead

This preview of weekly data looks at USOIL and XAUUSD, where economic data coming up later this week are the main market drivers for the near-term outlook.

Highlights of the week: UK unemployment & Inflation, BoC,Fed,BoJ and BoE interest rate decisions

Tuesday

- British unemployment at 06:00 AM GMT for the month of July is expected to hold steady at 4.7%, while the number of claimants is expected to increase to 20,300 for the month of August.

- Canadian Inflation rate at 12:30 GMT. The anticipation here is for an increase of around 0.1%, reaching 1.8%. If these anticipations become reality, then the loonie might view some short-term gains against its pairs.

Wednesday

- British Inflation rate at 06:00 AM GMT: The figure for the month of August is expected to increase from 3.8% to 3.9%. If this is confirmed, then the pound might witness some short-term gains against other currencies.

- The Bank of Canada’s Interest rate decision at 13:45 GMT is expected to decline from 2.75% to 2.50%. If confirmed, this would be the second rate cut in 2025 and could potentially create some losses for the loonie against its pairs.

- The decision at 18:00 GMT is broadly expected to proceed with a 25 basis point cut, reaching 4.25%. According to the there is a 94% chance of a 0.25% cut, so it’s pretty certain that the rate cut will take place. However, the significant part is the subsequent press conference, where market participants will try to get some hints as to the future direction of monetary policy.

Thursday

- Bank of England interest rate decision at 11:00 AM GMT. The general expectation is that the central bank will hold its rate stable at 4%. However, in the event that we witness another rate cut, it could put some pressure on the quid in many of its pairs, especially against the US dollar. In the unlikely event of a hike, it might give some support to the British pound in the later thanmath of the release.

Friday

- Bank of Japan Interest rate decision at 03:00 AM GMT. The market consensus is that the rates will remain static at 0.50% while in the unlikely scenario of any shift away from this figure will most certainly create volatility on the yen pairs.

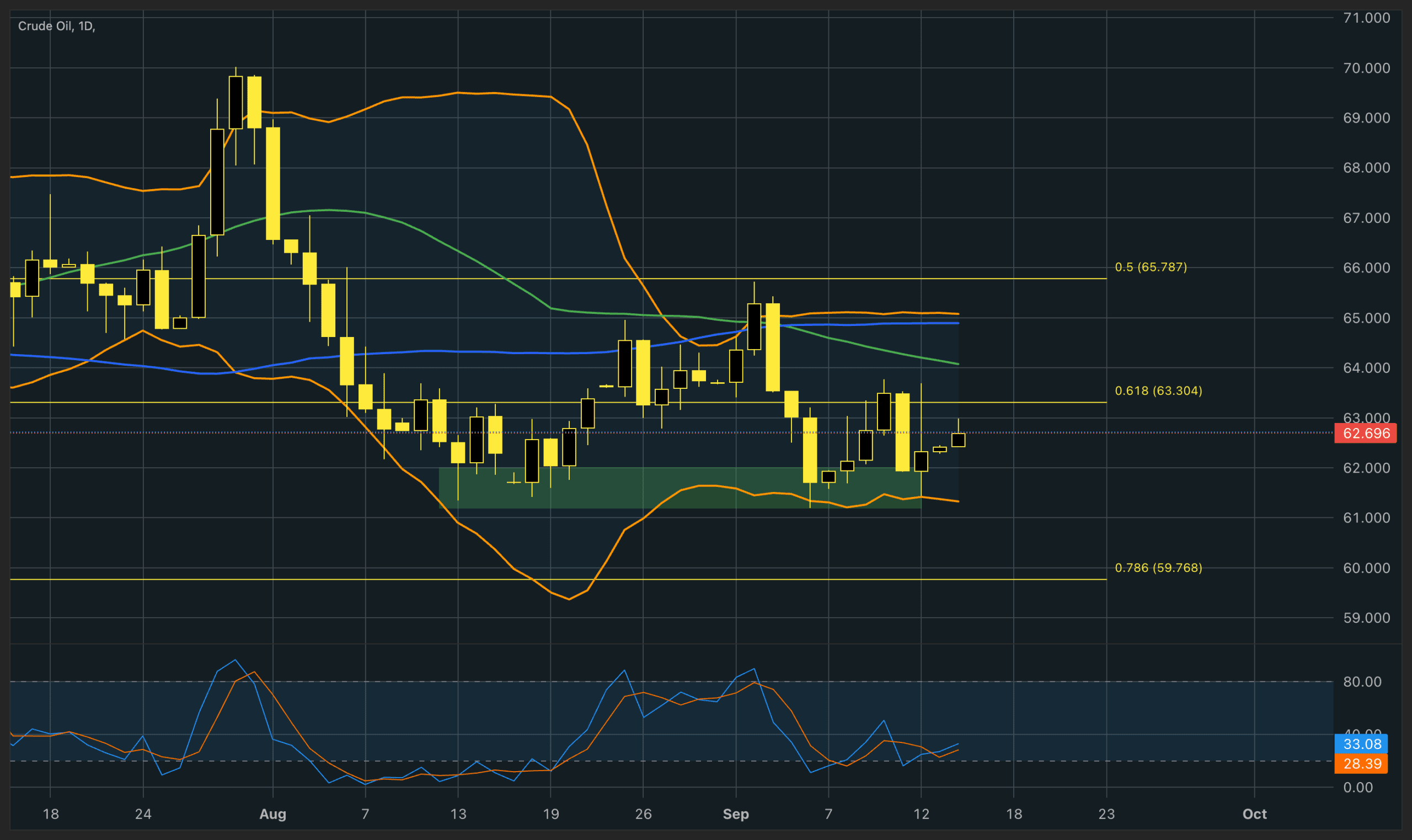

USOIL, daily

Oil prices extended last week’s gains as traders weighed rising geopolitical risks against forecasts of a surplus later this year. US President Donald Trump renewed pressure on Europe to cut Russian oil purchases and floated sanctions if NATO allies comply, while the US is also pushing G7 partners to impose tariffs on China and India for purchaseing Russian crude.

Market sentiment remains shaped by escalating tensions, including Israeli strikes in Qatar and Ukrainian drone attacks on Russian refineries. Analysts warn that sanctions and infrastructure damage could push prices higher in the short term, but expectations of a supply overhang and OPEC+ production increases keep downside risks in focus.

On the technical side, the has retested the major support area of $62 and has since rebounded to the upside. The Stochastic oscillator is back in neutral levels for the time being, hinting that the recent bullish correction could project into the near short term while the Bollinger bands are sufficiently expanded, showing that there is volatility to support any short-term spikes.

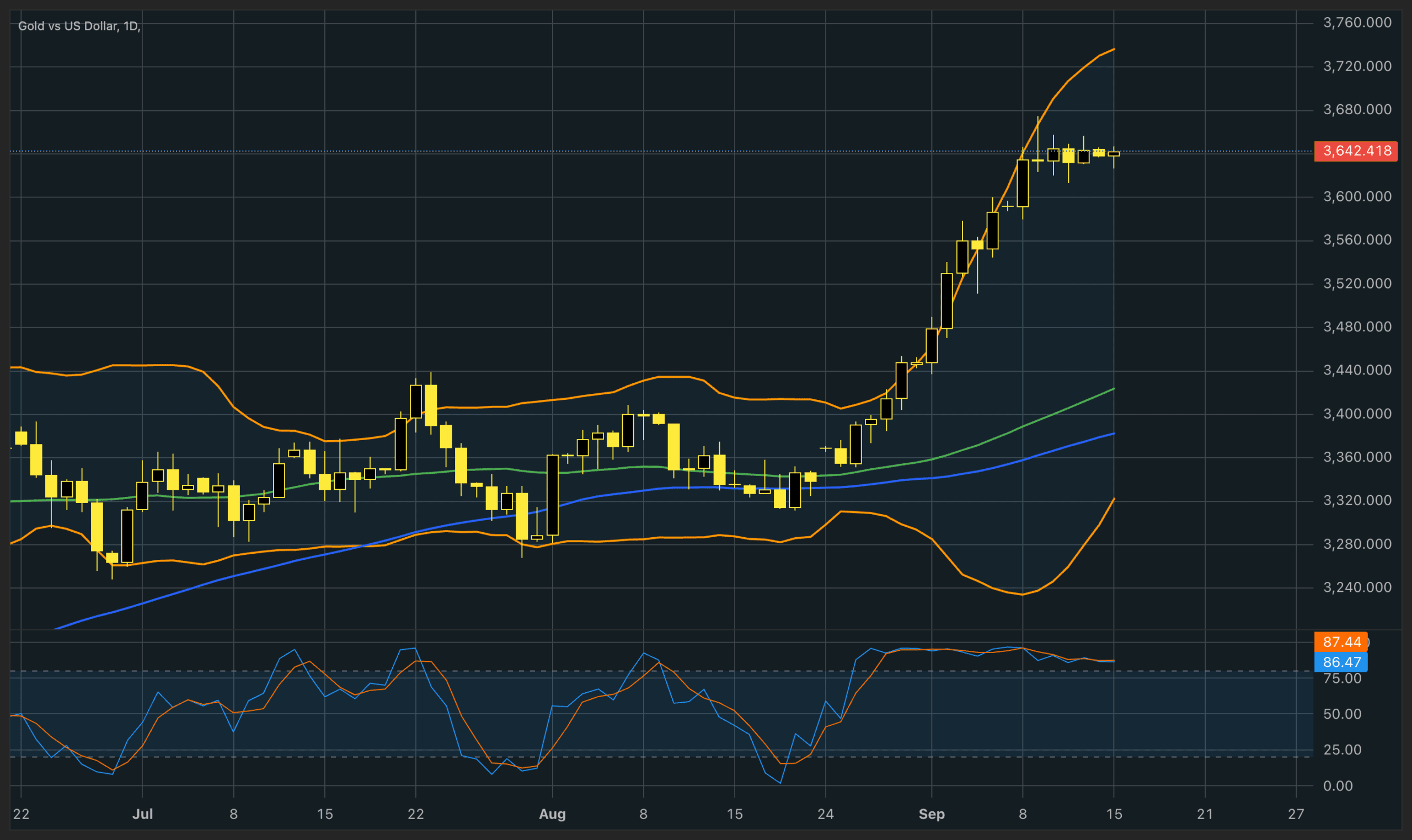

Gold-dollar, daily

Gold climbed near record levels in Asian trading as fragile US labor data reinforced expectations of a Federal Reserve rate cut this week. Markets anticipate a quarter-point move on Wednesday and further easing into 2026, supporting demand for the non-yielding asset. Ongoing US-China trade talks add another layer of risk sentiment, with any sign of easing tensions potentially weighing on gold’s secure-haven appeal.

From a technical point of view, the price of gold viewms to have reached a plateau, holding near its all-time highs. This is a rather dangerous point in time to trade this instrument because the risks are quite high from a technical analysis perspective. Price is near the all-time high, and the Stochastic oscillator has been in the extreme overbought levels for more than 3 consecutive weeks, hinting that a bearish correction might be imminent. On the other hand, the moving averages are validating the overall bullish trend, and the Bollinger bands are quite expanded, showing that volatility is there to support any major moves in the upcoming sessions.

Disclaimer: The opinions in this article are personal to the writer and do not reflect those of or Finance Feeds.

Disclaimer: This sponsored market analysis is provided for informational purposes only. We have not independently verified its content and do not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you viewk independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our.