Meso Co-Founders Bring PayPal, Venmo Experience to MoonPay

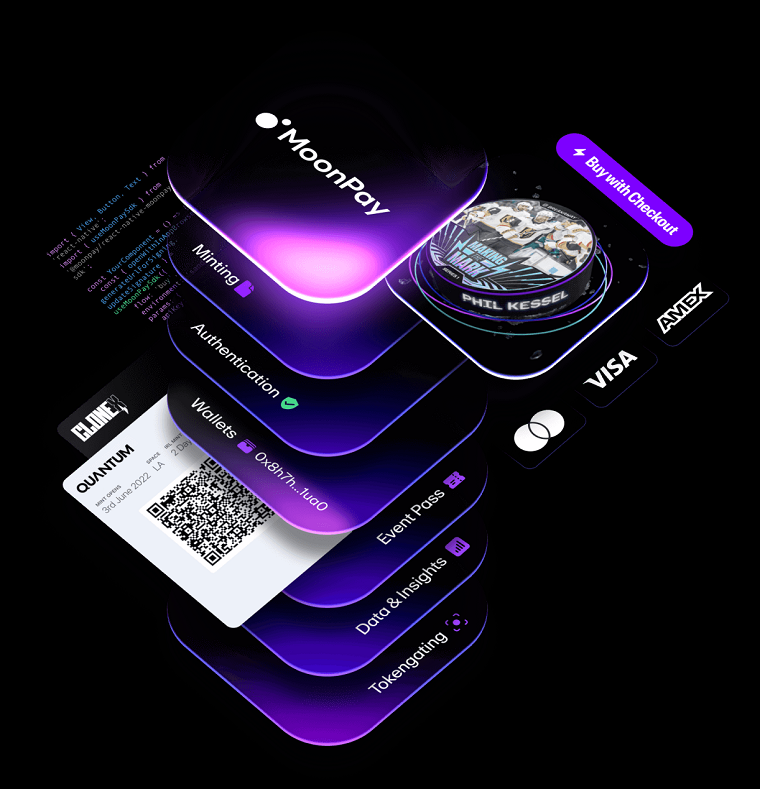

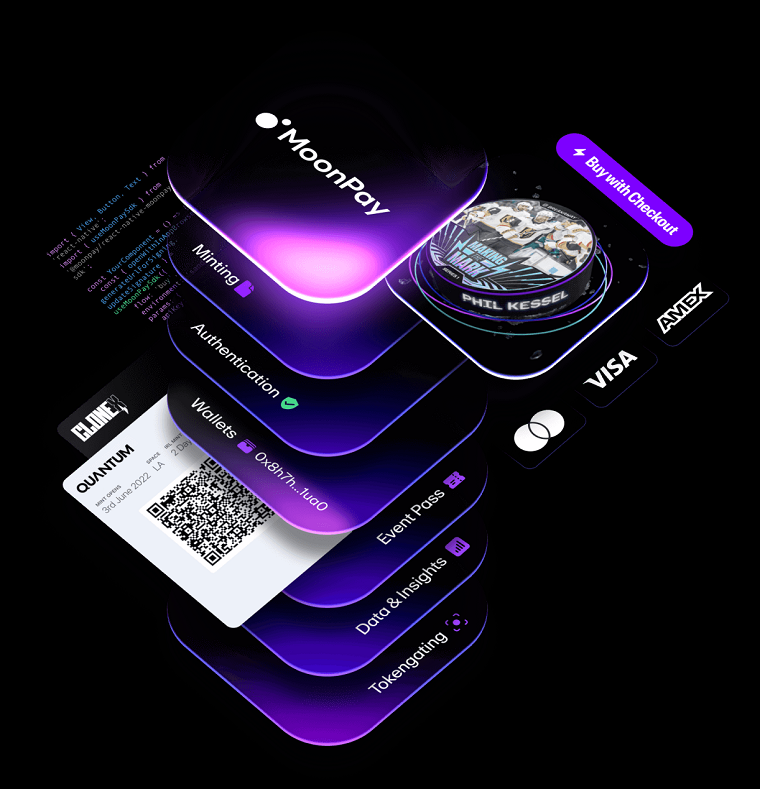

What MoonPay Announced

“We’ve built trusted ramps that brought millions into crypto, now we’re building the global network that will move money across every form and in every market,” said Ivan Soto-Wright, MoonPay’s co-founder and CEO.

Investor Takeaway

Who Are the Meso Founders?

Aghareza and Mills bring deep experience from fintech and payments. Aghareza was part of the original engineering team at Braintree, later acquired by PayPal, where he went on to lead engineering before co-founding Meso in 2022. Mills previously served as head of developer experience at Braintree and head of product at Venmo. Their track records at PayPal-owned platforms make them valuable hires as MoonPay scales into mainstream finance.

The integration of Meso follows a string of MoonPay acquisitions this year, including Solana-based payments processor Helio, stablecoin infrastructure provider Iron, and onchain payment tool Decent.xyz. Together, these moves point to MoonPay’s strategy of assembling key building blocks for a one-stop payments ecosystem.

Why This Matters for MoonPay

Founded in 2019, MoonPay was valued at $3.4 billion later than raising $555 million in a Series A round in 2021. However, it faced headwinds in June 2024, when it laid off 10% of staff due to high costs and fragile margins. The company has since sought to rebound by expanding its product suite and positioning itself as a bridge between traditional finance and digital assets.

The addition of ex-PayPal executives strengthens MoonPay’s ability to compete with both crypto-native firms and established fintechs like Stripe, PayPal, and Square. By layering stablecoins and blockchain payments into global banking rails, MoonPay aims to become the infrastructure provider of choice for institutions viewking compliant, cross-border answers.

Investor Takeaway

What’s Next for the Payments Race

MoonPay’s acquisitions indicate a bid to dominate the emerging landscape of regulated crypto payments. With U.S. and European regulatory frameworks now taking shape, firms capable of offering compliance-first answers across multiple jurisdictions stand to capture institutional demand.

For now, MoonPay’s focus is on integrating Meso’s technology and leadership to expand payment flows beyond on-ramps. Whether it can deliver scale and profitability in a competitive sector will determine if MoonPay can match its $3.4 billion valuation with sustained revenue growth in the years ahead.