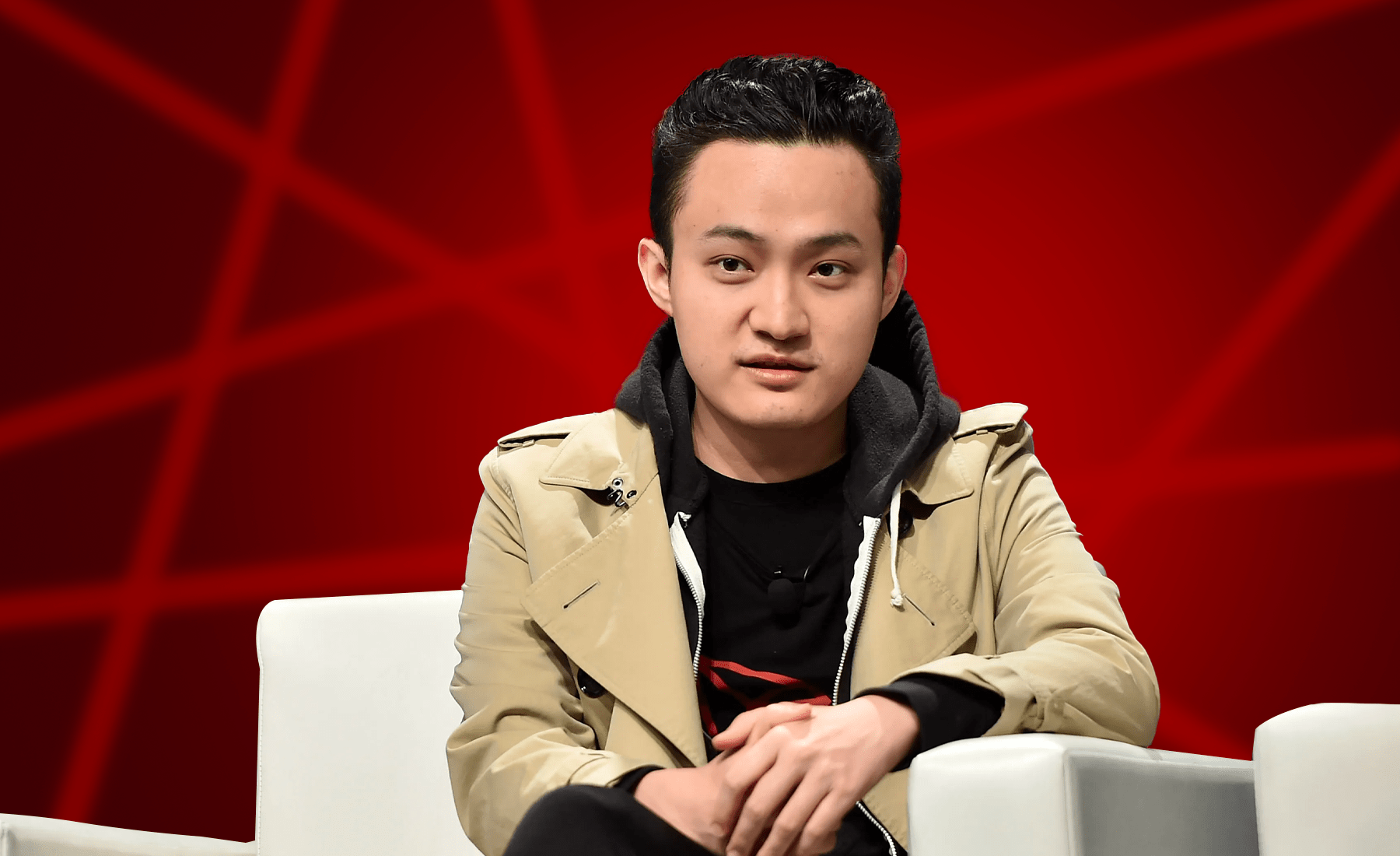

The $100 Million Standoff: Justin Sun Remains on WLFI Blacklist

Despite his status as the single largest individual investor in the project, Tron founder Justin Sun remains on the “restricted” list for World Liberty Financial (WLFI), the high-profile DeFi platform backed by the Trump family. As of late December 2025, Sun’s massive holdings—estimated to include 540 million unlocked tokens and 2.4 billion vested tokens—remain effectively frozen. The “blacklisting” occurred in September 2025 following an on-chain alert from Arkham Intelligence, which flagged a $9 million transfer of WLFI from Sun’s wallet to the HTX platform. This move triggered immediate concerns of a “liquidity dump” within the WLFI governance team, leading to a decisive and controversial freeze that Sun has characterized as “unreasonable.” Sun invested $75 million into the project during its ahead rounds, making this one of the most significant disputes in DeFi history.

Governance Testing and the “Experimental” Defense

The blacklisting of Justin Sun has become a landmark case study in the tension between decentralized ideals and centralized governance controls. World Liberty Financial defended the move as a necessary “protective measure” to prevent market manipulation and maintain investor confidence during the token’s critical price discovery phase. Sun, in a series of public rebuttals, has maintained that the $9 million transfer was merely a “routine platform deposit test” and an “address dispersion” exercise with no intent to trade. However, on-chain researchers have pointed to the fact that the WLFI token price dropped over 40% during the period of Sun’s active transfers, adding layers of suspicion to his narrative. This standoff has forced a larger debate about the “guardian blacklist” function in WLFI’s smart contracts, which was implemented just a week before the token became transferable.

The Path to Thaw: Regulatory Hurdles and Reputation Risks

The ongoing freeze is complicated by the broader political and legal landscape surrounding both Sun and the WLFI project. Reports suggest that the WLFI team, which aims to discourage whales from cashing out on the open market, is exercising extreme caution to avoid any “regulatory contamination” that could arise from close financial ties to Sun while his SEC case remains active. While Sun has reportedly offered to “market purchase” even more WLFI to demonstrate his long-term commitment, the tokens remain locked in his primary addresses. As 2026 approaches, the reanswer of Sun’s blacklist status is viewn as the ultimate test for World Liberty Financial’s credibility. The project must decide if it will honor the “inviolable” nature of on-chain property rights or continue to act as a centralized gatekeeper to ensure the token’s market stability.