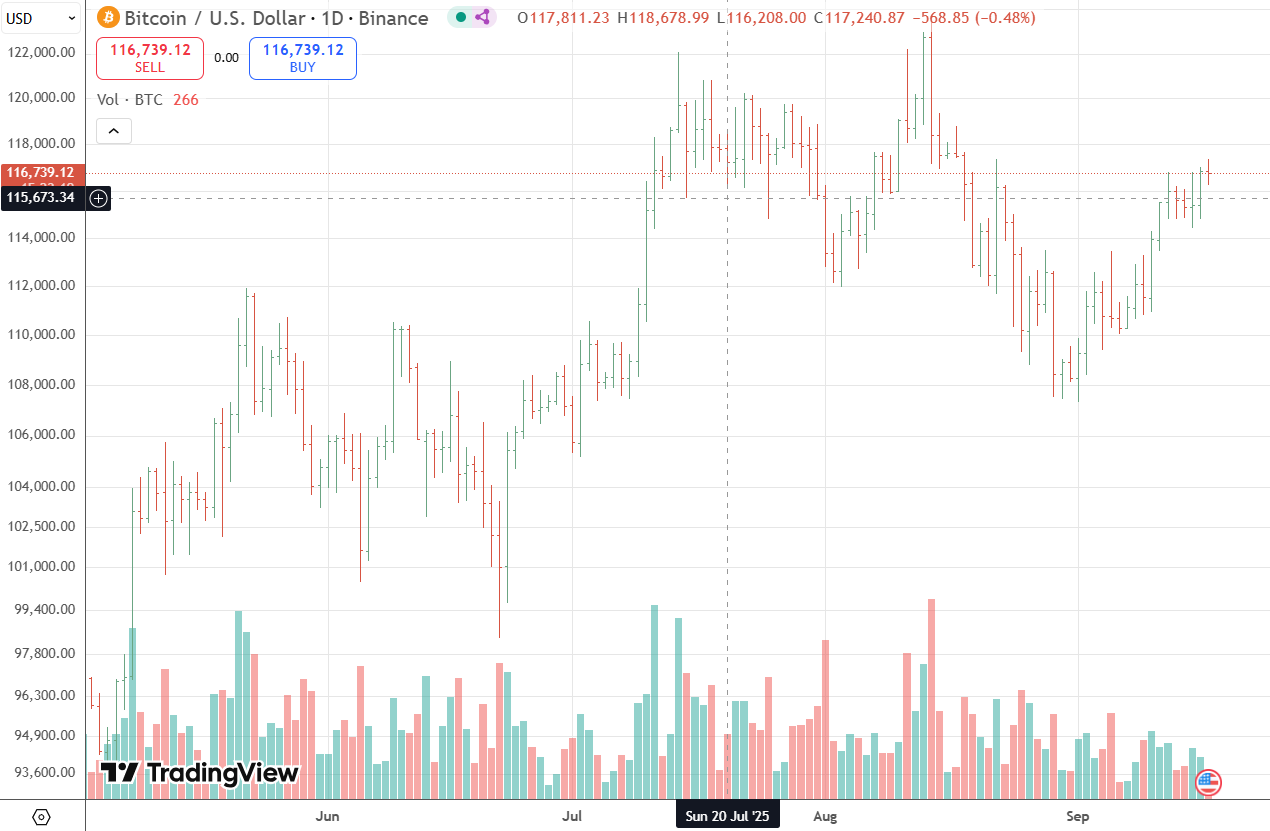

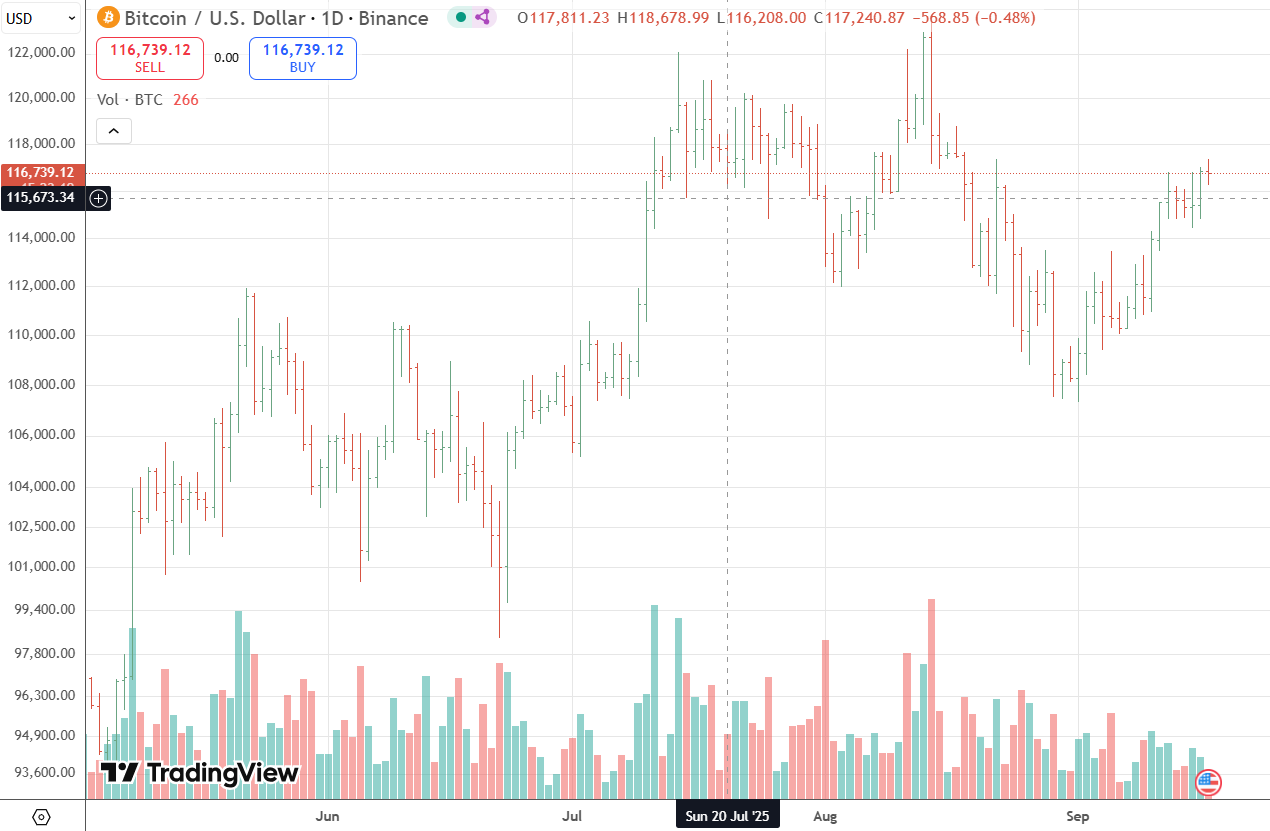

BTC Holds Above $116,000 as Technical Indicators Signal Continued Strength

BTC traded near $116,800 on Tuesday, holding firm above the $116,000 mark as technical indicators suggest continued bullish sentiment in the market. The world’s largest cryptocurrency registered an intraday range between $114,864 and $117,303, with traders closely watching resistance levels that could determine its next move.

Short-term momentum remains positive, with BTC trading above all key moving averages, including the 10, 20, 50, 100, and 200-day averages. Analysts point out that this alignment typically reflects sustained strength in the market. The Relative Strength Index (RSI) is hovering between 58 and 65, without entering overbought territory. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator continues to show a bullish trend.

The immediate resistance sits around $117,500 to $118,000, a zone that has repeatedly capped upward moves in recent sessions. Should BTC break through this threshold, analysts expect the next upside target around $120,000. However, traders also note signs of short-term overbought conditions, with the Stochastic indicator flagging potential for pullbacks.

On the downside, support levels are clustered between $114,000 and $115,000. A sustained break below this range could open the way for a deeper correction toward $112,000. Current volatility remains moderate, with the Average Directional Index (ADX) showing only a modestly strong trend, while the Average True Range (ATR) points to relatively controlled price swings compared with previous weeks.

Overall, BTC’s technical outlook suggests a bullish bias in the medium term, though the market may experience short-term consolidation before any decisive move higher. Traders will be watching closely to view if BTC can clear resistance at $118,000 or if it falls back toward its key support levels.

ETH held steady near $4,505 on Tuesday, consolidating later than recent gains as that could determine the cryptocurrency’s next move. The world’s second-largest within an intraday range of $4,429 to $4,552, reflecting a period of relative calm later than earlier volatility.

Technical indicators show a cautiously bullish outlook, though ETH faces resistance that may limit near-term upside momentum. On the daily chart, ETH is hovering just below its 100-hour simple moving average, a barrier that has capped recent rallies. The broader set of moving averages suggests underlying strength, with shorter-term averages still supporting upward movement.

ETH’s immediate resistance sits between $4,585 and $4,650, a zone reinforced by both the 100-hour moving average and prior peaks. Analysts suggest that a decisive break above this band could open the path toward $4,700 and potentially the psychological $5,000 mark. However, momentum oscillators point to possible hesitation. The Relative Strength Index (RSI) has retreated from overbought conditions, signaling that purchaseing pressure may be cooling.

On the downside, ETH has established firm support in the $4,360 to $4,400 range. A drop below this level could expose the asset to further declines toward $4,200 to $4,300. Volatility remains moderate, with market participants waiting for a clearer breakout or breakdown before committing to larger positions.

Overall, ETH’s technical profile indicates a neutral-to-bullish stance, with potential upside if resistance levels are cleared. Until then, traders are likely to view continued consolidation near the $4,500 pivot zone, with support and resistance levels providing the key markers for ETH’s next significant move.