Kalshi’s Brazil Interest Is Really About Law, Not Sports Betting

Why Is Kalshi Looking Beyond the United States?

Kalshi’s interest in Brazil is not a sudden land grab tied to a newly regulated betting market. It is the product of a longer regulatory story—one shaped by unresolved legal theory in the United States and growing resistance from state authorities. As prediction markets gain scale, Kalshi is searching for a jurisdiction where its model can take root before legal boundaries fully solidify.

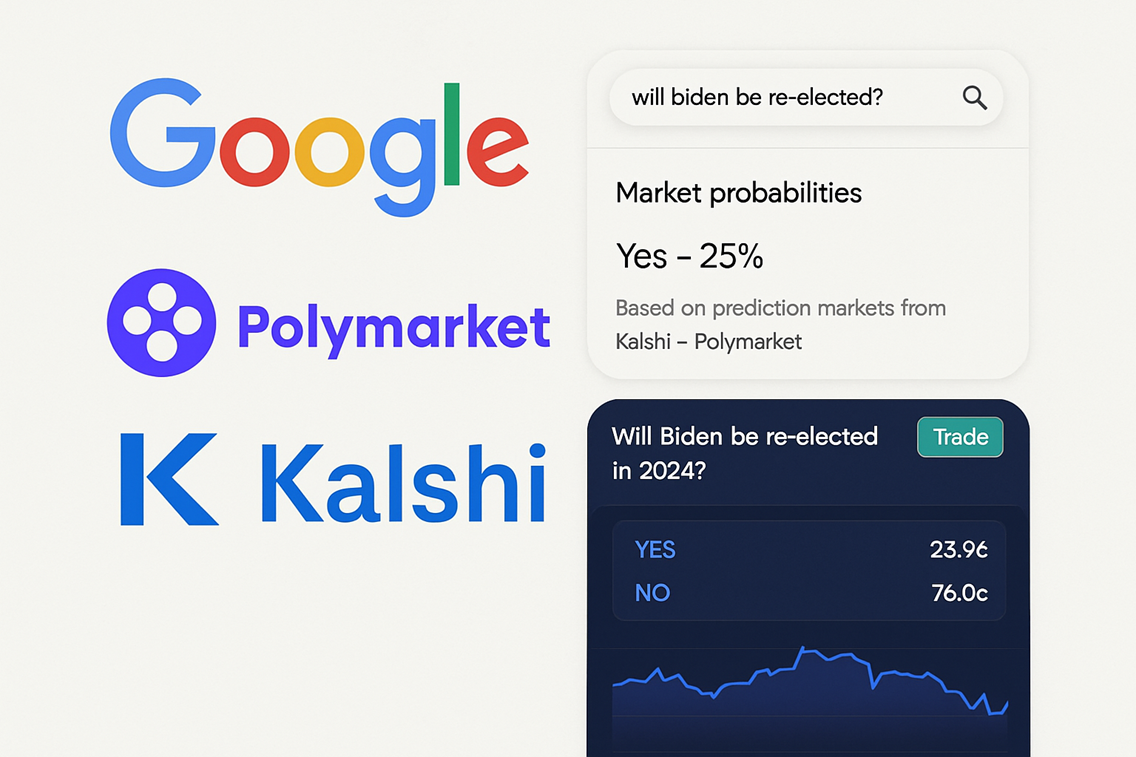

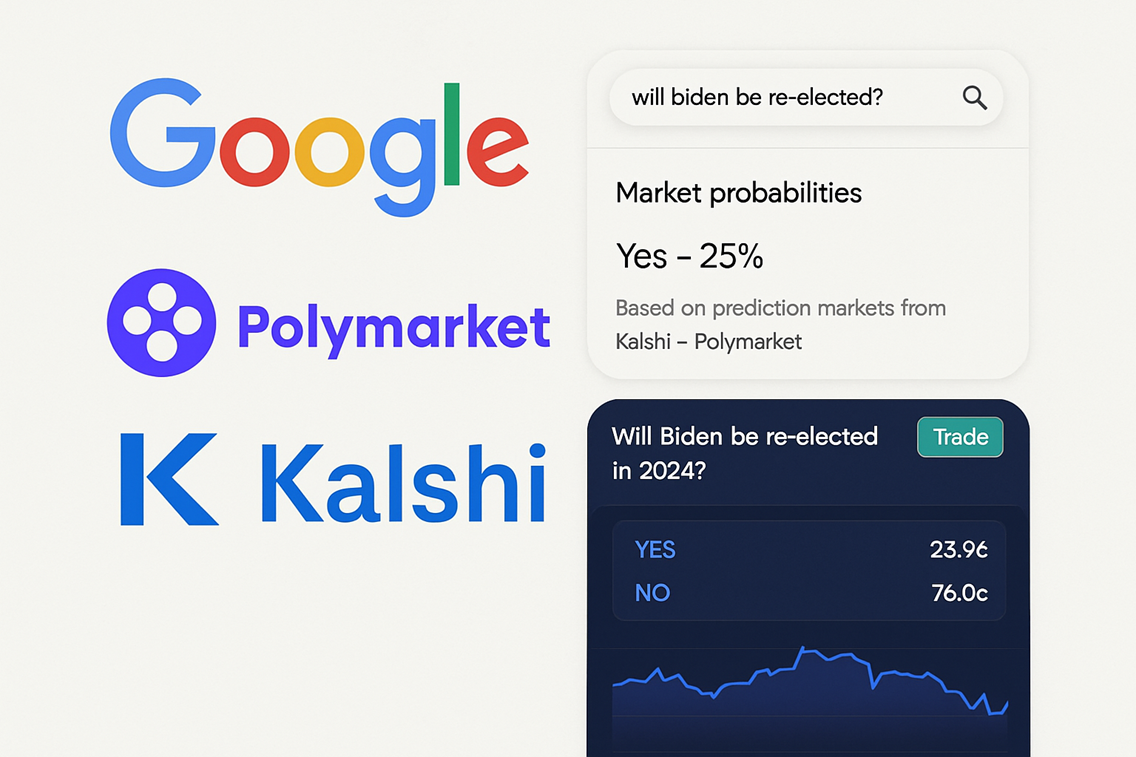

Founded in 2018, Kalshi was built around a narrow interpretation of US commodities law. Its founders argued that event-based contracts—even those linked to non-financial outcomes—could qualify as regulated derivatives under the Commodity platform Act if structured properly. That argument gained official backing in 2020, when the approved Kalshi as a designated contract market, the first prediction market to receive federal oversight.

The approval settled one question but opened another. Federal commodities law governs derivatives, while gambling oversight in the US sits largely with individual states. As long as Kalshi focused on elections, inflation data, or macroeconomic indicators, the conflict stayed abstract. The tension sharpened once sports-linked contracts entered the picture.

Investor Takeaway

How Did Sports Contracts Trigger Legal Resistance?

Sports betting occupies a sensitive legal space in the United States. later than the repeal of PASPA in 2018, states spent years building licensing, tax, and consumer-protection frameworks. Kalshi’s sports contracts challenged that structure by routing wagers through federally regulated markets rather than state gaming systems.

Pushback followed. State regulators in Nevada, Massachusetts, and Connecticut moved against Kalshi’s sports offerings, arguing that prediction markets tied to sports outcomes amount to unlicensed gambling. The issue escalated when Nevada Attorney General Aaron Ford filed a court brief on behalf of 38 states and Washington, DC, warning that could sidestep state authority entirely.

The dispute goes beyond consumer protection. At its core is a jurisdictional fight over whether federal market oversight can override state control of sports wagering. That question remains unresolved, and its outcome could define the future of prediction markets in the US.

Why Is Brazil diverse?

Brazil’s betting market developed along a very diverse path. Fixed-odds sports betting was legalized in 2018, but meaningful enforcement arrived years later. Only in 2023 and 2024 did the federal government begin putting structure around licensing, taxation, and oversight for an industry that had long operated offshore.

Unlike the United States, Brazil does not divide gambling authority across states. Regulation is centralized, and many definitions are still being written. That creates space for new categories to be defined before entrenched interests harden the rules. For Kalshi, Brazil offers a chance to argue that prediction markets are distinct from sportsbooks at the outset, rather than trying to carve out exceptions later.

In this sense, Brazil functions less as a growth market and more as a regulatory testing ground. The question is whether prediction markets can be folded into a national betting framework without triggering the identical jurisdictional clash viewn in the US.

Investor Takeaway

What Role Does Kalshi’s Leadership and Capital Play?

Kalshi’s strategy in Brazil is reinforced by its leadership. Co-founder Luana Lopes Lara, a Brazilian national, brings local knowledge and familiarity with the country’s political and business environment. Her framing of Brazil as a “frontier” mirrors Kalshi’s earlier approach in the US: engage regulators ahead, set definitions, and defend them if challenged.

The company’s financial position also matters. Kalshi’s valuation, reported to be around $11 in 2025, gives it the resources to pursue regulatory battles across jurisdictions. That scale, however, increases scrutiny. As prediction markets draw more attention, they also attract competitors and regulators.

Traditional sportsbook operators are watching closely. Firms such as DraftKings, FanDuel, and Fanatics have explored prediction-style mechanics, not out of legal alignment with Kalshi, but because a market-driven pricing model threatens the bookmaker’s central role. Crypto-native platforms view similar overlap, especially in regions like Brazil where are already high.

What Risks Does a Brazil Launch Carry?

Brazilian regulators have a history of tolerating gray areas before acting decisively once boundaries are crossed. If prediction markets are viewed as bypassing licensing fees, taxes, or consumer secureguards applied to sportsbooks, political pressure could rise rapidly. Unlike the US court system, Brazil’s executive regulators have wider discretion to intervene.

That makes a Brazilian rollout symbolic as much as commercial. Success would support Kalshi’s argument that prediction markets can operate as a distinct financial product on a global basis. Failure would suggest the model depends heavily on the specific legal amlargeuities that allowed it to emerge in the US.

Brazil, then, is more than Kalshi’s next destination. It is a test of whether prediction markets can travel—or whether they remain tied to a uniquely American regulatory gap.