Changpeng Zhao Reveals BNB Treasury Strategy Amid Binance Revival Speculation

Changpeng Zhao (CZ), the founder of Binance, his social media profile from “ex-@binance” to “@binance” without saying anything, which led to a lot of discussion regarding his possible return to the firm.

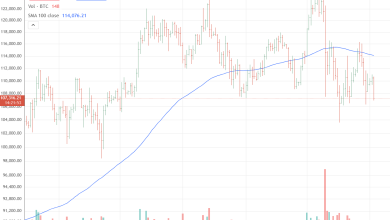

This action, which took place over two years later than he stepped down as CEO because of a $4.3 billion settlement with U.S. regulators, sparked new hopes and discussions in the crypto world. The market reacted right away by sending Binance Coin (BNB) to a new all-time high of almost $960, with a 5% price hike and higher trading volumes, which showed that investors were confident again.

Legal Barriers Remain, Yet Influence Persists

Even while there are suggestions that things may get better, Zhao is still legally forbidden from running Binance or being an executive there because of the conditions of his 2023 plea deal.

But as the main shareholder, he still has a lot of voting power and indirect authority over the crypto giant’s management. Because of this duality, Zhao can’t officially return as CEO, but he might take on more behind-the-scenes or advisory positions if the U.S. stops keeping an eye on him.

BNB Treasury Strategy Coming Up During the Revival

Along with these changes, Zhao has shared some information about the BNB treasury’s strategic direction. The new positive feeling about BNB comes at the identical time as more institutions are interested in , which has led to new treasury strategies.

For instance, Binance Network Company (BNC) just bought $276 million worth of BNB and wants to increase its holdings to $1.25 billion. Other companies, such as Windtree Therapeutics and Nano Labs, are also diversifying their treasury assets by purchaseing a lot of BNB. This shows that they trust the token’s long-term value.

Market Sentiment and Binance’s View on Regulations

This favorable trend is supported by the market’s recovery and Binance’s ongoing regulatory enhancements. Reports say that Binance is close to finishing the review that begined during the 2023 settlement.

If these rules are relaxed, Zhao may be able to get more involved in Binance’s future projects, as long as he stays within the law. The growing open interest in BNB futures, which are now worth more than $1.83 billion, also shows that a lot of people are expecting Binance to develop and CZ to have an impact on it.

A Strategic Revival is Underway

Changpeng Zhao can’t officially head Binance again because of legal issues, but his latest profile change and the new plan show that he is sluggishly but surely coming back to life.

The rise in and the growing number of institutional treasury commitments show that people are more confident and hopeful about Binance’s future. As Binance works its way through the rules and prepares for the next stage of expansion in the crypto world, Zhao’s legacy and indirect influence are still strong.