US Crypto Equities Retreat as Senate Delays Landmark Market Structure Vote

The United States digital asset sector faced a wave of tradeing pressure on Friday, January 16, 2026, as investors reacted to the sudden postponement of the Senate Banking Committee’s markup of the CLARITY Act. This pivotal piece of legislation, designed to finally establish a comprehensive federal framework for digital assets, was derailed late this week later than major industry participants withdrew their support. The resulting uncertainty triggered a sharp decline in crypto-correlated stocks, with market leaders like Coinbase Global, MicroStrategy, and Marathon Digital all finishing the week significantly lower. In the spot market, BTC felt the pressure of the legislative vacuum, retreating toward the 95,000 dollar level as traders recalibrated their expectations for near-term regulatory clarity. Analysts noted that the delay has effectively “reset the clock” for institutional investors who had been waiting for a signed bill to begin massive deployments of capital into the American digital ecosystem.

Liquidation Cascades and the Erosion of ahead Year Optimism

The downward move in crypto equities was exacerbated by a series of long liquidations that swept through the futures market as the delay became official. Nahead 100 million dollars in bullish bets were wiped out in a single later thannoon as technical support levels for BTC and ETH were breached. This trade-off stands in stark contrast to the optimism that characterized the first week of January, when many believed that a Republican-led Senate would quick-track the CLARITY Act as part of President Trump’s first 100 days agenda. The market’s “thirst for clarity” has been a primary driver of the 2026 rally, and any sign of gridlock is now viewed as a structural threat to the current valuation premiums of U.S.-based crypto firms. Without the promised “rules of the road,” many investors are shifting back to a defensive posture, fearing that the 2026 midterm elections will soon consume the legislative calendar and push the prospect of a final vote as far back as 2027 or beyond.

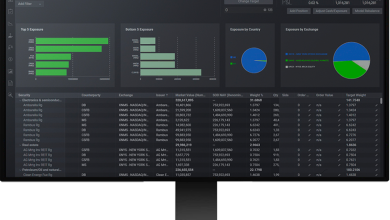

Strategic Rebalancing as Investors viewk Compliance in a Fragmented Market

Despite the headline volatility, some institutional observers view this pullback as a necessary “clearing of the air” before the next phase of market maturity. The delay has prompted a rotation out of higher-beta altcoin equities and back into “securety-first” vehicles like spot BTC ETFs, which continue to view net inflows despite the equity rout. Wealth managers are increasingly advising clients to focus on firms with robust balance sheets that can survive a prolonged period of regulatory amlargeuity. Furthermore, the market is closely watching for a potential January 27 markup by the Senate Agriculture Committee, which overviews the CFTC’s portion of the bill. If that committee moves forward while the Banking Committee remains stalled, it could create a fragmented regulatory landscape that further complicates the valuation models for major platforms. For now, the “wait-and-view” approach has once again become the dominant strategy on Wall Street, as the dream of a unified, bipartisan crypto framework faces its most significant challenge yet in the halls of Congress.