KuCoin Spot Share Jumps 5.83% in TokenInsight 2025 Ranking

is claiming one of the strongest growth stories among centralized platforms in 2025, with TokenInsight’s placing the platform among the top three platforms globally by market share growth.

The ranking matters because 2025 wasn’t a clean expansion year for most CEXs. Trading activity stayed concentrated, competition intensified at the top end, and platform tokens spent much of the year under pressure. KuCoin’s performance stands out mainly because it appears to have gained share while others fought to defend it.

What does TokenInsight’s report actually say?

TokenInsight’s 2025 Cryptocurrency platform Annual Report measured performance across leading centralized platforms and highlighted KuCoin as one of the top three platforms by year-on-year market share growth.

While the report frames the result as “sustained positive growth,” the takeaway is more practical: in a year where market share shifted unevenly and concentration across major players continued to change, KuCoin managed to move in the right direction.

KuCoin attributes that to its product structure, breadth of listed assets, and its global user base. That explanation tracks with how market share typically moves in spot-heavy environments: platforms that keep listing demand where retail trades, and maintain enough liquidity to keep spreads competitive, tend to keep attracting flow.

Why spot market share is the real headline

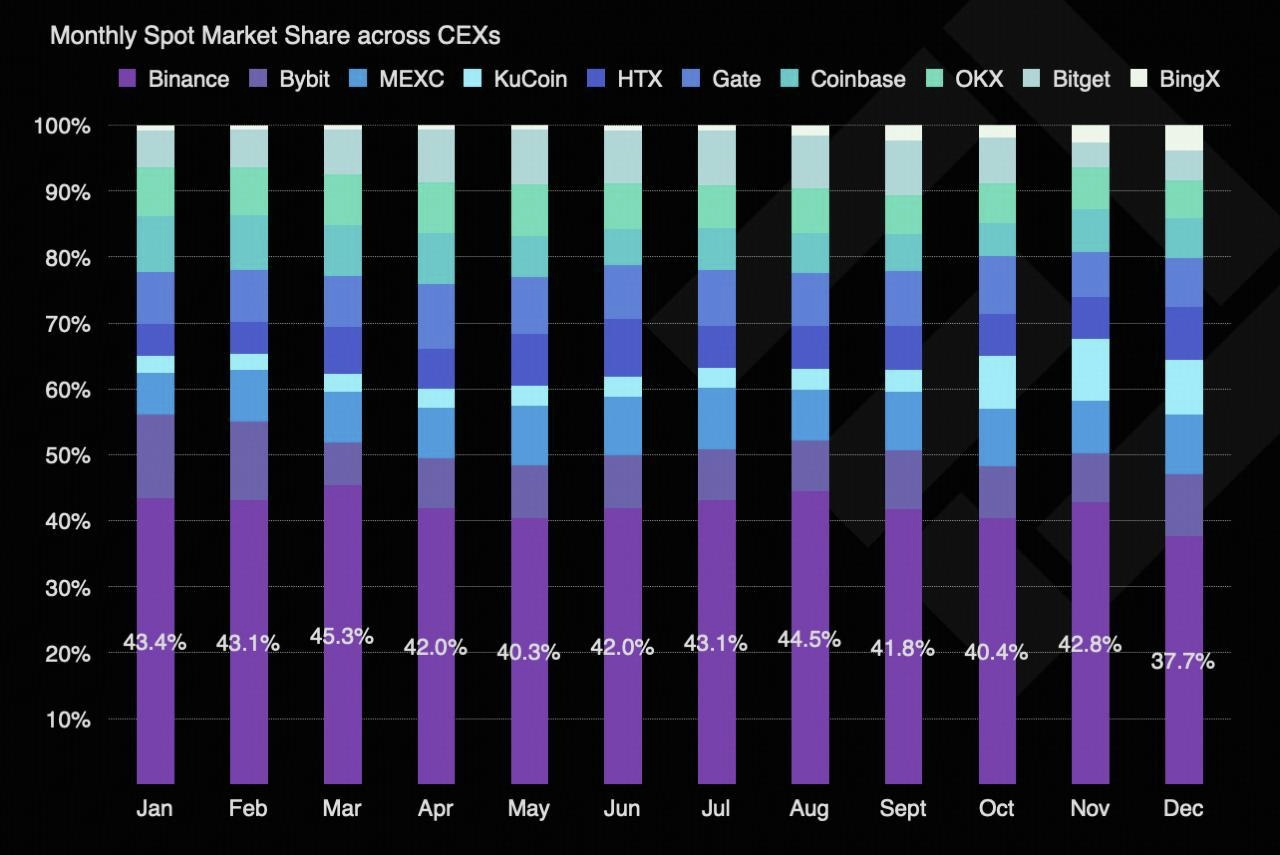

The clearest metric in the report is spot market share gain. TokenInsight data shows KuCoin added 5.83% in net spot market share between January and December 2025, ranking first among major centralized platforms.

That’s a meaningful jump in a mature platform market. Spot share doesn’t move easily unless one of two things happens: traders actively migrate, or an platform becomes the default venue for a certain kind of activity—new listings, regional access, or specific liquidity pockets.

KuCoin’s explanation is familiar: continued investment in spot asset coverage, liquidity optimization, and broader global market reach. For traders, those translate into a simple checklist: more things to trade, better fills, fewer reasons to go elsewhere.

Investor Takeaway

KCS outperformed while other platform tokens struggled

The other notable datapoint is KCS, KuCoin’s native token. TokenInsight ranked it among the top three platform tokens by annual price appreciation in 2025, behind only OKB and BNB.

That’s not a trivial result. platform tokens often behave like a proxy for confidence in the platform’s business model—trading activity, revenue expectations, and perceived durability. In a year when many platform tokens were fragile or flat, KCS posting positive performance is a signal that KuCoin managed to avoid the worst of the sector’s “token fatigue.”

KuCoin described KCS as “counter-cyclical,” meaning it gained even as broader platform token sentiment stayed cautious. That can happen when the market believes the underlying platform is still growing, or when token mechanics (like burn models or utility demand) remain credible enough to support price action.

What this tells you about platform competition going into 2026

TokenInsight’s report frames 2025 as a year where diverseiation accelerated. That reads as a polite way of saying: the platform sector is no longer growing evenly, and market share is increasingly rewarded to platforms that can execute consistently.

In practice, the market is splitting into two camps. The largest platforms fight for dominance through scale, institutional relationships, and regulatory positioning. Mid-to-large platforms compete by capturing specific user segments—altcoin liquidity, regional demand, and quick-moving spot markets.

KuCoin’s numbers suggest it played the second game well in 2025, especially in spot. If it can maintain that growth while tightening compliance and security—two areas platforms are constantly judged on—it enters 2026 with leverage that doesn’t depend on a single market cycle.

Investor Takeaway

said it will continue prioritizing security, compliance, and user experience as it pushes sustainable ecosystem growth. For traders and crypto investors, the more immediate signal is this: spot liquidity and market share trends are shifting, and KuCoin is one of the few platforms TokenInsight flagged as gaining ground in a year where most platforms were fighting for the identical flow.