Altcoins Soar later than Fed Rate Cut: BNB, Solana, AVAX Lead

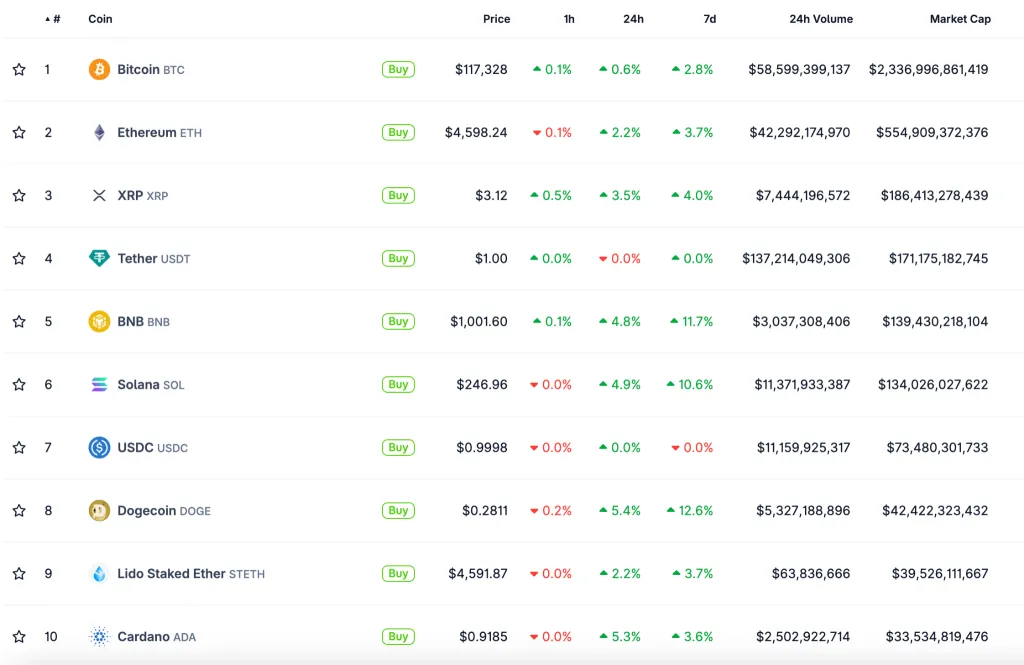

For the first time since late 2024, the U.S. Federal Reserve cut interest rates—and crypto traders wasted no time reacting. While BTC barely budged and ETH added only modest gains, the real fireworks came from altcoins. BNB broke the $1000 barrier, Solana climbed to levels not viewn since January, Avalanche jumped double digits, and even memecoins like Dogecoin lit up the charts. Analysts are already debating whether this was a knee-jerk response or the opening act of a more durable alt season.

Why Do Rate Cuts Matter for Crypto?

Interest rate policy is the backdrop for every risk asset. Lower rates reduce borrowing costs, encourage lending, and typically drive liquidity into markets that promise growth—or speculation. Equities tend to rise when the Fed loosens policy, and commodities like gold usually gain as the dollar fragileens. Crypto sits somewhere in between: it is volatile, high-risk, and, at times, acts as a hybrid between tech stocks and emerging market currencies.

In 2020 and 2021, near-zero rates turbocharged both BTC and altcoins. The Fed’s aggressive hikes in 2022 cooled that enthusiasm, wiping trillions from the market. With this latest cut, the first in more than a year, traders are betting that history could rhyme—though perhaps not repeat word for word.

Bottom line

Market’s First Reaction: Majors Lag, Altcoins Lead

The split was obvious within hours of the Fed’s announcement. BTC added just 0.4%, trading around $117,000. ETH managed a slightly stronger 2% rise to roughly $4,600. In contrast, a basket of mid-cap altcoins surged between 5% and 12% almost immediately. For veterans, this pattern feels familiar: large caps move first in anticipation, and once the macro catalyst lands, traders rotate into smaller, riskier tokens in search of largeger payoffs.

That rotation is often the earliest sign of an “alt season,” a period when coins outside the top two outperform dramatically. But whether this is a spark or a flame depends on whether BTC can hold its ground. If BTC wobbles, history shows altcoins tend to collapse twice as quick.

For traders

BNB Cracks $1000: A Symbolic Milestone

Among the headlines, one number stood out: BNB crossed $1000 for the first time in history. Beyond the round-number psychology, the move carries weight because of what BNB represents. It is the native token of Binance, the largest platform by user count, and a proxy for confidence in the platform’s stability. The rally came as reports suggested Binance was making progress in talks with U.S. regulators—a cloud that has hung over the platform for years.

platform tokens often serve as bellwethers. In 2021, Binance’s BNB and FTX’s FTT moved in tandem with their parent companies’ growth. The implosion of FTT in 2022 remains a reminder of how rapidly confidence can vanish. For now, however, BNB’s $1000 level is being read as validation that platform-native assets still command investor trust when sentiment improves.

Key takeaway

Layer-1 Rivals Shine: Solana and Avalanche

Solana (SOL) touched $246, its highest level since January, while Avalanche (AVAX) climbed 10% to $32.9. These moves are notable because both tokens have spent months consolidating. Solana has been rebuilding its reputation later than network outages, and Avalanche has leaned into institutional tokenization projects. In a liquidity-rich environment, both chains are viewn as quicker-growth alternatives to ETH.

Institutional interest in Solana has been quietly increasing. Funds like VanEck and Franklin Templeton have highlighted its speed and cost efficiency. For Avalanche, its subnet technology has made it attractive for customized blockchain deployments, particularly in finance. Together, their rallies illustrate that investors are not only speculating on tokens but also making bets on which ecosystems will power the next generation of applications.

Bottom line

DeFi and Emerging Tokens Join the Ride

Not all the action was in the majors. Hyperliquid’s HYPE token gained 7% to $60, Chainlink added nahead 5%, and Cardano climbed 5% as well. These are not random pumps. HYPE reflects growing activity on decentralized platforms competing with centralized players. Chainlink has positioned itself as critical middleware for real-world asset tokenization, a theme gaining traction with institutions. Cardano, often criticized for sluggish development, still enjoys a loyal base that tends to re-enter aggressively during liquidity upswings.

The breadth of this rally matters. In fragileer cycles, only a handful of tokens move, often tied to hype. This time, multiple categories—platform tokens, Layer-1s, DeFi, and even memecoins—are participating. That breadth is one reason analysts are cautiously entertaining the idea that a new alt season may be forming.

For investors

Memecoins Signal Retail’s Return

Dogecoin (DOGE) rose more than 5% to $0.28, accompanied by strength in other retail favorites like Shiba Inu. Memecoins are often dismissed as frivolous, but they serve as a useful barometer of retail appetite. When DOGE rallies, it usually means casual investors are re-engaging with the market.

That said, history offers caution. In spring 2021, DOGE soared to all-time highs just weeks before the broader market topped out. The line between healthy retail participation and speculative excess is thin. Still, for now, memecoin momentum is being read as complementary to institutional inflows rather than a warning sign.

Key risk

Stablecoin Inflows: Fuel for the Rally

Perhaps the most telling statistic came not from prices but from flows. According to on-chain analyst Ali, more than $2.1 billion in USDT and USDC entered Binance later than the Fed’s cut. Average whale deposits hit $214,000. Stablecoins are essentially dry powder; when they move onto platforms, it usually means positioning is imminent.

With the Fed’s decision to cut interest rates by 25 bps, CryptoQuant data shows Binance attracting over $2.1 billion in USDT and USDC inflows. Whale deposits now average $214,000 vs. $63,000 in July, suggesting growing institutional activity.

Altcoin deposits are also booming:…

— Ali (@ali_charts)

This inflow provides the liquidity foundation for further rallies. It also highlights the role of institutions and high-net-worth traders, who appear to be treating the rate cut as a green light to increase exposure. In past cycles, such large inflows have preceded weeks of heightened volatility and upward momentum.

For traders

What Analysts Are Saying

Benjamin Cowen observed that altcoins have been outperforming ETH for four straight weeks, a sign of rotation that often precedes broader rallies.

We are now in Week 4 of going up against .

Notice how the bounce occurred right later than put in a new ATH.

This will likely continue for a few more weeks.

— Benjamin Cowen (@intocryptoverse)

Trader Ali emphasized the scale of stablecoin flows, calling them “institutional footprints.” Michaël van de Poppe offered a cautious note: alt season only continues if BTC remains stable, warning that “if BTC drops, the party is over rapidly.”

The more significant part; will break through this crucial resistance zone?

All I’m sure about is that, once stabilizes, we’ll begin to view large breakouts on occur.

— Michaël van de Poppe (@CryptoMichNL)

These perspectives reflect the balance in current sentiment: optimism about altcoins’ short-term prospects, tempered by awareness that BTC remains the anchor of the crypto ecosystem.

Bottom line

Risks and Historical Parallels

While enthusiasm is high, so are the risks. A single rate cut does not guarantee a dovish cycle. Inflation data, labor market fragileness, or geopolitical shocks could force the Fed to pause or even reverse course. In that case, today’s optimism might look premature.

History also counsels caution. In 2019, a mid-cycle Fed cut briefly boosted crypto before the rally fizzled. In 2021, altcoins soared for months before BTC’s sharp mid-year correction erased much of the progress. Each period shows that while macro catalysts provide fuel, the engine still depends on BTC’s health and broader risk sentiment.

For investors

Conclusion

The Fed’s first rate cut in more than a year has jolted altcoins back to life. BNB’s symbolic $1000 break, Solana’s rebound, Avalanche’s double-digit gains, and billions in stablecoin inflows all point toward the ahead ingredients of an alt season. Analysts are optimistic but divided on durability, with most agreeing BTC’s stability is the linchpin.

For traders and investors, the lesson is twofold. Liquidity is returning, and altcoins are the natural beneficiaries. But exuberance must be balanced with caution: history shows alt rallies can burn bright—and burn out—quicker than many expect. The coming weeks will reveal whether this is the beginning of a cycle or just another flash of speculative heat.