Solana Price Prediction: SOL Targets $250–$260 Breakout as Technical Momentum Builds

, the sixth-largest cryptocurrency with a market capitalization of $128.9 billion, is at a critical juncture in the market—a step closer to reaching a new high.

The cryptocurrency has been building momentum over the past week, with hitting $5.98 billion in the last 24 hours.

Despite this surge in volume, sentiment isn’t directly tied to strong purchaseing activity. In fact, analysis shows that while momentum is building, it could still be bearish, opening the way for a potential pullback before a rally.

This article takes an in-depth look at SOL’s price movement and why a drop remains the most anticipated move for the asset in the coming days.

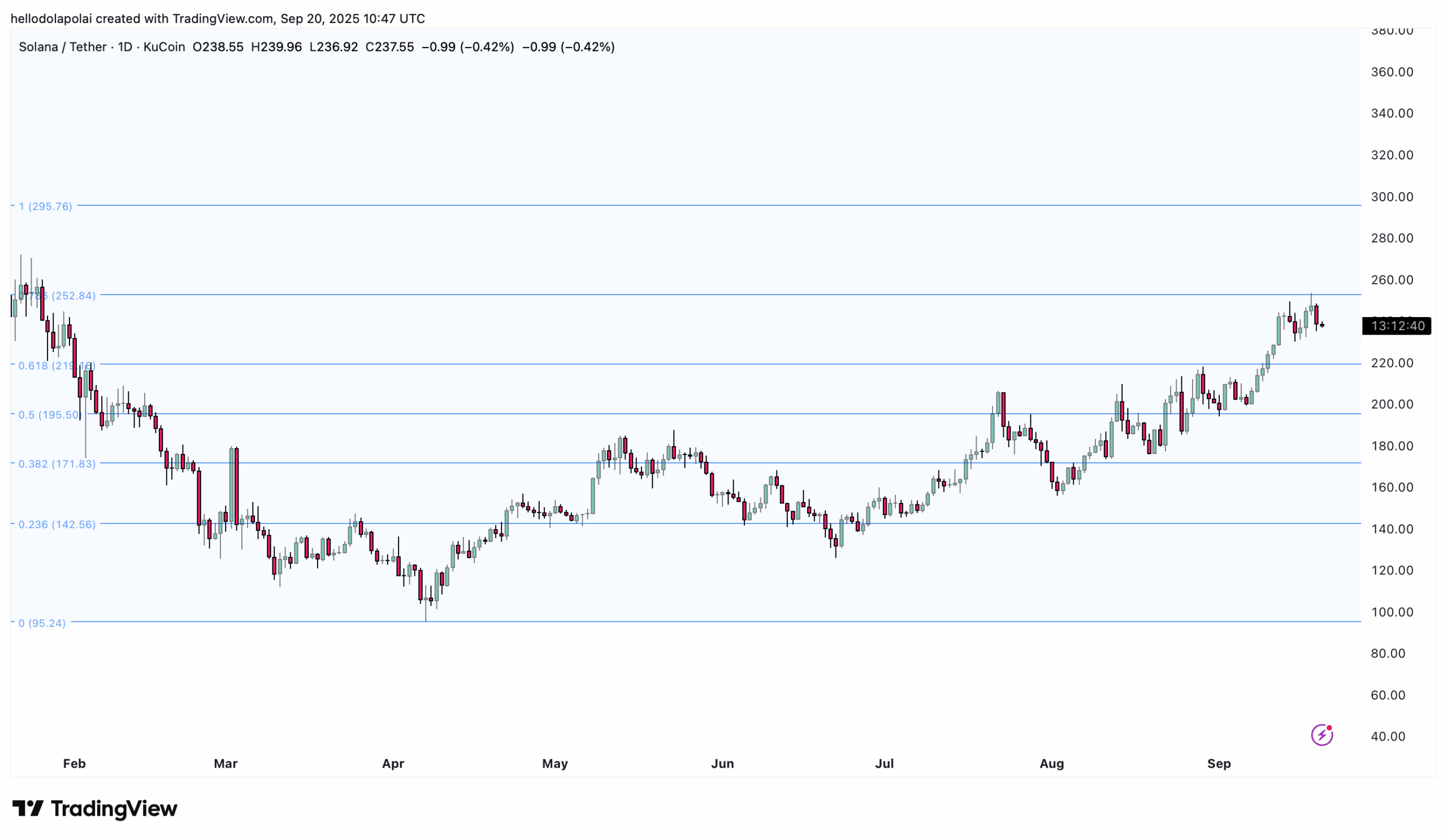

Fibonacci Suggests a Possible Drawdown

The first signal of a short-term bearish downturn emerged from the Fibonacci line.

A Fibonacci line is used in trading to highlight possible points where price may pause or reverse. It is drawn using key percentages from the Fibonacci sequence, and traders use it to identify potential support or resistance levels on a chart.

Based on the current chart pattern, SOL is likely to view a major drawdown toward the $252 (0.786) Fibonacci level as price continues to decline, already dropping 2.05% in the past day.

Historical data shows this level has not previously acted as a strong support zone, suggesting that purchase orders may remain limited. This could cause the asset to trend lower, with key support targets at $195.50 (0.5 Fib), $171.83 (0.382 Fib), and $142.56 (0.236 Fib).

The $195.50 support level, however, stands out as a high-probability reversal zone, as it has historically triggered rallies in previous market cycles.

Technical Indicators Add to Decline Probability

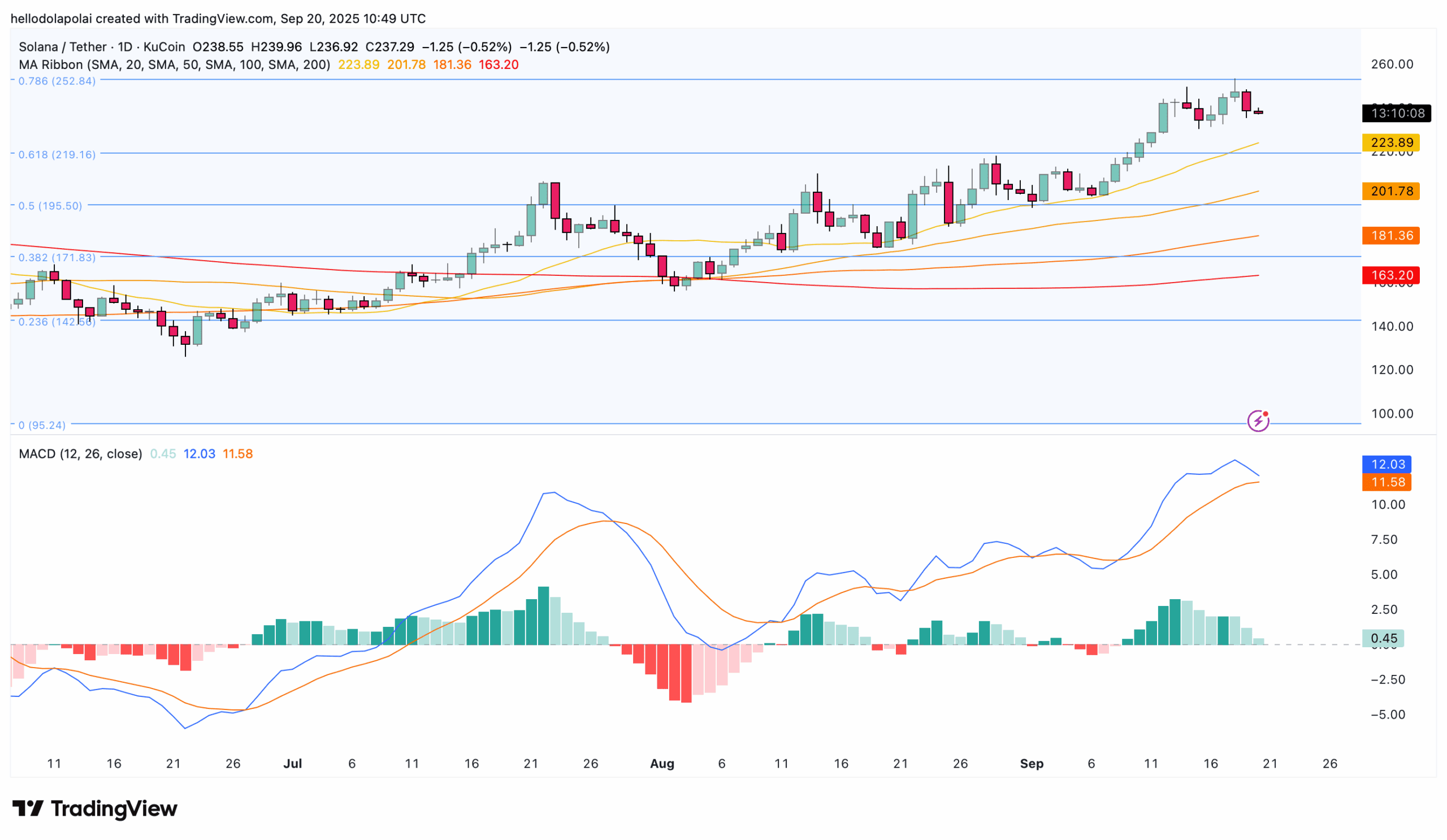

The likelihood of a drop before SOL gathers enough momentum remains high, supported by moving average indicators.

The Moving Average Ribbon, which includes a basket of 20, 50, 100, and 200-day moving averages, assists identify market trends and momentum.

At the time of writing, the short-term (20 and 50) simple moving averages are positioned above the longer-term SMAs (100 and 200). This formation usually signals bullish strength.

However, historical data shows that price often retraces to the 20 SMA—the topmost yellow line on the chart—before any significant rally.

If this pattern repeats, SOL could decline toward the 20 SMA, which nahead aligns with the top Fibonacci level of $198.

This bearish confirmation also appears in the Moving Average Convergence Divergence (MACD) indicator.

Similar to the MA Ribbon, the MACD assists determine market momentum and trend. It uses two key lines: the MACD line (blue) and the signal line (yellow).

Currently, both lines are trending downward, confirming fragileening momentum and suggesting a likely price drop. This mirrors the bearish signal viewn in the MA Ribbon.

Although this points to a likely short-term pullback, analysts maintain that SOL could stage a major rally to the upside in the coming trading sessions.

On-Chain Activity Signals Bullish Strength

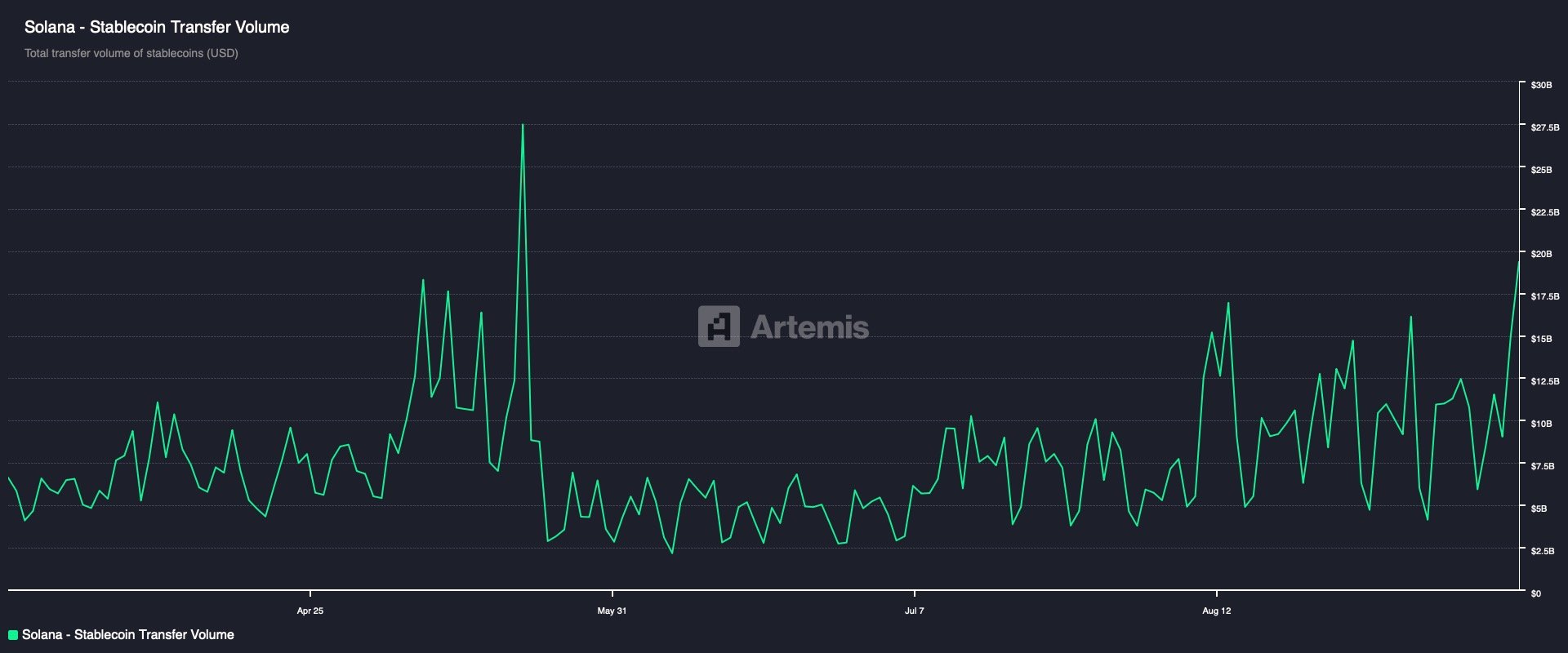

On-chain activity has largely been bullish for Solana, particularly in terms of capital inflows into the blockchain.

The Total Value Locked (TVL)—a key metric showing the value of assets deposited into Solana protocols by staking SOL—remains high despite a recent decline.

TVL dropped 2.2% in the past day to $12.456 billion. However, broader data shows the overall trend remains strong, and the decline is only a slight pullback within the larger uptrend.

activity on Solana has also surged. , stablecoin trading volume has increased significantly in recent days.

At present, stablecoins account for $19.4 billion in total trading volume, representing a 284% increase and marking the highest stablecoin activity since March.

A surge in stablecoin volume often signals rising utility and transaction activity on the network, reinforcing the likelihood of continued upward momentum for SOL.

Potential Outcome for Price

The potential outcome for SOL is that the asset may view a pullback in the coming days, trading into a key support level marked on the chart.

Given the overall bullish sentiment, it remains likely that the asset will stage a major upside move, targeting $252 on the chart, a level marked by the Fibonacci line.

This drop could also coincide with investors adding more capital into Solana protocols by staking the asset, further contributing to the overall bullish outcome.

Otherwise, it is likely that SOL will continue dropping lower on the chart as liquidity outflows intensify in the market, forcing the price further down.

Frequently Asked Questions (FAQs)

1. What key support level is SOL expected to test in the near term?

The asset may pull back to a marked support level on the chart before making its next major move.

2. Why are analysts maintaining a bullish outlook on SOL despite short-term pullbacks?

The broader sentiment around SOL remains positive, supported by technical indicators such as the Fibonacci line pointing to a potential move toward $252.

3. How does staking activity impact SOL’s price outlook?

Increased staking on Solana protocols could strengthen demand for the asset, adding weight to the bullish scenario.

4. What risks could drive SOL’s price lower instead of higher?

Continued liquidity outflows in the market could force SOL below support levels, leading to deeper price declines.

5. What price target are traders watching if SOL maintains its bullish momentum?

Traders are eyeing the $252 level, highlighted by the Fibonacci retracement, as the next major upside target.