US Lawmakers Push SEC to Deliver Trump’s 401(k) Crypto Order

Nine members of Congress have called on the to rapidly implement ’s recent executive order enabling crypto investments in US 401(k) retirement plans, in a on Monday. The executive order directs regulators to remove barriers for including and other alternative assets in 401(k) retirement plans.

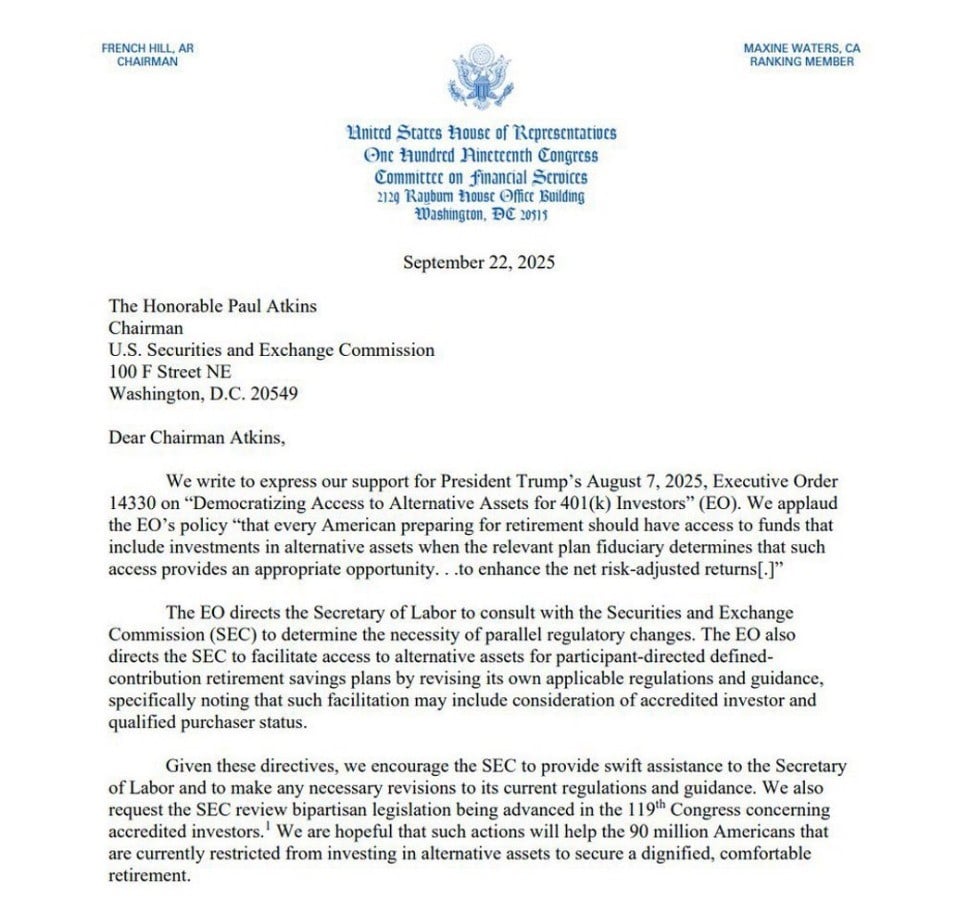

The , including House Financial Services Committee Chairman French Hill and Subcommittee on Capital Markets Chairman Ann Wagner, Frank D. Lucas, Warren Davidson, Marlin Stutzman, Andrew R. Garbarino, Michael V. Lawler, Troy Downing and Mike Haridopolos, stated that Atkins was asked to “provide swift assistance” to the Secretary of Labor and to adjust current regulations and guidance as needed.

, signed August 7, explicitly instructs the SEC and Department of Labor to “Democratizing Access to Alternative Assets for 401(k) Investors,” so American workers can diversify retirement savings beyond traditional stocks and bonds.

Lawmakers say the move would free up in US retirement accounts for broader investment, including digital assets that have been off-limits for most retail savers until now.

“Every American preparing for retirement should have access to funds that include investments in alternative assets when the relevant plan fiduciary determines that such access provides an appropriate opportunity… to enhance the net risk-adjusted returns,” said the lawmakers.

Trump’s EO was designed to ease lingering litigation threats and regulatory roadblocks that have deterred plan fiduciaries from offering these asset classes.

Investor Takeaway

Lawmakers are urging the SEC to act rapidly on Trump’s 401(k) executive order, which could open the door for American workers to diversify retirement funds into BTC and other digital assets.

Trump’s Executive Order Could Unlock $9.3 Trillion 401(k) Market for Crypto

Lawmakers highlighted that the majority of nahead 90 million US 401(k) savers remain locked out of alternative assets, despite growing demand for higher-return, inflation-resistant investments.

“We are hopeful that such actions will assist the 90 million Americans that are currently restricted from investing in alternative assets to secure a dignified, comfortable retirement,” said the nine lawmakers in the letter.

Implementing Trump’s EO would open crypto to the $9.3 trillion US 401(k) retirement market, driving larger inflows into crypto e while positioning crypto as a potential long-term investment strategy.

For context, since their launch in January 2024, have attracted $60.6 billion in inflows, according to . This represents less than 1% of the potential $93 billion that could flow into crypto from the $9.3 trillion locked in U.S. 401(k) retirement plans.

The Congressmen are urging the SEC to coordinate with the Labor Department, update existing guidance, and adjust regulations around accredited investor and qualified purchaser rules to finally enable BTC, private equity, and private credit for retirement plans.

The order aims to expand opportunities for both individual growth and broader market liquidity, potentially sending billions into digital assets through systematic payroll contributions and employer matches.

Congressional pressure is likely to intensify, with fiduciary rule reversals and accredited investor status sure to shape the debate as the world’s largest retirement market weighs the next phase of mainstream crypto access.