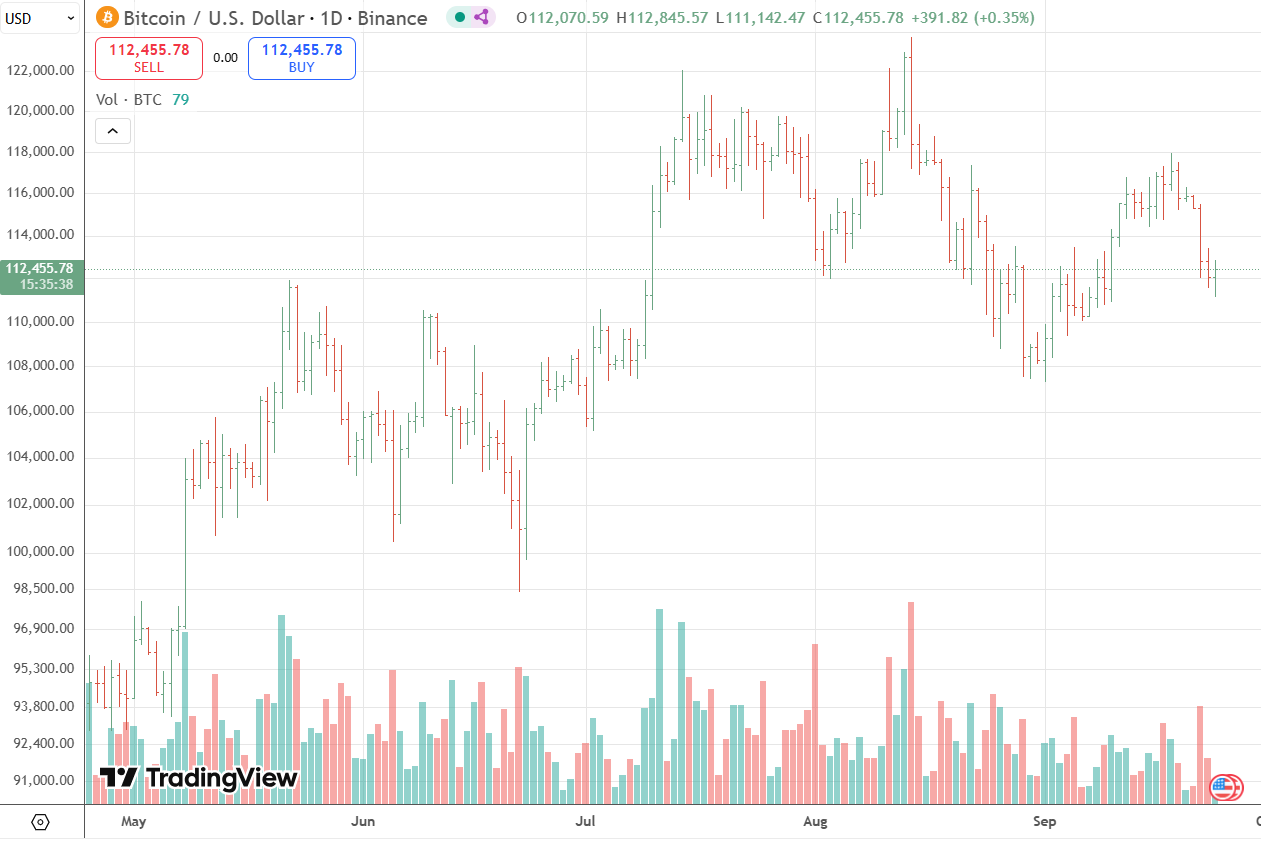

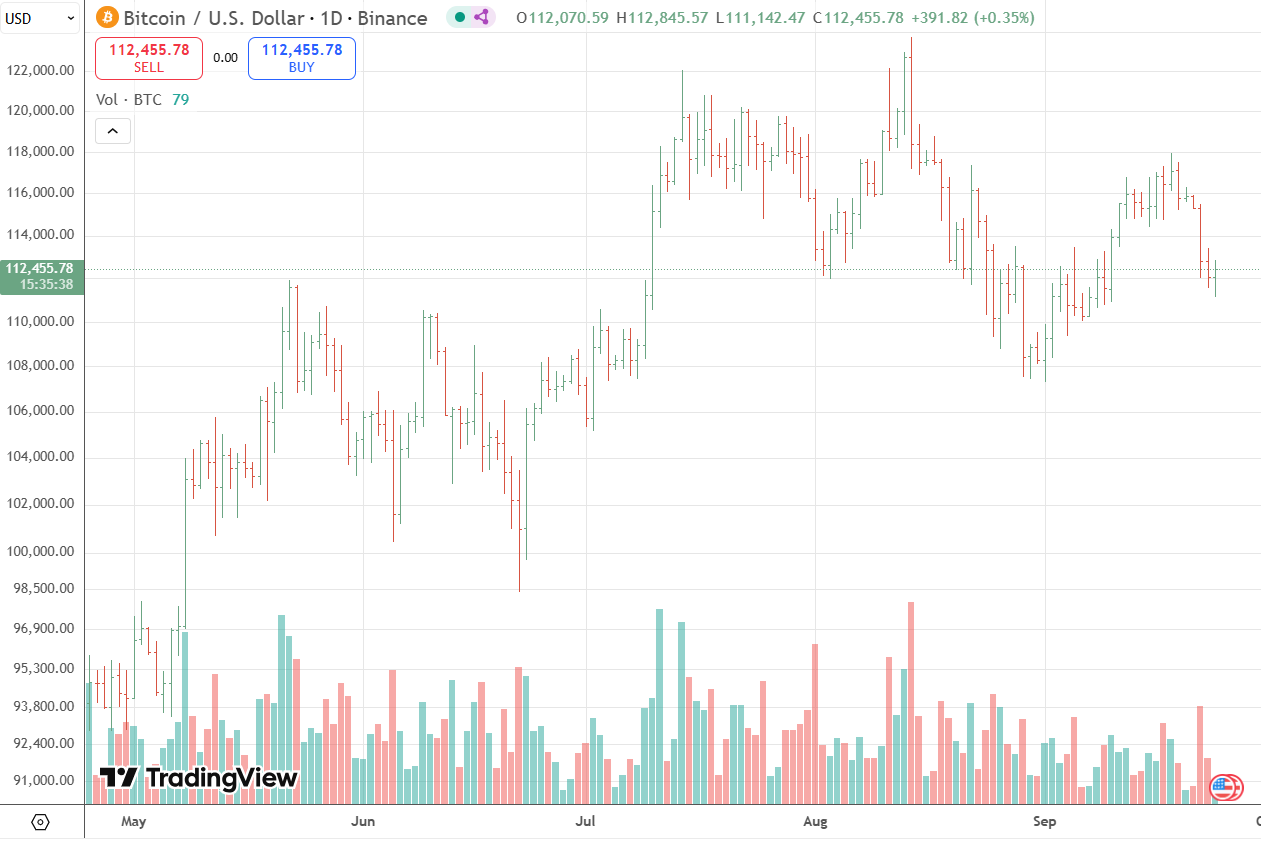

BTC Price Consolidates at $112K as Traders Watch Key Support and Resistance Levels

BTC (BTC) is trading near $112,400, down slightly on the day, as the world’s largest cryptocurrency continues to consolidate between $110,000 and $115,000. Technical indicators show a lack of clear direction, with traders closely monitoring whether BTC can break out of its current range.

Market analysts point to $118,000 as the immediate resistance level for BTC, with stronger resistance near the all-time high region of $124,000. On the downside, support is forming around $107,000 to $105,000. A decisive move below this range could open the door to a deeper correction toward $100,000, while a breakout above $118,000 would likely put fresh highs back on the table.

Moving averages remain mixed, with shorter-term signals fluctuating between purchase and neutral while longer-term averages present resistance. Some analysts warn of a potential “death cross” — a bearish technical pattern where the 50-day moving average crosses below the 200-day average.

Momentum indicators such as the Relative Strength Index (RSI) are currently neutral, suggesting neither overbought nor oversold conditions. Meanwhile, the MACD and ADX show fragile trend strength, further reinforcing the picture of consolidation. Declining trading volume also highlights reduced market participation, a common feature during range-bound phases.

BTC’s short-term bias appears neutral to slightly bearish, but the broader uptrend remains intact as long as support levels hold. A breakout above $118,000 could shift sentiment bullish again, while a breakdown under $107,000 would likely intensify tradeing pressure.

With momentum indicators muted and macroeconomic uncertainty still influencing crypto markets, traders are advised to watch these technical levels closely for confirmation of BTC’s next large move.

ETH (ETH) is trading near $4,200 as the market’s second-largest cryptocurrency consolidates in a narrow range. The price action reflects indecision among traders, with technical indicators suggesting that ETH could either mount a breakout or face renewed tradeing pressure in the short term.

Analysts highlight $4,400 to $4,500 as the immediate resistance zone for ETH, where recent highs and key moving averages converge. A sustained break above this level could pave the way for a push toward previous peak levels. On the downside, support remains around $4,000 to $4,100. If ETH falls below this range, a deeper pullback toward $3,800 to $3,900 could follow. These zones will be closely monitored as the deciding factors for ETH’s next trend.

Moving averages are sending mixed signals. Shorter-term averages are fluctuating between purchase and neutral, while longer-term indicators such as the 100-day and 200-day moving averages are acting as resistance. Oscillators including the Relative Strength Index (RSI) are hovering in neutral territory, suggesting neither overbought nor oversold conditions. The Average Directional Index (ADX), a measure of trend strength, remains fragile, indicating that ETH may continue trading sideways until a catalyst emerges.

ETH’s near-term bias is neutral to slightly bearish, with traders cautious of losing support near $4,000. However, the broader uptrend remains intact if support levels hold. A decisive move above $4,400 could rapidly shift sentiment back in favor of the bulls, while a breakdown under $4,000 may invite heavier tradeing pressure. For now, market participants are advised to watch these technical levels closely for confirmation of ETH’s next move.