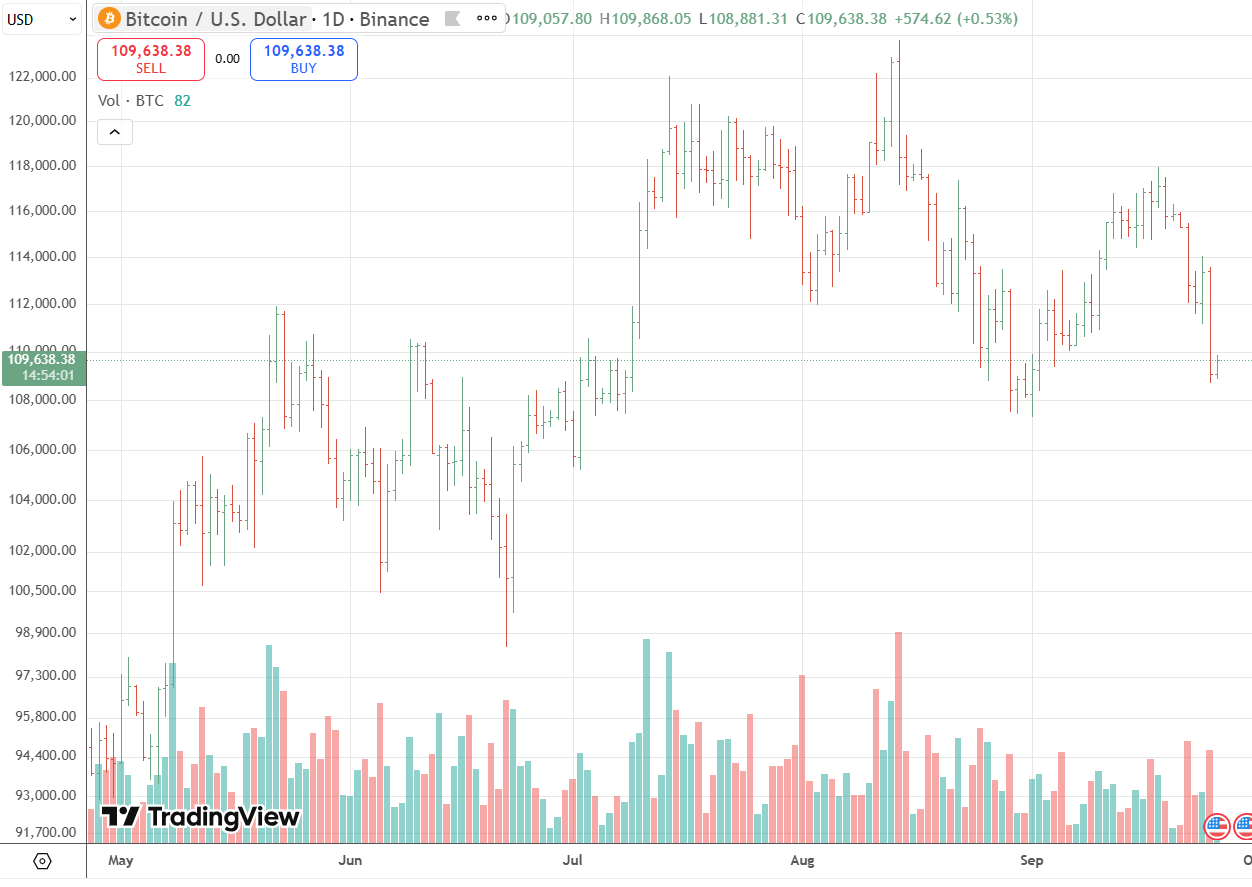

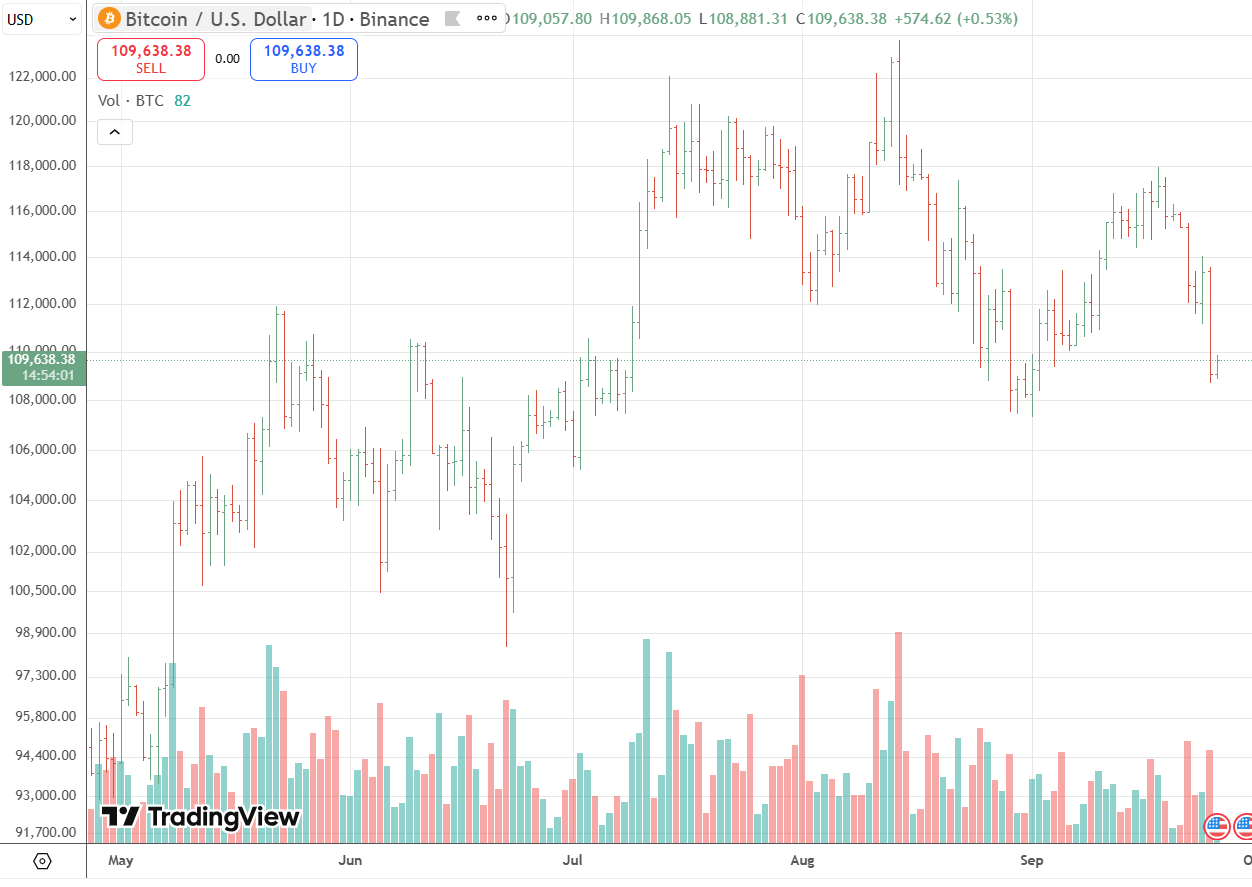

BTC Prices Faces Tight Range as Technical Indicators Signal Potential Breakout

BTC (BTC) is holding near $109,500 later than a pullback from recent highs, with traders closely watching for signals of the next major move. Price action has consolidated between $108,500 and $113,000, and the compression of Bollinger Bands suggests a volatility squeeze that often precedes a breakout.

Technical indicators remain divided on BTC’s short-term direction. Data from Investing.com shows the overall technical summary leaning “strong trade” on shorter timeframes. Relative Strength Index (RSI) is hovering around 40, indicating neutral to slightly bearish momentum, while the MACD remains in negative territory. The Average Directional Index (ADX) near 39 reflects moderately strong trend conditions tilted to the downside.

Support is clustered around $108,500 to $109,000, a zone that has repeatedly attracted purchaseing interest. A break below this region could trigger a move toward the 200-day moving average near $102,000. On the upside, bulls face heavy resistance at $113,500 to $115,000, where multiple moving averages converge. A decisive breakout above this band could open the door toward $120,000.

For now, BTC remains range-bound, with compressed volatility signaling a strong move may be imminent. Traders are watching whether the next decisive break comes to the upside or downside as global markets await catalysts.

ETH (ETH) is trading close to $4,000 later than recent volatility, with the market testing critical support and resistance levels that could dictate its short-term trajectory. The second-largest cryptocurrency by market capitalization has entered a phase of consolidation, mirroring broader indecision across digital assets.

Technical data from Investing.com shows ETH leaning toward a “strong trade” signal on daily timeframes, as short- and medium-term moving averages trend below current levels. Oscillators, however, present a more neutral picture, suggesting limited momentum in either direction.

ETH faces immediate support near the $4,000 mark. A decisive break lower could open the door to further declines toward the $3,500–$3,800 range. On the upside, ETH must clear resistance between $4,300 and $4,500, an area aligned with several moving averages and prior swing highs.

With compressed volatility on shorter timeframes, traders anticipate that a larger move may be imminent. The coming sessions could prove decisive, as ETH’s ability to hold above $4,000—or break through resistance—will shape the next phase of price action.