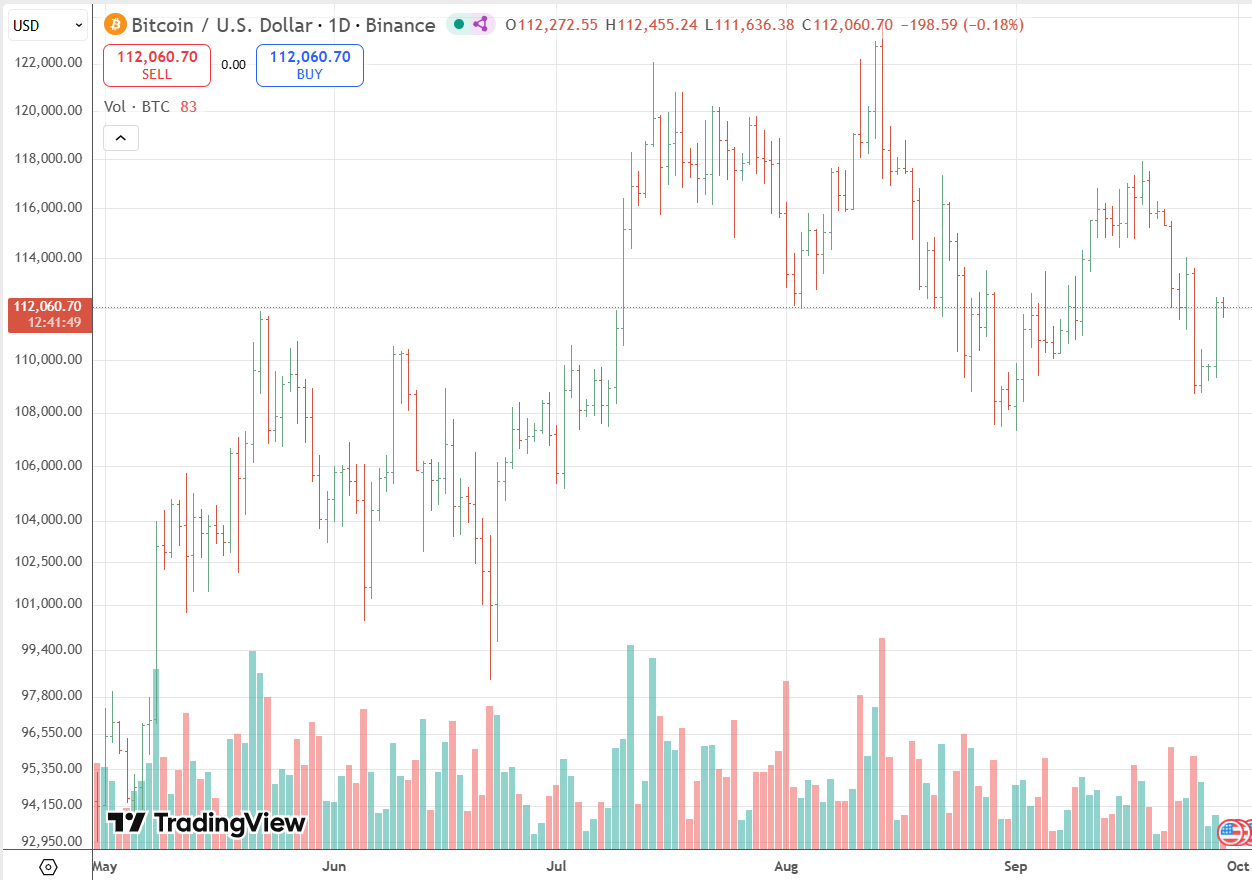

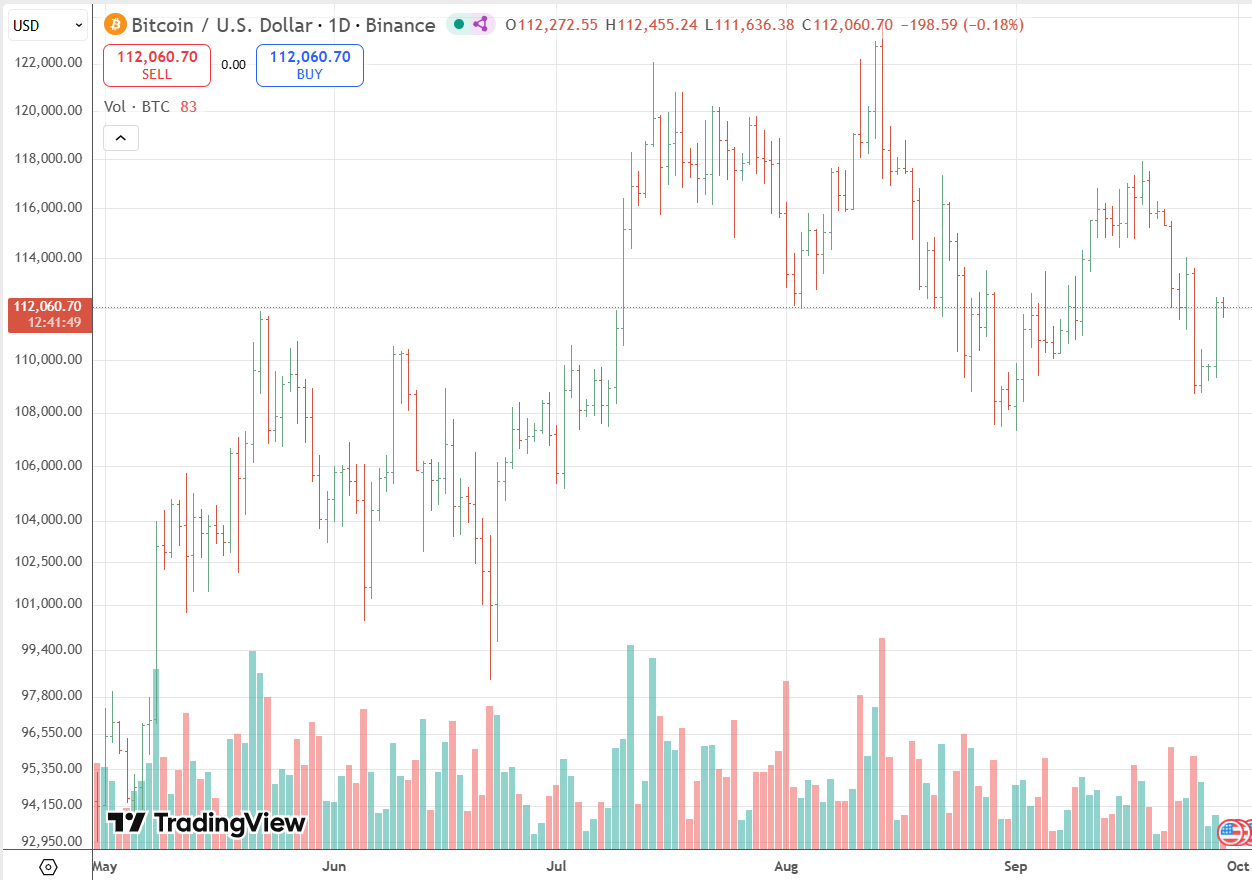

BTC Holds Above $111,000 as Traders Watch Key Levels

BTC (BTC) is trading near $111,942, holding steady above the $111,000 mark as traders weigh momentum signals and chart patterns that point to both upside potential and short-term risks. The cryptocurrency posted an intraday high of $112,340 and a low of $109,256, according to market data.

Technical analysis shows that BTC’s longer-term trend remains positive, with most major moving averages—50-day, 100-day, and 200-day—positioned below the current price. Analysts note that this alignment signals a bullish bias. However, shorter-term indicators, including the Relative Strength Index (RSI) and Stochastic Oscillator, suggest overbought conditions that could trigger consolidation or a pullback.

Key support levels are being monitored at around $107,000 and $102,000. The $107,000 level reflects recent swing lows, while $102,000 marks the lower boundary of a descending channel. A break below these thresholds could invite further downside pressure. On the upside, resistance is viewn near $117,000, aligning with the upper boundary of the identical channel, and a further test could emerge at $123,000 if momentum builds.

Market watchers caution that while the broader structure favors bulls, the cryptocurrency’s volatility remains elevated. The Average True Range (ATR) suggests daily price swings of 2.5% to 3%, underscoring the potential for sharp moves in either direction. Some analysts have also pointed to the possibility of a “death cross”—a bearish technical signal—if the 50-day moving average were to fall below the 200-day moving average in coming sessions.

In the immediate term, BTC’s ability to hold above $107,000 will be closely tracked by traders. A decisive breakout above $117,000, supported by volume, could pave the way for a run toward $123,000, while a failure to defend support may bring a deeper correction.

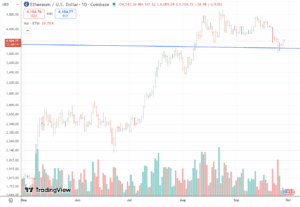

ETH (ETH) is trading near $4,102, maintaining support above the $4,100 threshold as traders watch for a possible test of higher resistance levels. The cryptocurrency rose more than 2% intraday, highlighting renewed purchaseing momentum later than recent swings.

Technical indicators remain broadly positive. Market dashboards show ETH in a “Strong purchase” posture, with the majority of moving averages trending above current price action. The Relative Strength Index (RSI) sits around 63, signaling strength without yet breaching overbought territory. Additional indicators, including the MACD and Stochastic Oscillator, also lean bullish, while the Average Directional Index (ADX) suggests the prevailing trend has moderate but not overwhelming strength.

On the chart, support is now viewn in the $3,900 region, a level that recently acted as a key pivot later than ETH reclaimed the $4,000 handle. If price fails to hold that zone, downside pressure could extend toward $3,700, a deeper support area. Resistance lies near $4,300, with a breakout above that mark opening the possibility of a run toward prior cycle highs.

Volatility remains an significant factor. Daily ranges continue to show swings of 2% to 3%, with shorter-term moving averages fluctuating between consolidation and breakout conditions. Traders are closely monitoring whether ETH can sustain momentum at current levels or if another phase of consolidation will emerge before a decisive move.

For now, ETH’s structural strength remains intact, supported by favorable technical readings and firm price action above key supports. Market participants will look for confirmation in the coming sessions, with $3,900 as the downside level to defend and $4,300 as the upside level to clear.