Aster Price Surges 2,800% later than Changpeng Zhao Endorsement as Innovative ‘Hidden Orders’ Drive Institutional Volume

Decentralized perpetuals platform (DEX) Aster’s native token, ASTER, has defied a flat market, surging into the crypto spotlight following its Token Generation Event (TGE) and high-profile endorsements.

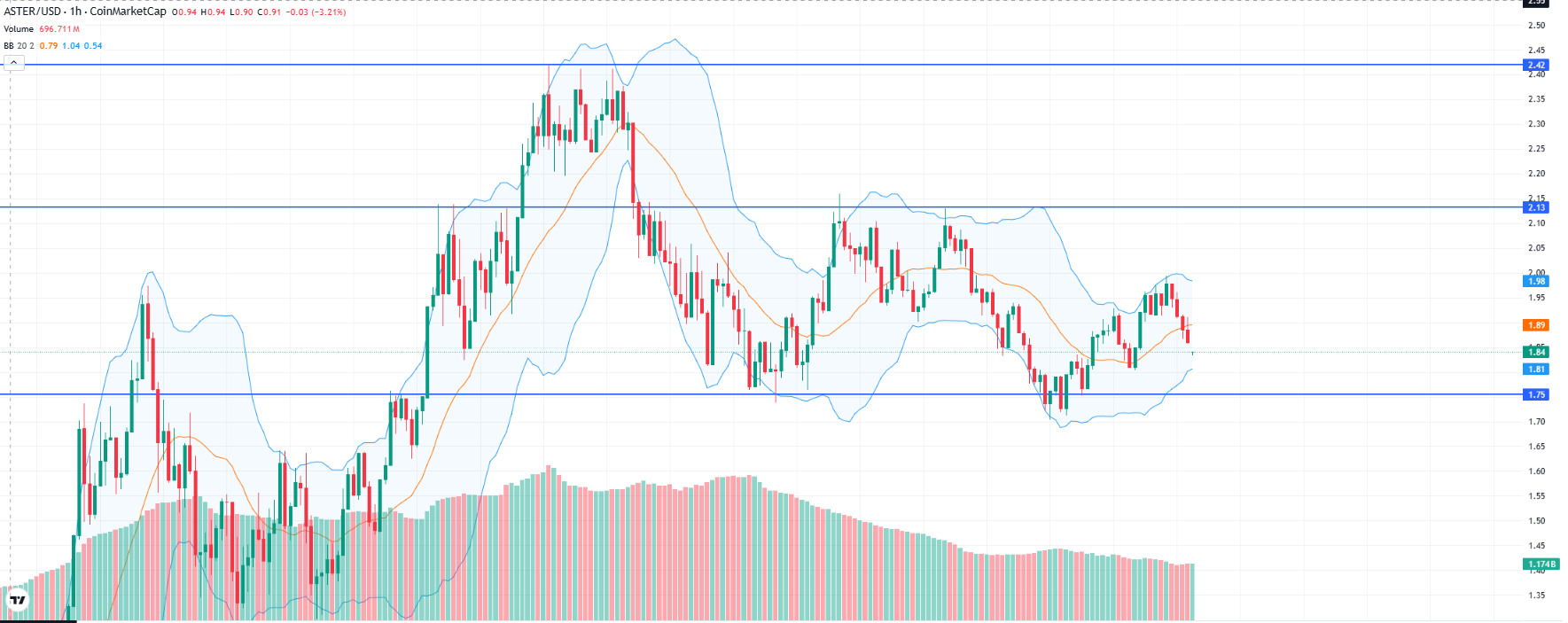

ASTER recorded an astonishing 2,800% increase from the initial price to an all-time high of $2.42 within a week. The DEX has temporarily acquired market dominance over rival Hyperliquid in both day-to-day trading volume and fee revenue. The rally, one of the key drivers of any potential future Aster price prediction, is boosted by strong backing from YZi Labs (formerly Binance Labs) and open support from Binance co-founder Changpeng Zhao (CZ).

The Perpetual DEX Token Surge: Innovation and the ‘CZ Effect’ Drive Momentum

The cryptocurrency space has just witnessed one of the most spectacular token launches of 2025 in the shape of Aster. Since its 17, 2025, the ASTER token traded at a modest price of $0.08439 before racing to an all-time high of $2.42 as of September 24. The move was a whopping 2,768% increase in its inaugural week. The ASTER sensational surge is not just a speculative mania, but a perfect storm that is the culmination of product innovation combined with high-profile strategic backing that has sired a runaway hit with record-breaking market penetration.

The initial investor fevering came directly in tandem with key public acknowledgment by Changpeng CEO. Although CZ has since clarified his advisory role and that Binance has no official affiliation with the project, his public support through social media served as a powerful catalyst. This so-called ‘CZ Effect’ immediately provided the project with instantaneous credibility and hugely reduced the risk factor to an enormous international audience of both retail and institutional capital. The rumor of CZ’s connection was also nurtured by the detail that his venture firm, YZi Labs, holds a minority ownership in employees are the backbone of the development team.

A blockchain advisor and founder of Ajoobz, Elja (@eljaboom), tweeted that Aster ($ASTER) has surpassed Hyperliquid ($HYPE) in 30-day fees. This suggests that the new decentralized platform, Aster, is generating more revenue than its established riva

just flipped 30-day fees. Coded

Find your Aster trade link & Farm the Airdrop below

— Elja

(@Eljaboom)

Former Binance CEO, Changpeng “CZ” Zhao, has retweeted the tweet about Aster flipping Hyperliquid in 30-day fees.

At the risk of stating the obvious:

Aster’s per-trade fees are lower (cheaper for users).

Lower fees, higher volume.

— CZ

BNB (@cz_binance)

Famous YouTuber Mr. Beast is continuing to fuel the rally for the Aster perpetual futures DEX by investing nahead $1 million more to acquire ASTER tokens. On-chain data confirms that a crypto wallet linked to him has been actively accumulating the token, withdrawing the purchases from platforms to a personal storage address, thereby lending his fame and liquidity to the project.

Talking about the volatility, prominent crypto analyst Michael van de Poppe explained that the DEX altcoin is “attracting large trading volumes and high volatility,” which is a tremendous force for more gains. This mindset is part of producing a bullish price prediction for Aster. ASTER currently trades at $2.2011 and has consolidated slightly beneath its new-found resistance top. The payment-specialized DEX token now boasts over 624% gain in the month and comfortably occupies the leadership of its counterparts in decentralized derivatives for the period.

Product diverseiators: How Aster Captures Trading Volume

The underlying power of the ASTER token rally is rooted in the technological expertise and strategic direction of closing the efficiency gap between decentralized finance (DeFi) and centralized finance (CeFi) of the platform. The platform, which emerged from the March 2025 consolidation of Astherus and APX Finance, has become a “next-generation DEX.”

Hidden Orders: Mitigating MEV and Front-Running

Aster’s most significant innovation is its “Hidden Orders” feature. This allows users, particularly whales and institutional large traders, to place sophisticated limit orders without revealing the size or direction of their position on the public order book until they are executed. This is a fundamental deviation from the transparent order books of the majority of on-chain platforms and addresses in particular DeFi perpetual pain points of trading, namely Miner Extractable Value (MEV) and front-running. By offering such institutional-grade privacy and execution quality, Aster is able to attract high-value volume that tends to remain segregated to centralized platforms.

Maximum Leverage and Dual Trading Modes

Aster actively recruits speculative traders with one of the market’s most leveraged options: up to 1001x on major markets like BTC and ETH in its ‘Degen Mode’ (or Simple Mode). Highly risky, this option has still attracted a sizable retail base and publicity buzz.

The platform also caters to a broad range of user sophistication through its Dual Trading Modes:

• Simple Mode (1001x Mode): For convenience and retail traders, with one-click trading and built-in MEV resistance.

• Pro Mode: A professional, order-book-centric user interface with enhanced features like grid trading automation and professional order types (stop-loss, take-profit, trailing orders). Pro Mode is further diverseiated by offering exposure to U.S. stocks like Tesla, Apple, Microsoft, and Amazon, settled in cryptocurrency, with leverage capped at 50x.

Capital Efficiency with Yield-Bearing Collateral

One of the key product advantages is the convenience for yield-bearing assets to be utilized as margin for perpetuals trading. Compared to legacy platforms where collateral is idle, Aster enables customers to utilize tokens such as asBNB liquid staking tokens or USDF stablecoins as margin so they can earn passive yield while maintaining active leveraged trading positions. The generation of income in parallel by way of a “Trade & Earn” model significantly boosts capital efficiency and presents a compelling incentive for user onboarding and retention.

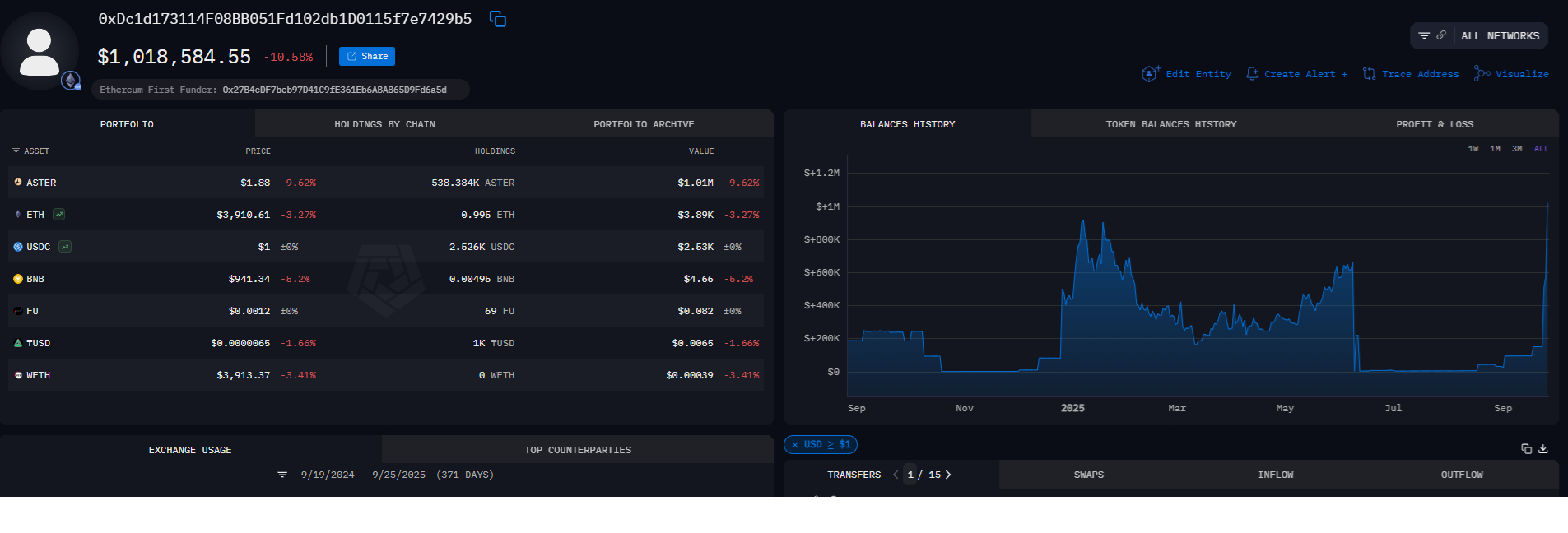

Technical and On-Chain Analysis: The Whale Accumulation Paradox

Beneath the ASTER’s phenomenal price movement lies the strong on-chain accumulation, as testified by technical metrics that demonstrate a well-heeled “smart money” is perpetuating the rally. Such on-chain information is fundamental to any valid Aster price prediction.

Smart Money Inflows and Technical Levels

ASTER/USD chart readings confirm a steady uptrend in the token’s Smart Money Index (SMI) since its launch, testifying that the price surge has sound backing from institutional investors and experienced traders. The Elder-Ray Index, measuring purchaseing and tradeing pressure, is also positively positioned, testifying that a prolonged accumulation phase is underway for the altcoin. This has taken the token to its all-time high of $2.42, with analysts watching key technical levels:

•Immediate Resistance: New high at $2.13 is immediate resistance. A clean break above that level should drive a new leg higher to the old all-time high.

•Significant Support Area: Significant technical support is established at $1.75. A fall to this level would most likely be a short-term profit-taking pullback and a potential purchaseing opportunity.

• Upside Target: Sustained momentum could have ASTER target the range of $2.15–$2.30, before potentially testing new highs.

ASTER vs. HYPERLIQUID: A Tale of Contrasting 7-Day Price Changes.”

The chart shows ASTER (blue line) experiencing substantial growth over a 7-day period, peaking at over a 60% price change and finishing around a 30% increase. In contrast, HYPERLIQUID (red line) remained relatively stable, fluctuating between 0% and -10% during the identical period.

Tokenomics and Centralization Risk

While the setup is bullish, token distribution within the project represents a huge, well-documented risk that investors must take into account. The total supply of ASTER has been capped at a maximum of 8 billion units. On-chain inspection has revealed outrageous concentration of the supply: up to 96% of cumulative ASTER supply is held by six addresses.

Unpacking the concentration further:

• Combined, the top five wallets hold more than 93% of the circulating supply.

• The largest of these individually holds up to 44.7% of the supply.

This concentration has raised concerns among traders and analysts, who warn of widespread market manipulation and instantaneous, volatile price crashes from an organized “whale dump”. This threat must be considered in any long-term Aster price prediction because it could lead to wild volatility. That risk is then pitted against the large inflows of institutional capital, as two whale wallets have recently accumulated a total of over 118.25 million ASTER tokens, valued at approximately $270 million, or 7.13% of circulating supply. That aggressive accumulation shows that while the centralization risk is elevated, the key players believe the platform’s growth trajectory outweighs the tokenomics risk.

Aster’s Dominance in the Perp DEX Landscape

Aster’s success is not just a token phenomenon; it is rapidly capturing market share and challenging established leaders in the decentralized derivatives sector, most notably Hyperliquid. Aster’s explosive growth in operational metrics highlights its newfound dominance:

• Day-to-Day Fee Income: Aster is also leading on DefiLlama in terms of day-to-day fee income, which saw it rake in over $25 million in fees in one 24-hour period. This is a lot more than its competitor Hyperliquid’s $3.17 million in the identical period.

•Weekly Revenue: The DEX’s revenue from fees over the last week was just under $70 million, making it the second highest protocol fee income for the entire network, beating out giants such as Circle and Uniswap and second only to stablecoin issuer Tether.

•tTrading Volume: The platform has exhibited a remarkable uptick in activity, with 24-hour perpetual trading volume rising into the tens of billions. On September 24, the daily perpetuals volume of Aster stood at $20.8 billion compared to Hyperliquid’s $9.7 billion. At the close of the week, the gap was higher, with Aster posting volumes of $42.8 billion against Hyperliquid’s $4.6 billion. Cumulatively, the platform’s total trading volume has already hit over $840 billion, with nahead $200 billion in volume having been traded in the previous seven days alone.

The competition has further been intensified by Changpeng Zhao himself, who, in a rare comparison, hinted that Aster needs to be compared against Binance, and not merely other DEXs. Such a positioning emphasizes the high-performance nature of the project and the aim of offering CEX-like experience with the additional value proposition of self-custody.

Resilience and User Confidence

The protocol also demonstrated real-time operational capacity following an abnormal price surge in XPL, the Plasma blockchain token, which forced multiple traders into forced liquidations. Aster halted trading at once and within hours implemented full compensation of all affected traders in USDT, including trading and liquidation fees. This public and rapid reanswer served to solidify user confidence, showing the team’s commitment to protecting users from technology difficultys—a high priority for a new derivatives platform.

Future Trajectory and Speculation: The purchaseback Catalyst

The backbone of Aster’s success is the support of multiple chains, with its first target being the BNB Chain ecosystem. The protocol has an ambitious future road map that includes its own custom layer-1 answer, Aster Chain, and will later introduce privacy features and advanced execution engines, such as Zero-Knowledge Proof (ZKP) integration.

Piling a lot of fuel on the speculation of subsequent price action, news has been rampant on a possible ASTER token purchaseback plan. The concept, which was likened to corporate stock purchasebacks, has the protocol using its significant fee income—now at over $10 million in daily income and nahead $70 million in weekly income—to purchase back ASTER tokens from the open market. Screenshots circulating in the community suggest that the team is seriously considering this move to limit supply and signal long-term confidence.

With the token’s already high volatility and massive recent appreciation, the possibility of a purchaseback alone has already given traders a strong reason to stay long and continue waiting for one of the quickest-growing projects in decentralized finance.

Analysts have given a bullish price prediction of Aster with ASTER expected to reach $2.074 by 2025. The future price of Aster in the long term aims to reach $9.823 by 2030 in case its adoption and technological momentum continue to roll in the DeFi perpetual trading platform.

ASTER Price FAQ

What is the maximum leverage offered by Aster?

Aster offers maximum leverage of up to 1001x on major perpetual contracts such as BTC and ETH in its ‘Degen’ or Simple Mode. Leverage on other markets, including altcoins and tokenized stocks (Apple, Tesla), is lower, capped at up to 50x for equities.

Is the ASTER token supply controlled by whales?

Yes, on-chain data shows extreme centralization. An estimated 96% of the total ASTER token supply is concentrated in just six wallets, with the single largest wallet controlling 44.7%. This raises significant risks of market manipulation, sudden price volatility, and potential large-scale trade-offs if these key holders decide to move their positions.

Has Aster surpassed Hyperliquid and other rivals in total market dominance?

Aster has decisively surpassed Hyperliquid in daily fee revenue and daily trading volume over the last two weeks, briefly becoming the top DEX by these metrics. However, in terms of broader, long-term market dominance, Hyperliquid still maintains a larger total market capitalization and a significantly higher all-time cumulative trading volume. Aster’s continued growth is challenging Hyperliquid’s position, but it has not yet overtaken it in every cumulative metric.