BTC Hits Optimistic ‘No Return’ Zone, Mirroring Previous Bull Runs, Says Quant Analyst PlanB

Popular quant analyst PlanB has shown his strong confidence in BTC later than saying that the world’s largest cryptocurrency has entered a “no return” zone and is far from ending its bullish season.

In a new thread on X, PlanB told his millions of followers that the current BTC price movement reflects its historical phase that precedes a . The current BTC bull-bear transition point mirrors previous rallies in October 2020, February 2017, and January 2013. If his is anything to go by, that means BTC is expected to rise until the end of 2025.

PlanB’s Signal Suggests A New BTC Rally

In his latest BTC price analysis, PlanB shared that BTC’s current market behavior mirrors the turnaround points of 2013, 2017, and 2020, all of which preceded significant price explosions.

According to him, “The current setup suggests BTC has crossed a threshold, and historically, once BTC enters this phase, retracing to lower cycle levels becomes almost impossible, and upward momentum accelerates.”

Meanwhile, BTC has had a turbulent September, but with its price consolidating in late September 2025, PlanB’s signal suggests this could be the beginning of a new exponential BTC price jump.

For PlanB, history shows that BTC will continue to rise until the end of the year, as shown by the major difference between its August closing price and its 200-week moving average. He also notes that the relative strength index (RSI), an indicator that measures an asset’s momentum, is hovering in bullish territory.

Prior to this prediction, the analyst predicted that BTC would reach $300,000 by 2026 because of the “separation between money and state.” With the major economic indices from the pointing at lower interest rates and higher unemployment in the US, there could be a stronger demand for risky assets like BTC.

BTC Lessons From 2013 and 2020

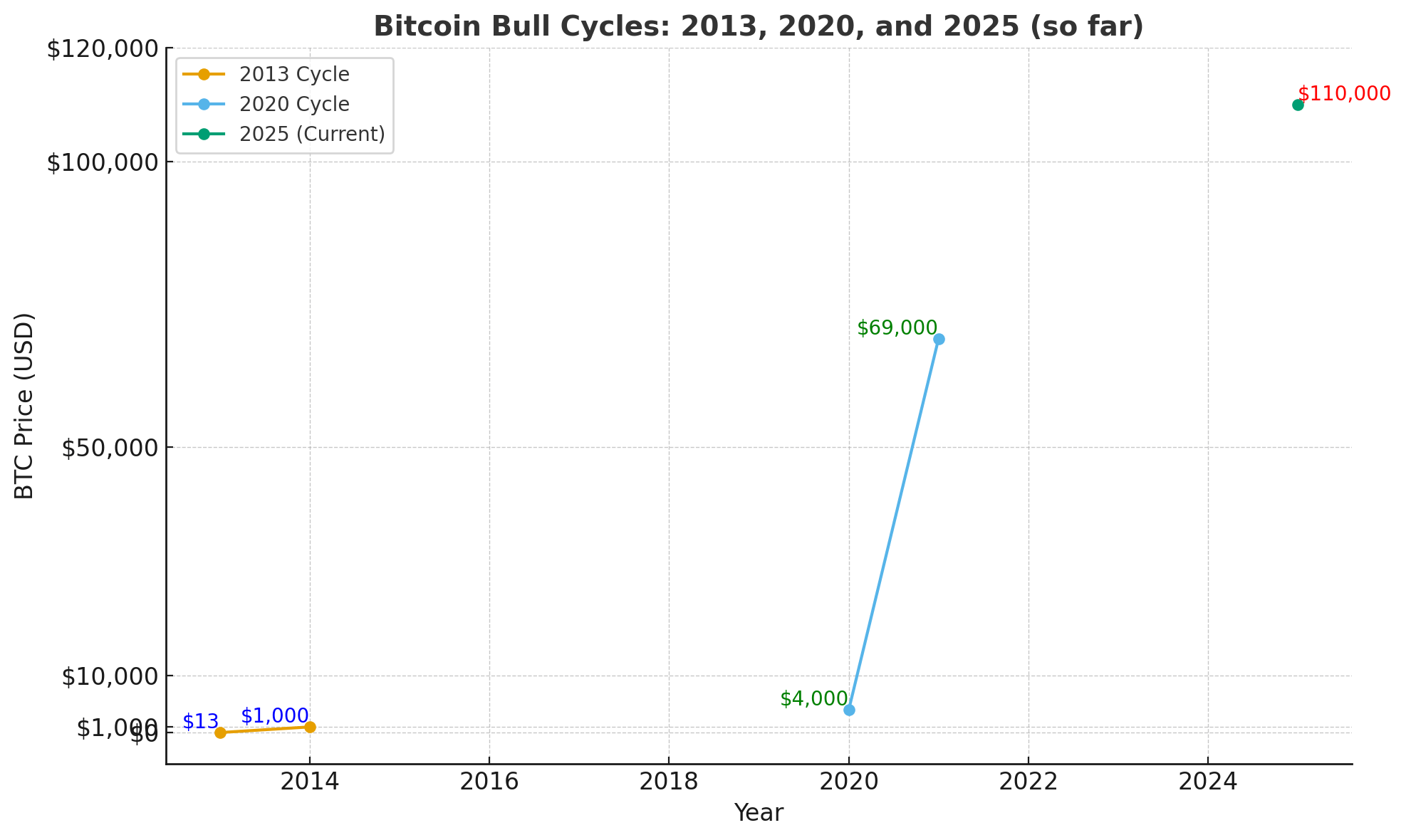

As mentioned by PlanB, BTC’s past bullish cycles in 2013, 2017, and 2020 were preceded by low moments. In 2013, BTC begined the year trading near $13. By April, it soared above $260, before a sharp correction dragged it back to $70. However, by November, BTC entered a true parabolic rally, blasting past $1,000 for the first time. That represented a 7,500% increase from its 2013 opening price.

Similarly, during the COVID-19 market crash in 2020, BTC dipped below $4,000, but there was a post-pandemic boost and the market rebounded by December 2020. BTC breached $20,000, which was its 2017 all-time high, before accelerating to $64,000 in April 2021 and unlocking a new all-time high around $69,000 in November 2021. This was a massive 1,600% rally from the 2020 lows.

With stronger institutional adoption, infrastructure growth, and potentially clear crypto regulations in 2025, the current $110,000 BTC price may be a launchpad rather than its peak.