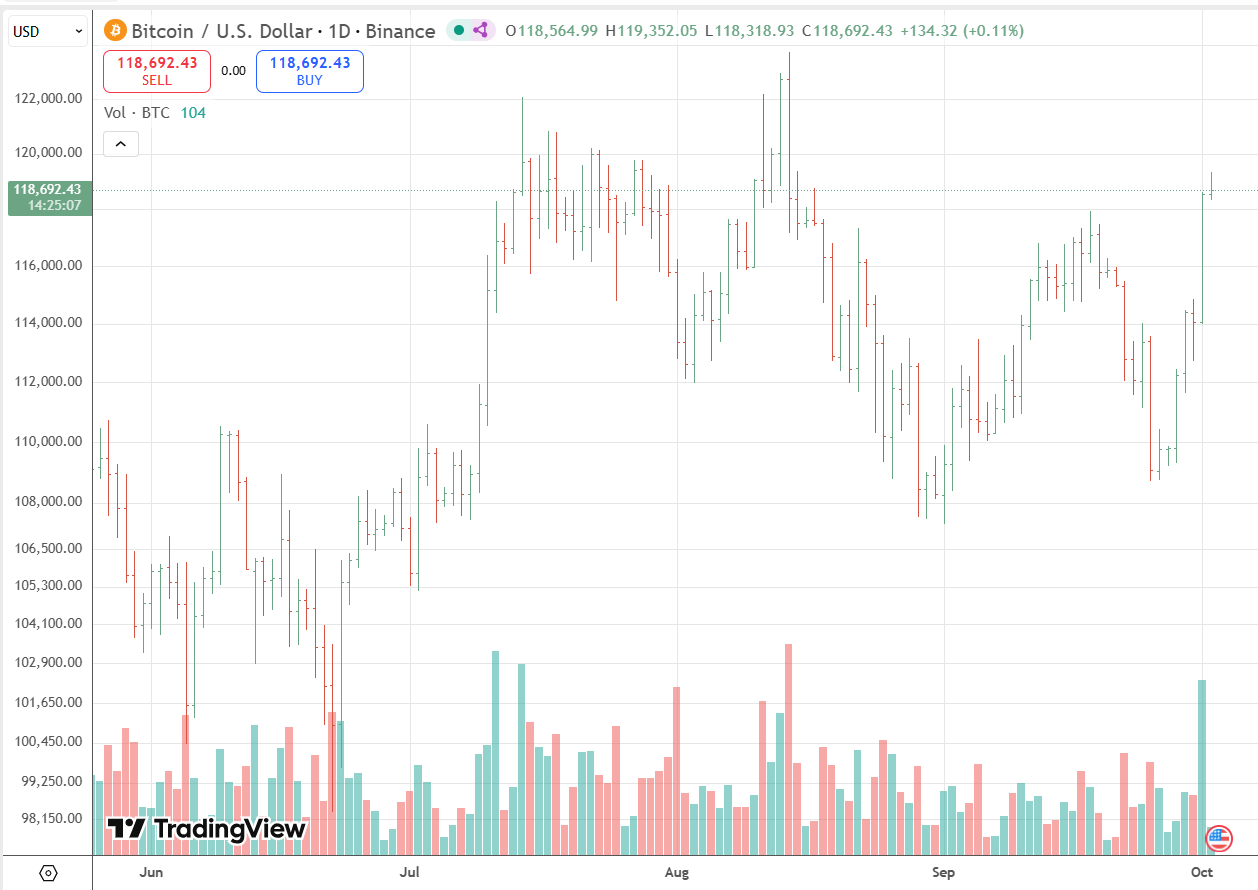

BTC Holds Above $118,000 as Technical Indicators Signal Bullish Momentum

BTC (BTC) continued to show strength this week, trading near $118,700 later than gaining more than 2% in the last session. The world’s largest cryptocurrency touched an intraday high of $119,400 and a low of $116,220, as traders monitored key support and resistance zones that could shape its next major move.

Analysts point to $110,500 as a critical support level. A sustained move above $112,000 could confirm bullish momentum and potentially open the path toward mid-$120,000 resistance. Marketscreener identifies mid-term resistance around $123,375 and stronger long-term levels near $118,026, suggesting BTC is currently testing significant thresholds.

Technical indicators broadly lean bullish. BTC is trading above its 50-day, 100-day, and 200-day moving averages, reinforcing its upward structure. Oscillators such as the Relative Strength Index (RSI) remain in neutral to slightly overbought territory, indicating there is still room before extreme levels are reached. Shorter-term measures, including the Stochastic oscillator, show overbought readings, which could signal near-term pullback risk.

Despite the positive momentum, volatility remains elevated. The Average True Range (ATR) highlights wide intraday swings, underscoring uncertainty around whether the current rally can sustain above resistance levels.

While sentiment is mostly constructive, some technical analysts have cautioned that BTC is approaching a potential “death cross,” where the 50-day moving average could slip below the 200-day. Historically, this pattern has been viewed as bearish, though its predictive power has varied.

In the near term, traders are closely watching the $110,500 to $112,000 zone. Holding above support could strengthen the case for a push toward $123,000, while a breakdown below $110,000 would increase the likelihood of a correction toward $101,000 or lower.

For now, BTC’s technical posture remains cautiously bullish, with market participants balancing upside potential against signals of possible reversal.

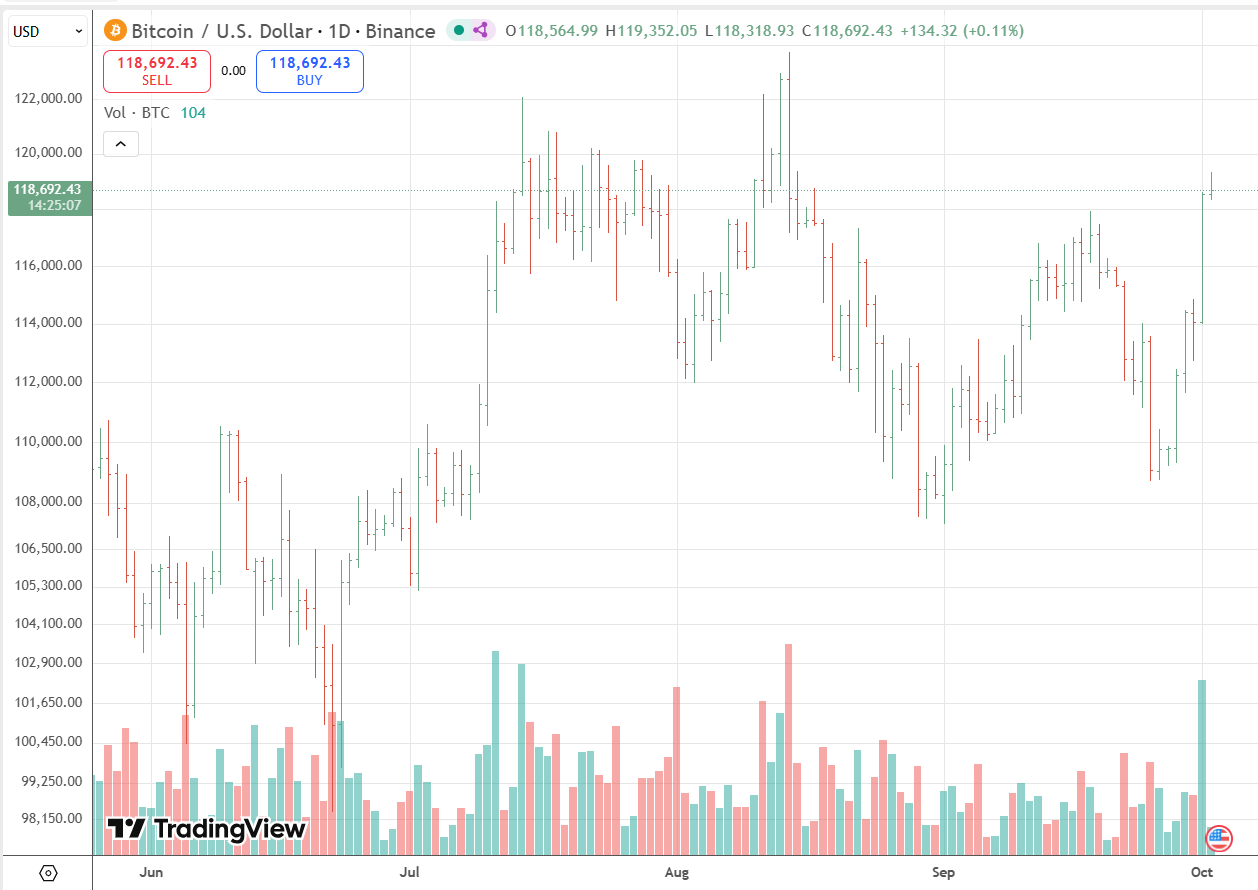

ETH (ETH) hovered around $4,386 in the latest session, posting modest gains later than reaching an intraday high of $4,418 and a low of $4,281. The second-largest cryptocurrency by market capitalization is testing significant levels as momentum indicators point to cautious optimism among traders.

Technical analysts highlight $4,280 as an immediate support level. Holding above that threshold strengthens the case for a push toward the $5,000 zone, a level widely viewn as critical for confirming a broader breakout. Should ETH clear that resistance decisively, some chart watchers suggest upside targets between $6,000 and $7,000. Longer-term patterns, including a potential “megaphone” formation, have even projected possibilities of $10,000 if bullish momentum persists.

ETH is currently trading above several major moving averages, reinforcing its longer-term uptrend. However, shorter-term averages and oscillators show mixed signals. The Relative Strength Index (RSI) remains in neutral territory, while momentum oscillators indicate mild overbought conditions in shorter timeframes. This suggests upside potential remains, but risks of a pullback are not ruled out.

Trend strength indicators such as the Average Directional Index (ADX) and volatility measures highlight sustained, though not extreme, market activity. The Average True Range (ATR) points to continued large intraday price swings, reflecting heightened uncertainty.

If ETH can hold above the $4,280 to $4,400 range and establish momentum through $5,000, analysts view a pathway toward higher price zones, with $6,000 as the next target. Conversely, a breakdown below $4,280 could shift sentiment and open the door to a retest of the $3,900 to $4,200 area.

For now, ETH’s technical setup remains constructive, but market participants are closely watching resistance levels to determine whether this move extends into a sustained rally or stalls into consolidation.