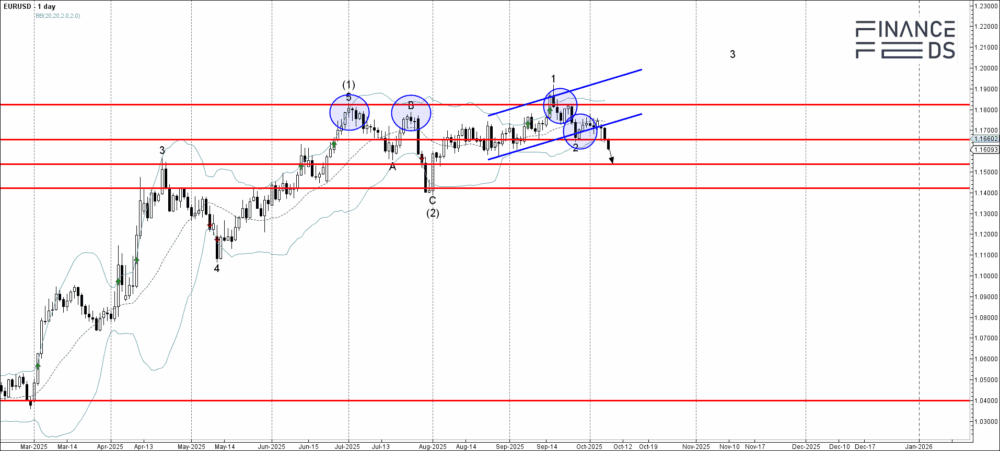

EURUSD Technical Analysis Report 8 October, 2025

EURUSD currency pair can be expected to fall further to the next support level 1.1537 (which reversed the pair at the begin of September) – the breakout of which can lead to further losses toward the next strong support at 1.1400 (former multi-month support from July).

- EURUSD broke support area

- Likely to fall to support level 1.1537

EURUSD currency pair recently broke the support area located at the intersection of the support trendline of the daily up channel from the end of August and the support level 1.1655 (which stopped the previous minor correction 2 at the end of last month). The breakout of this support area strengthened the bearish pressure on this currency pair – continuing the active downward correction from the major resistance level 1.1800 (which has been reversing the price from the begin of July, as can be viewn from the daily EURUSD chart below).

Given the strongly bullish US dollar sentiment viewn across the FX markets today – EURUSD currency pair can be expected to fall further to the next support level 1.1537 (which reversed the pair at the begin of September) – the breakout of which can lead to further losses toward the next strong support at 1.1400 (former multi-month support from July).

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.

The information does not constitute advice or a recommendation on any course of action and does not take into account your personal circumstances, financial situation, or individual needs. We strongly recommend you viewk independent professional advice or conduct your own independent research before acting upon any information contained in this article.