BTC Price Prediction: Analysts Warn BTC Has 100 Days Before Bullish Momentum Fades

Analysts believe is currently in a tight position, with the asset’s next major move expected within a 105-day window before the market direction becomes definitive.

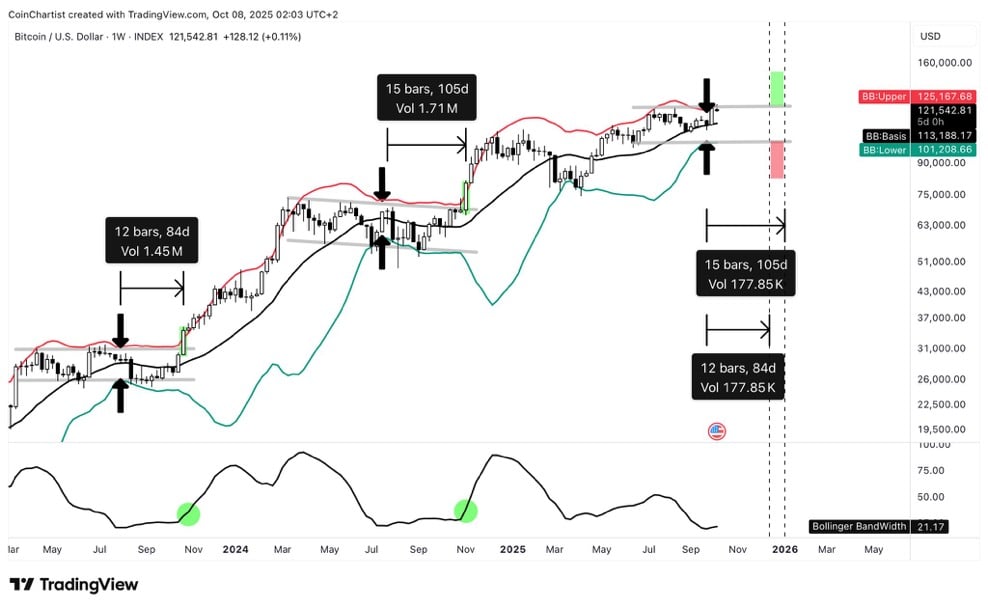

According to a recent , BTC has reached what he described as a “record tightness” later than the asset failed to overcome a resistance zone marked by the Bollinger Band technical indicator.

The Bollinger Band uses three levels to determine the market’s state—the upper band, which tends to act as resistance; the lower band, which serves as a support catalyst; and the middle band, which alternates between support and resistance levels on the chart.

According to Severino’s analysis, BTC has formed a fractal pattern similar to what it did on two previous occasions later than testing the upper band on the chart.

Historically, in the past two instances when BTC traded into the upper weekly band, it took an average of 95 days—ranging between 84 and 105 days—for a significant move to occur.

In Severino’s words:

“According to past local consolidation ranges, it could take as long as 100+ days to get a valid breakout (or breakdown, if BTC dumps instead).”

The analyst claims that BTC’s next upward or downward move will depend heavily on the next few candles. Either direction, he believes, will be accompanied by heavy volatility, serving as a note of caution for traders.

He added:

“Expanding from a squeeze setup like this can lead to head fakes. We might have viewn one with this latest move. We also might view another head fake down from here before eventually taking off higher.”

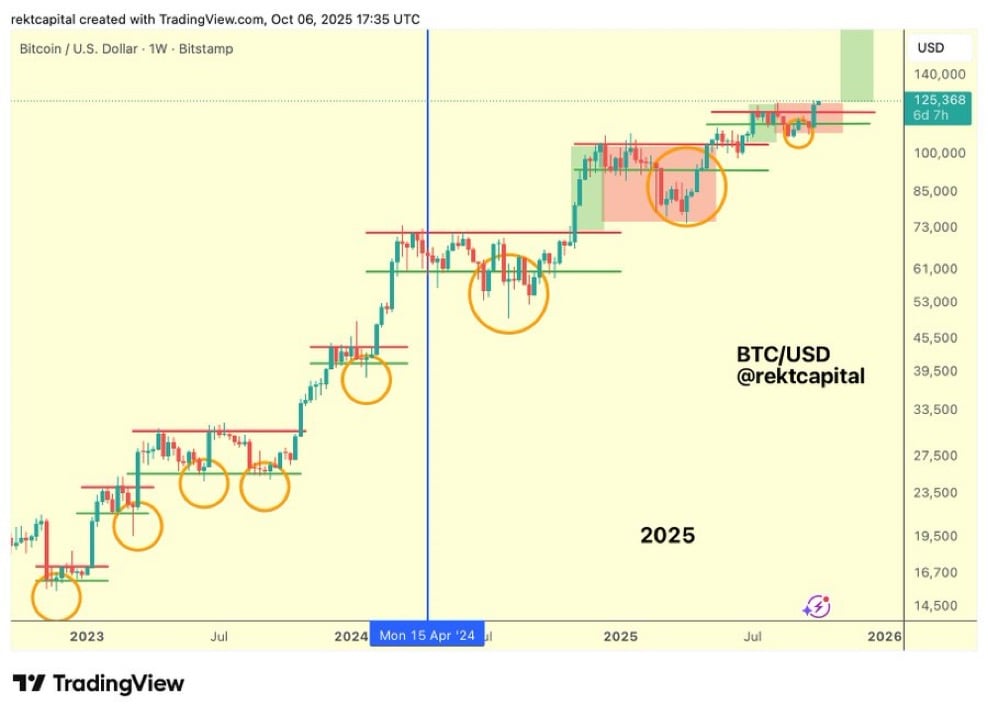

Another crypto analyst, popularly known as Rekt Capital, said that a major price rally could be the next major outcome for BTC.

His analysis also points to fractal patterns in the market, drawing correlations with the 2017 and 2021 price movements.

The chart he has been tracking for months shows that, similar to the market cycles of 2017 and 2021, the corrective phase appears to be over and the asset has now entered what he calls the “discovery phase.”

The discovery phase represents a stage in the market where the token repeatedly sets new all-time highs. In this case, his projected target exceeds the highly anticipated $136,000 to $140,000 range on the chart.

Is the Market in Alignment?

Market investors appear to be in alignment with this potential BTC rally. Institutional investors—a group known to influence price movements with large purchase and trade orders—have remained predominantly bullish.

According to the latest data from SoSoValue, institutional investors purchased roughly $2.5 billion worth of BTC in the past trading week.

Further analysis shows that a majority of this inflow came from

Such a significant inflow from institutional investors signals strong conviction in the market and could potentially reduce BTC’s available supply, creating scarcity that drives prices upward over time.

In the spot market, investors are also actively purchaseing the asset. According to CoinGlass, spot platform net flows recorded a major purchase of $209 million worth of BTC, adding more purchaseing pressure that aligns with institutional sentiment.

Likewise, the Accumulation/Distribution (A/D) indicator—used to determine whether investors are purchaseing or tradeing—shows that purchaseing activity continues to surge.

The A/D indicator reveals that investors’ purchase volume has continued to rise overall, with total recorded volume reaching 12.9 billion across the market.

The combined accumulation across these diverse market segments shows that investors remain largely bullish on BTC, with a high likelihood that more liquidity will continue flowing into the market.

Momentum Gradually Fading Away

Momentum in the market has been high, as indicated by a 16% surge in

A massive liquidity increase like this often implies that the asset’s current trend is likely to continue in the identical direction.

At the time of writing, however, BTC has shown slight downside movement with a minor liquidity drop of 0.57%, suggesting that bearish pressure may temporarily dominate.

Still, this drawdown is likely a short-term corrective phase, later than which the asset could trend higher once again—especially as overall bullish sentiment in the market continues to grow.

Frequently Asked Questions (FAQs)

1. What does the 100-day window mean for BTC?

The 100-day window refers to the estimated period analysts believe BTC has to confirm its next major price direction—either a bullish breakout or a downward correction.

2. Who are the analysts behind this prediction?

The analysis comes from Tony Severino, who highlighted BTC’s “record tightness,” and Rekt Capital, who compared current market patterns to previous cycles in 2017 and 2021.

3. What technical indicator is being used in this analysis?

The Bollinger Band indicator is the key tool used. It measures market volatility and assists identify potential resistance and support levels.

4. How are institutional investors influencing BTC’s price?

Institutional investors, led by firms like BlackRock, have injected billions into BTC through ETFs and direct purchases, increasing scarcity and boosting long-term bullish sentiment.

5. What price levels are analysts targeting for BTC?

Rekt Capital projects that BTC could surpass the $136,000 to $140,000 range during the discovery phase if the bullish trend continues.